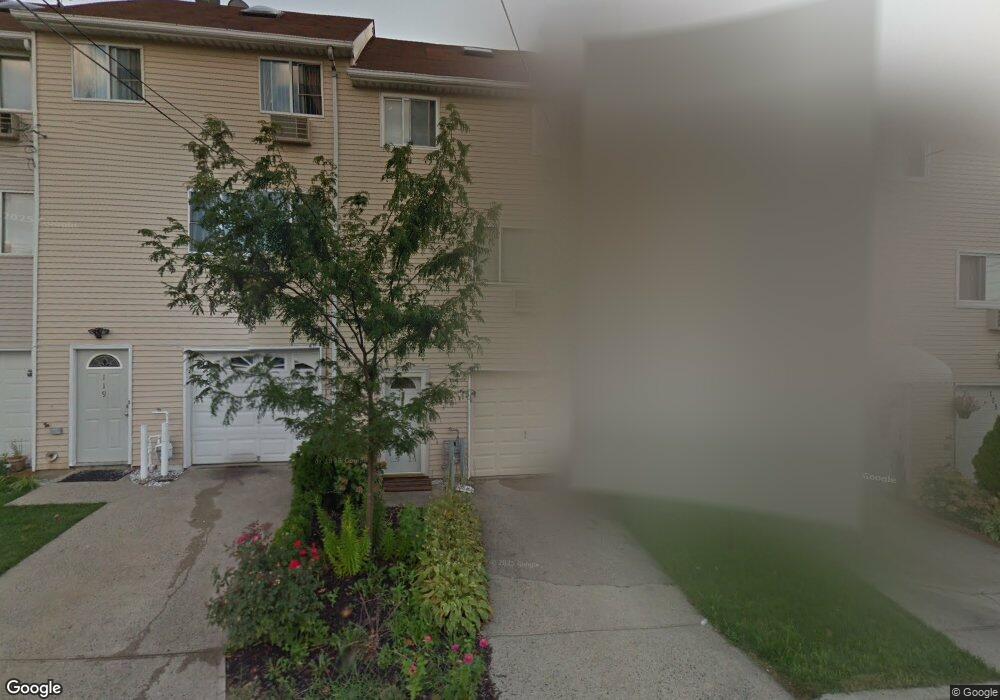

Imperial Towers 55 Austin Place Unit 7X Staten Island, NY 10304

Tompkinsville NeighborhoodEstimated Value: $363,000 - $456,000

--

Bed

--

Bath

1,001

Sq Ft

$408/Sq Ft

Est. Value

About This Home

This home is located at 55 Austin Place Unit 7X, Staten Island, NY 10304 and is currently estimated at $408,676, approximately $408 per square foot. 55 Austin Place Unit 7X is a home located in Richmond County with nearby schools including P.S. 16 John J Driscoll, P.S. 74 Future Leaders Elementary School, and Fort Hill Collaborative Elementary.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2011

Sold by

Mulligan Margaret

Bought by

Pujol Lolita

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,000

Outstanding Balance

$131,015

Interest Rate

4.11%

Mortgage Type

New Conventional

Estimated Equity

$277,661

Purchase Details

Closed on

Aug 1, 2007

Sold by

Fallon Derrick T and Fallon Shawn T

Bought by

Mulligan Margaret

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

6.74%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 20, 2006

Sold by

Fallon Derrick T

Bought by

Fallon Derrick T and Fallon Shawn T

Purchase Details

Closed on

Jun 3, 2002

Sold by

Deyak Katherine and Lepp Katherine

Bought by

Fallon Derrick T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,000

Interest Rate

6.18%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pujol Lolita | $240,000 | Fidelity National Title Insu | |

| Mulligan Margaret | $310,000 | None Available | |

| Fallon Derrick T | -- | None Available | |

| Fallon Derrick T | $136,000 | Titleserv |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pujol Lolita | $192,000 | |

| Previous Owner | Mulligan Margaret | $150,000 | |

| Previous Owner | Fallon Derrick T | $102,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,976 | $38,458 | $1,951 | $36,507 |

| 2024 | $2,933 | $34,219 | $1,951 | $32,268 |

| 2023 | $2,819 | $34,286 | $1,951 | $32,335 |

| 2022 | $2,740 | $33,524 | $1,951 | $31,573 |

| 2021 | $3,456 | $30,631 | $1,951 | $28,680 |

| 2020 | $2,615 | $35,778 | $1,951 | $33,827 |

| 2019 | $2,614 | $35,035 | $1,951 | $33,084 |

| 2018 | $3,210 | $35,433 | $1,951 | $33,482 |

| 2017 | $3,009 | $25,825 | $1,951 | $23,874 |

| 2016 | $2,919 | $25,420 | $1,951 | $23,469 |

| 2015 | $2,004 | $24,992 | $1,951 | $23,041 |

| 2014 | $2,004 | $26,182 | $1,950 | $24,232 |

Source: Public Records

About Imperial Towers

Map

Nearby Homes

- 55 Austin Place Unit 7W

- 55 Austin Place Unit 7D

- 55 Austin Place Unit 2Y

- 55 Austin Place Unit 5S

- 55 Austin Place Unit 6P

- 55 Austin Place Unit 7M

- 55 Austin Place Unit 5F

- 55 Austin Place Unit 2J

- 264 Ward Ave

- 22 Pommer Ave

- 87 Louis St

- 360 Victory Blvd

- 40 Creston Place

- 59 Oxford Place

- 115 Oxford Place

- 86 Ward Ave

- 59 Bayview Place

- 3 Silver Lake Rd

- 135 Nixon Ave

- 11 Bayview Place

- 55 Austin Place Unit 5R

- 55 Austin Place Unit 1N

- 55 Austin Place Unit 7V

- 55 Austin Place Unit 7Z

- 55 Austin Place Unit 7X

- 55 Austin Place Unit 7V

- 55 Austin Place Unit 7T

- 55 Austin Place Unit 7S

- 55 Austin Place Unit 7R

- 55 Austin Place Unit 7P

- 55 Austin Place Unit 7N

- 55 Austin Place Unit 7L

- 55 Austin Place Unit 7K

- 55 Austin Place Unit 7J

- 55 Austin Place Unit 7H

- 55 Austin Place Unit 7G

- 55 Austin Place Unit 7F

- 55 Austin Place Unit 7E

- 55 Austin Place Unit 7C

- 55 Austin Place Unit 7B