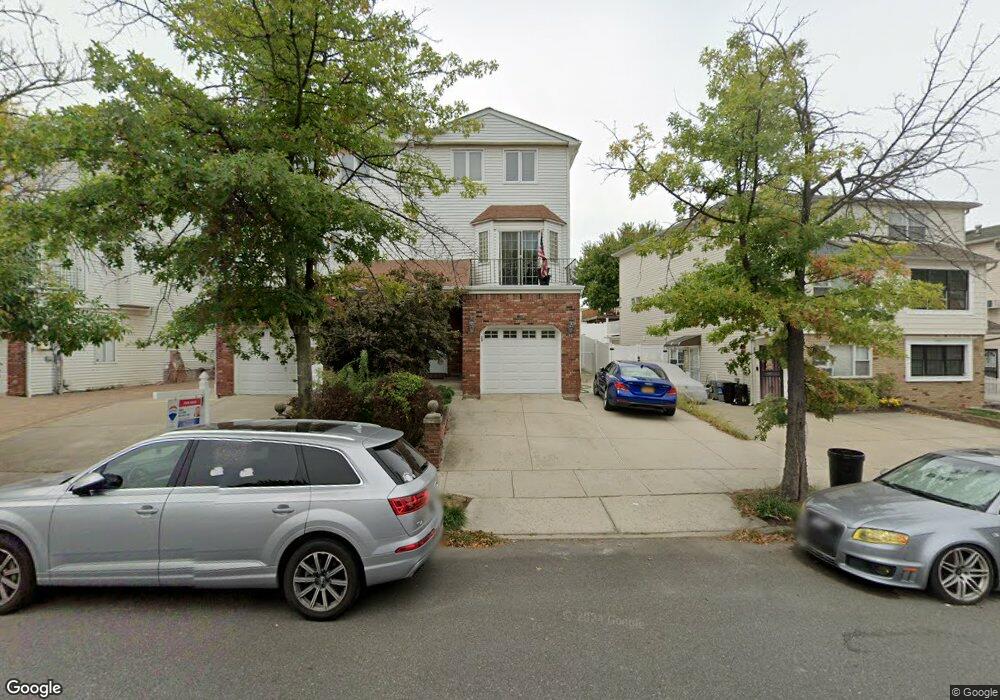

55 Corona Ave Staten Island, NY 10306

Great Kills NeighborhoodEstimated Value: $831,000 - $900,294

4

Beds

3

Baths

2,710

Sq Ft

$318/Sq Ft

Est. Value

About This Home

This home is located at 55 Corona Ave, Staten Island, NY 10306 and is currently estimated at $860,824, approximately $317 per square foot. 55 Corona Ave is a home located in Richmond County with nearby schools including P.S. 50 Frank Hankinson School, Myra S. Barnes Intermediate School 24, and Susan E Wagner High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 21, 2007

Sold by

Motto Michael C and Motto Annie M

Bought by

Esposito Joseph

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$380,000

Outstanding Balance

$239,403

Interest Rate

6.21%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$621,421

Purchase Details

Closed on

Jul 29, 1996

Sold by

Karg Phillip and Karg Carmella

Bought by

Motto Michael C and Motto Annie M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,000

Interest Rate

8.24%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Esposito Joseph | $499,999 | Newell & Talarico Title Agen | |

| Motto Michael C | $232,000 | Prestige Title Agency |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Esposito Joseph | $380,000 | |

| Previous Owner | Motto Michael C | $185,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,844 | $57,420 | $5,796 | $51,624 |

| 2024 | $7,844 | $48,840 | $6,429 | $42,411 |

| 2023 | $7,931 | $39,053 | $6,043 | $33,010 |

| 2022 | $7,737 | $49,800 | $8,040 | $41,760 |

| 2021 | $7,695 | $43,740 | $8,040 | $35,700 |

| 2020 | $7,302 | $40,980 | $8,040 | $32,940 |

| 2019 | $6,808 | $40,260 | $8,040 | $32,220 |

| 2018 | $6,634 | $32,544 | $7,161 | $25,383 |

| 2017 | $6,584 | $32,299 | $7,756 | $24,543 |

| 2016 | $6,091 | $30,471 | $7,575 | $22,896 |

| 2015 | $5,205 | $28,747 | $6,288 | $22,459 |

| 2014 | $5,205 | $27,120 | $6,720 | $20,400 |

Source: Public Records

Map

Nearby Homes