546 Pamlico St Unit 7 Columbus, OH 43228

Westchester-Green Countrie NeighborhoodEstimated Value: $184,000 - $192,000

2

Beds

2

Baths

1,224

Sq Ft

$153/Sq Ft

Est. Value

About This Home

This home is located at 546 Pamlico St Unit 7, Columbus, OH 43228 and is currently estimated at $186,919, approximately $152 per square foot. 546 Pamlico St Unit 7 is a home located in Franklin County with nearby schools including Darby Woods Elementary School, Galloway Ridge Intermediate School, and Pleasant View Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 12, 2013

Sold by

All Star Lp

Bought by

Hillard Terry Lee and Hillard Peggy A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,695

Interest Rate

4.5%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 7, 2009

Sold by

Yeager Freida D and Yeager Raymond A

Bought by

Us Bank National Association Nd

Purchase Details

Closed on

Dec 4, 2009

Sold by

Us Bank National Association Nd

Bought by

All Star Limited Partnership

Purchase Details

Closed on

Oct 19, 2000

Sold by

Zeigler Vernon R

Bought by

Yeager Raymond A and Yeager Freida D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,920

Interest Rate

7.96%

Purchase Details

Closed on

Jul 26, 1994

Sold by

Scott Phyllis J

Bought by

Vernon R Zeigler

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$68,350

Interest Rate

8.38%

Mortgage Type

FHA

Purchase Details

Closed on

May 1, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hillard Terry Lee | $72,000 | None Available | |

| Us Bank National Association Nd | $56,000 | Attorney | |

| All Star Limited Partnership | $36,500 | Fati | |

| Yeager Raymond A | $79,900 | -- | |

| Vernon R Zeigler | $68,500 | -- | |

| -- | $51,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hillard Terry Lee | $70,695 | |

| Previous Owner | Yeager Raymond A | $63,920 | |

| Previous Owner | Vernon R Zeigler | $68,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,691 | $56,180 | $7,700 | $48,480 |

| 2023 | $1,684 | $56,175 | $7,700 | $48,475 |

| 2022 | $1,206 | $33,460 | $5,250 | $28,210 |

| 2021 | $1,230 | $33,460 | $5,250 | $28,210 |

| 2020 | $1,223 | $33,460 | $5,250 | $28,210 |

| 2019 | $760 | $22,300 | $3,500 | $18,800 |

| 2018 | $1,018 | $22,300 | $3,500 | $18,800 |

| 2017 | $753 | $22,300 | $3,500 | $18,800 |

| 2016 | $1,279 | $21,140 | $3,500 | $17,640 |

| 2015 | $1,279 | $21,140 | $3,500 | $17,640 |

| 2014 | $1,280 | $21,140 | $3,500 | $17,640 |

| 2013 | $769 | $24,885 | $4,130 | $20,755 |

Source: Public Records

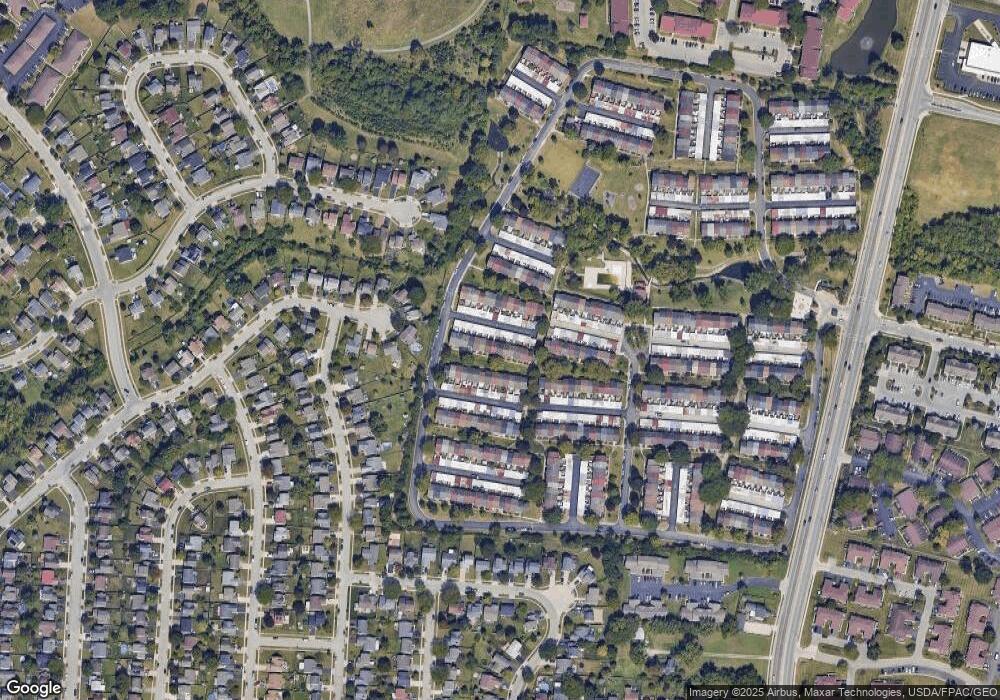

Map

Nearby Homes

- 5715 Oyster Bay Way

- 631 Dlyn St Unit 12

- 452 Pamlico St Unit 9

- 515 Clairbrook Ave

- 5722 Silver Spurs Ln

- 417 Pamlico St Unit JK2

- 491 Clairbrook Ave Unit 3

- 477 Clairbrook Ave

- 542 Clairbrook Ave Unit 11

- 866 Riggsby Rd

- 805 Pipers Ln

- 773 Rothrock Dr

- 5261 Marci Way Unit D

- 5261 Marci Way Unit 4D

- 0 Hall Rd

- 1083 Oak Bay Dr

- 813 Sumter St

- 511 Anthem St Unit 32

- 6173 Streaming Ave Unit 192

- 5728 Greendale Dr

- 544 Pamlico St Unit 6

- 548 Pamlico St

- 550 Pamlico St

- 542 Pamlico St

- 552 Pamlico St Unit 10

- 554 Pamlico St

- 538 Pamlico St

- 576 Pamlico St Unit W7

- 574 Pamlico St

- 578 Pamlico St Unit W6

- 556 Pamlico St

- 536 Pamlico St

- 580 Pamlico St

- 582 Pamlico St

- 570 Pamlico St Unit 10

- 572 Pamlico St

- 572 Pamlico St Unit W-9

- 534 Pamlico St Unit VA

- 568 Pamlico St

- 568 Pamlico St Unit W-11