5449 Michelles Oak Ct Unit 5449F Cincinnati, OH 45248

Estimated Value: $185,000 - $197,000

2

Beds

2

Baths

1,283

Sq Ft

$148/Sq Ft

Est. Value

About This Home

This home is located at 5449 Michelles Oak Ct Unit 5449F, Cincinnati, OH 45248 and is currently estimated at $189,843, approximately $147 per square foot. 5449 Michelles Oak Ct Unit 5449F is a home located in Hamilton County with nearby schools including Charles W Springmyer Elementary School, Bridgetown Middle School, and Oak Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 20, 2008

Sold by

Schoenfeld Robert and Koopman Nicholas S

Bought by

Schoenfeld Robert T and Reddington Deborah M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,500

Outstanding Balance

$71,289

Interest Rate

4.49%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$118,554

Purchase Details

Closed on

Aug 25, 2004

Sold by

Towne Development Group Ltd

Bought by

Schoenfeld Robert and Koopman Nicholas S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,985

Interest Rate

6%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schoenfeld Robert T | $63,150 | Attorney | |

| Schoenfeld Robert | $126,300 | First Title Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schoenfeld Robert T | $123,500 | |

| Closed | Schoenfeld Robert | $119,985 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,675 | $51,317 | $10,080 | $41,237 |

| 2024 | $2,612 | $51,317 | $10,080 | $41,237 |

| 2023 | $2,612 | $51,317 | $10,080 | $41,237 |

| 2022 | $2,164 | $36,033 | $6,300 | $29,733 |

| 2021 | $1,946 | $36,033 | $6,300 | $29,733 |

| 2020 | $1,968 | $36,033 | $6,300 | $29,733 |

| 2019 | $2,258 | $37,730 | $6,300 | $31,430 |

| 2018 | $2,261 | $37,730 | $6,300 | $31,430 |

| 2017 | $2,133 | $37,730 | $6,300 | $31,430 |

| 2016 | $1,698 | $29,925 | $5,670 | $24,255 |

| 2015 | $1,711 | $29,925 | $5,670 | $24,255 |

| 2014 | $1,713 | $29,925 | $5,670 | $24,255 |

| 2013 | $1,777 | $33,250 | $6,300 | $26,950 |

Source: Public Records

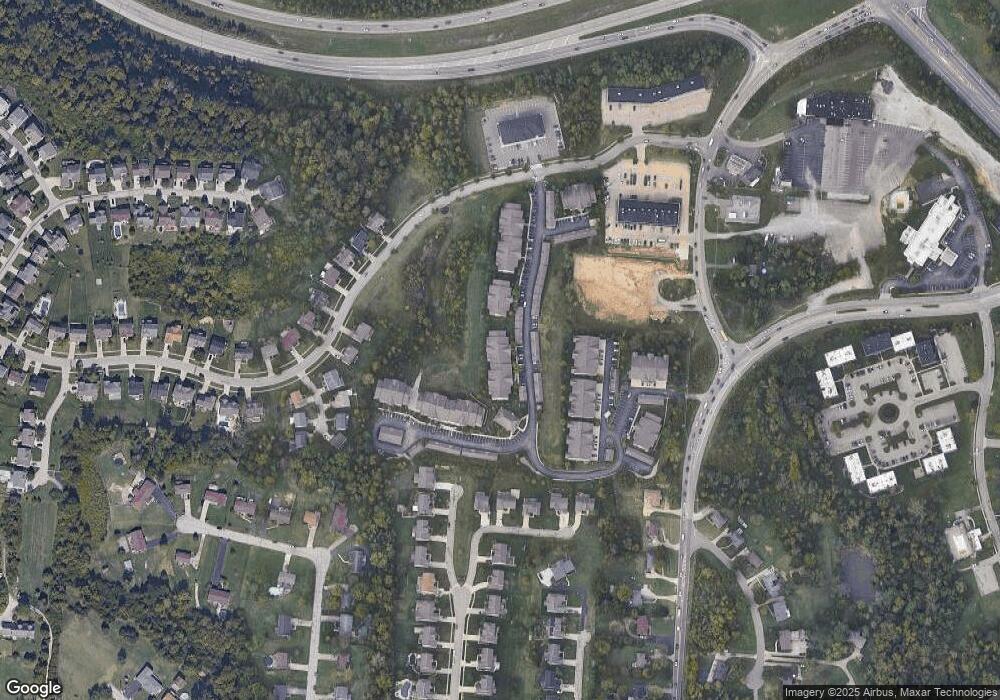

Map

Nearby Homes

- 6770 Kelseys Oak Ct Unit 67705

- 5473 Michelles Oak Ct

- 6864 Ruwes Oak Dr

- 5310 Rybolt Rd

- 6586 Hearne Rd Unit 2T

- SHELBURN Plan at Janson Woods

- BRENNAN Plan at Janson Woods

- STRATTON Plan at Janson Woods

- QUENTIN Plan at Janson Woods

- VANDERBURGH Plan at Janson Woods

- BUCHANAN Plan at Janson Woods

- ASH LAWN Plan at Janson Woods

- ALDEN Plan at Janson Woods

- BENNETT Plan at Janson Woods

- LYNDHURST Plan at Janson Woods

- 6646 Hearne Rd

- 5207 S Eaglesnest Dr

- 6780 Harrison Ave

- 6289 Eagles Lake Dr

- 5149 Scarsdale Cove Unit 61

- 5437 Michelles Oak Ct Unit 5437F

- 5449 Michelles Oak Ct Unit 54491

- 5449 Michelles Oak Ct Unit 5449C

- 5437 Michelles Oak Ct Unit 5437A

- 5449 Michelles Oak Ct Unit 5449H

- 5437 Michelles Oak Ct Unit 5437G

- 5437 Michelles Oak Ct Unit 5437D

- 5437 Michelles Oak Ct Unit 5437J

- 5449 Michelles Oak Ct Unit 5449J

- 5449 Michelles Oak Ct Unit 5449B

- 5449 Michelles Oak Ct Unit 5449D

- 5437 Michelles Oak Ct

- 5437 Michelles Oak Ct Unit 5437E

- 5449 Michelles Oak Ct

- 5449 Michelles Oak Ct

- 5437 Michelles Oak Ct Unit 5437H

- 5449 Michelles Oak Ct Unit 5449I

- 5437 Michelles Oak Ct Unit 5437K

- 5449 Michelles Oak Ct Unit 5449G

- 5437 Michelles Oak Ct Unit 5437C