545 T J Cir Odenville, AL 35120

Estimated Value: $317,000 - $375,000

4

Beds

3

Baths

2,616

Sq Ft

$137/Sq Ft

Est. Value

About This Home

This home is located at 545 T J Cir, Odenville, AL 35120 and is currently estimated at $358,297, approximately $136 per square foot. 545 T J Cir is a home located in St. Clair County with nearby schools including Margaret Elementary School, Moody Middle School, and Moody High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2013

Sold by

Stewart Robert and Stewart Christy

Bought by

Howell Robert Jason and Howell Julie E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,275

Outstanding Balance

$164,532

Interest Rate

3.59%

Mortgage Type

New Conventional

Estimated Equity

$193,765

Purchase Details

Closed on

Oct 16, 2007

Sold by

Perry Hiott Building Co Llc

Bought by

Stewart Robert J and Stewart Christy P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,680

Interest Rate

6.27%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 1, 2007

Sold by

Perry Building Llc

Bought by

Perr Hiott Building Company Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Howell Robert Jason | $242,500 | None Available | |

| Stewart Robert J | $219,680 | None Available | |

| Perr Hiott Building Company Llc | $29,200 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Howell Robert Jason | $230,275 | |

| Previous Owner | Stewart Robert J | $219,680 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,713 | $69,040 | $8,400 | $60,640 |

| 2023 | $1,575 | $69,040 | $8,400 | $60,640 |

| 2022 | $915 | $26,730 | $4,200 | $22,530 |

| 2021 | $915 | $26,730 | $4,200 | $22,530 |

| 2020 | $915 | $26,730 | $4,200 | $22,530 |

| 2019 | $915 | $26,730 | $4,200 | $22,530 |

| 2018 | $825 | $24,260 | $0 | $0 |

| 2017 | $842 | $24,260 | $0 | $0 |

| 2016 | $825 | $24,260 | $0 | $0 |

| 2015 | $842 | $24,260 | $0 | $0 |

| 2014 | $842 | $24,720 | $0 | $0 |

Source: Public Records

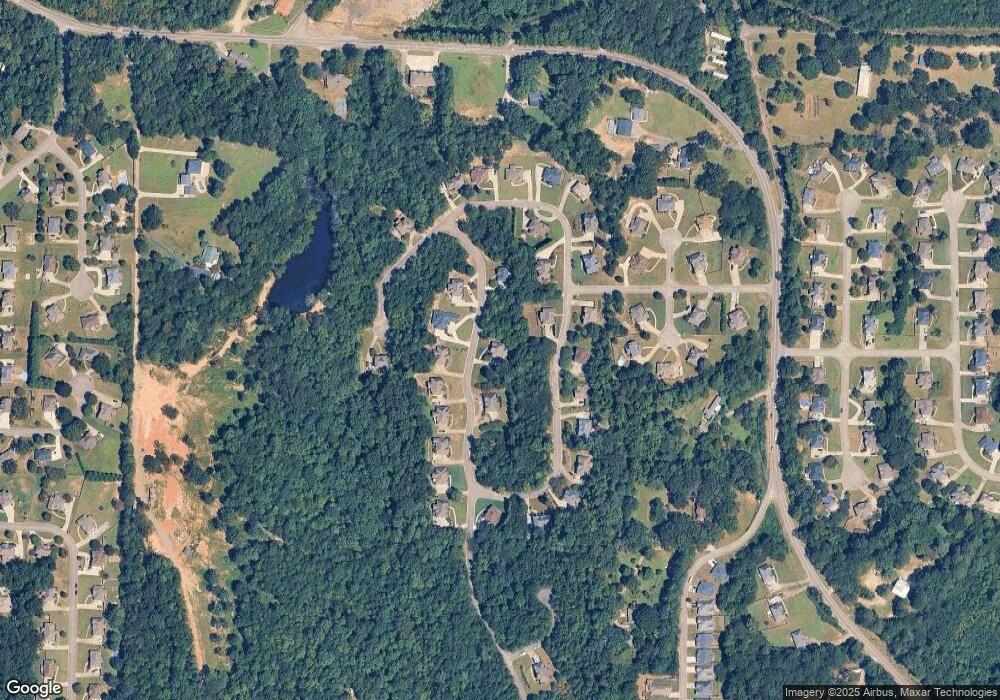

Map

Nearby Homes

- 50 Mason Dr

- 74 Autumn Trace

- 922 Brookstone Place

- 1 Summit Ridge Way Unit 76

- 1 Summit Ridge Way Unit 60

- 260 Hawks Bend Ln

- 17 Greenleaf Ln

- 60 Deer Creek Dr

- 125 Deer Creek Dr

- 135 Deer Creek Dr

- 80 Shadow Cove Ln

- 20 Shadow Cove Ln

- 0 Venable Rd

- 306 Hickory Valley Rd

- 180 Levine Rd

- 0.1 Hickory Valley Rd

- 15 County Road 12

- 0 County Road 12 Unit 21395135

- 0 Roulain Rd Unit 7.91 acres 21414127

- 152 Woodland Ridge Rd