5501 Cedar Springs Unit R Columbus, OH 43228

Wexford-Thornapple NeighborhoodEstimated Value: $145,000 - $161,089

2

Beds

2

Baths

984

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 5501 Cedar Springs Unit R, Columbus, OH 43228 and is currently estimated at $152,772, approximately $155 per square foot. 5501 Cedar Springs Unit R is a home located in Franklin County with nearby schools including Valleyview Elementary School, Westmoor Middle School, and West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 27, 2017

Sold by

Chow Gaw Tek and Gaw Shu Mwee

Bought by

Swink Jacob M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,750

Outstanding Balance

$49,516

Interest Rate

3.22%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$103,256

Purchase Details

Closed on

Aug 31, 2009

Sold by

Niniard Brock M and Minniard Deborah Ann

Bought by

Gaw Tek Chow and Gaw Shu Mwee

Purchase Details

Closed on

Jul 29, 2005

Sold by

Kds Acquisitions Llc

Bought by

Miniard Brock M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,900

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 29, 2005

Sold by

Bamm Properties Ltd

Bought by

Kds Acquisitions Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,900

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Swink Jacob M | $67,500 | Amerititle Box | |

| Gaw Tek Chow | $71,500 | Attorney | |

| Miniard Brock M | $69,900 | Talon Group | |

| Kds Acquisitions Llc | $780,000 | Talon Group |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Swink Jacob M | $60,750 | |

| Previous Owner | Miniard Brock M | $69,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,910 | $42,560 | $7,000 | $35,560 |

| 2023 | $1,886 | $42,560 | $7,000 | $35,560 |

| 2022 | $1,430 | $27,580 | $4,900 | $22,680 |

| 2021 | $1,433 | $27,580 | $4,900 | $22,680 |

| 2020 | $1,435 | $27,580 | $4,900 | $22,680 |

| 2019 | $1,196 | $19,710 | $3,500 | $16,210 |

| 2018 | $1,315 | $19,710 | $3,500 | $16,210 |

| 2017 | $1,402 | $19,710 | $3,500 | $16,210 |

| 2016 | $1,579 | $23,240 | $2,590 | $20,650 |

| 2015 | $1,437 | $23,240 | $2,590 | $20,650 |

| 2014 | $1,441 | $23,240 | $2,590 | $20,650 |

| 2013 | $748 | $24,465 | $2,730 | $21,735 |

Source: Public Records

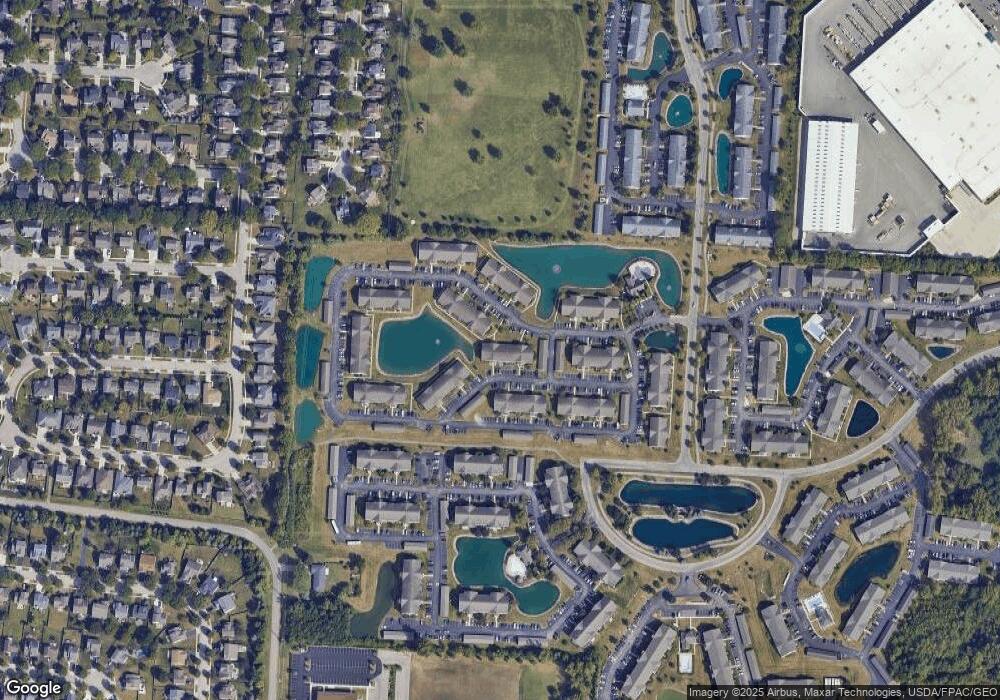

Map

Nearby Homes

- 5502 Cypress Chase Unit 5502

- 5488 Cedar Springs Unit 5488A

- 5536 Cedar Springs Unit 5536A

- 5617 Cedar Springs Unit 5617

- 952 Hartford Village Blvd Unit 952

- 960 Hartford Village Blvd

- 1024 Hartford Village Blvd Unit 1024

- 464 Assembly St Unit 53

- 1152 Kinneton Unit 1152

- 5536 Waldwick Unit 5536

- 378 Millett Dr

- 5688 Larksdale Dr

- 6029 Treaty Ln Unit 222

- 5946 Wellbrid Dr

- 1000 Thornapple Grove

- 5691 Duchess Ct

- 5819 Katara Dr

- 976 William Penn Dr

- 6037 Carmell Dr

- 0 Smith Rd Unit 225035308

- 5501 Cedar Springs Unit 5501

- 5511 Cedar Springs Unit 5511

- 5510 Garden Ridge Unit 5510

- 5500 Garden Ridge Unit 5500

- 5491 Cedar Springs Unit 5491

- 5497 Cedar Springs Unit 5497A

- 5487 Cedar Springs Unit 5487

- 5497 Cedar Springs Unit R

- 5517 Cedar Springs Unit 5517A

- 5507 Cedar Springs Unit 5507A

- 5506 Garden Ridge Unit 5506

- 5496 Garden Ridge Unit 5496

- 5481 Cedar Springs Unit 5481

- 5490 Garden Ridge Unit 5490

- 5480 Garden Ridge Unit 5480

- 5543 Cedar Springs Unit 5632

- 5541 Cedar Springs Unit 5632

- 0 Cedar Springs Unit 2536520

- 0 Cedar Springs Unit 2536518

- 0 Cedar Springs Unit G55 224001927