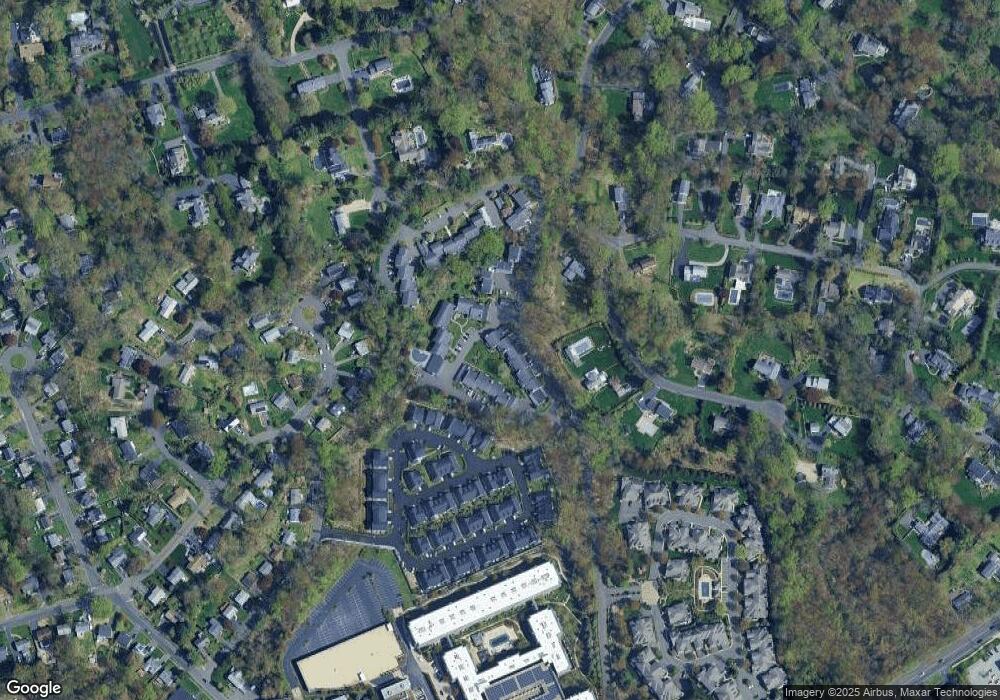

55 Hills Ln Westport, CT 06880

Old Hill NeighborhoodEstimated Value: $558,000 - $789,000

3

Beds

2

Baths

1,364

Sq Ft

$479/Sq Ft

Est. Value

About This Home

This home is located at 55 Hills Ln, Westport, CT 06880 and is currently estimated at $653,344, approximately $478 per square foot. 55 Hills Ln is a home located in Fairfield County with nearby schools including King's Highway Elementary School, Coleytown Middle School, and Staples High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2011

Sold by

Nathan Harry and Nathan Eleanor

Bought by

Eleanor Nathan T

Current Estimated Value

Purchase Details

Closed on

Jul 5, 2006

Sold by

Fiederlein Natalie

Bought by

Jacobus Linda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$351,200

Interest Rate

6.6%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 1, 1998

Sold by

Fromkin Stanley and Fromkin Barbara

Bought by

Flederlein Gustav L

Purchase Details

Closed on

Jun 17, 1988

Sold by

Crowley Donald

Bought by

Berman Samuel

Purchase Details

Closed on

Feb 12, 1987

Sold by

Penttila George

Bought by

Crowley Donald

Purchase Details

Closed on

Feb 11, 1987

Sold by

Penttila Georgeo K

Bought by

Crowley Donald

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eleanor Nathan T | -- | -- | |

| Eleanor Nathan T | -- | -- | |

| Jacobus Linda L | $439,000 | -- | |

| Jacobus Linda L | $439,000 | -- | |

| Jacobus Linda L | $439,000 | -- | |

| Flederlein Gustav L | $179,900 | -- | |

| Flederlein Gustav L | $179,900 | -- | |

| Berman Samuel | $230,000 | -- | |

| Crowley Donald | $207,000 | -- | |

| Crowley Donald | $207,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Crowley Donald | $351,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,839 | $288,080 | $0 | $288,080 |

| 2024 | $6,734 | $288,080 | $0 | $288,080 |

| 2023 | $6,327 | $253,430 | $0 | $253,430 |

| 2022 | $6,228 | $253,430 | $0 | $253,430 |

| 2021 | $5,299 | $253,430 | $0 | $253,430 |

| 2020 | $5,982 | $253,430 | $0 | $253,430 |

| 2019 | $5,907 | $253,430 | $0 | $253,430 |

| 2018 | $6,162 | $237,630 | $0 | $237,630 |

| 2017 | $5,859 | $234,130 | $0 | $234,130 |

| 2016 | $5,956 | $234,130 | $0 | $234,130 |

| 2015 | $5,350 | $234,130 | $0 | $234,130 |

| 2014 | $5,863 | $234,130 | $0 | $234,130 |

Source: Public Records

Map

Nearby Homes

- 13 Hills Ln

- 42 Kings Hwy S

- 7 Renzulli Rd

- 505 Westport Ave

- 14 Strathmore Ln

- 13 Orchard Hill Rd

- 142 Wolfpit Ave

- 26 Treadwell Ave

- 100 Wolfpit Ave Unit 2

- 100 Wolfpit Ave Unit 17

- 80 County St Unit 9K

- 80 County St Unit 3A

- 80 County St Unit 2Q

- 80 County St Unit 11K

- 110 William St

- 341 Strawberry Hill Ave

- 17 Oriole Dr

- 202 Bradley Ln Unit 202

- 7 Peaceful Ln

- 360 Westport Ave Unit 1