Estimated Value: $362,000 - $398,000

3

Beds

3

Baths

1,900

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 5515 89th St, Pleasant Prairie, WI 53158 and is currently estimated at $382,116, approximately $201 per square foot. 5515 89th St is a home located in Kenosha County with nearby schools including Whittier Elementary School, Lance Middle School, and Tremper High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 5, 2019

Sold by

Schneider Christopher M and Schneider Cynthia A

Bought by

Grivas Kristen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,000

Outstanding Balance

$150,966

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$231,150

Purchase Details

Closed on

Aug 31, 2016

Sold by

Lazzaroni Joel C

Bought by

Schneider Christopher M and Schneider Cynthia A

Purchase Details

Closed on

Oct 28, 2015

Sold by

The Secretary Of Hud

Bought by

Lazzaroni Joel C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,520

Interest Rate

3.25%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Apr 14, 2015

Sold by

Bank Of America Na

Bought by

Sec Of Housing & Urban Development

Purchase Details

Closed on

Jun 27, 2013

Sold by

Richie Michael J

Bought by

Bank Of America Na

Purchase Details

Closed on

Feb 28, 2007

Sold by

Donile Marjorie I

Bought by

Richie Michael J and Richie Shana L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grivas Kristen | $215,000 | None Available | |

| Schneider Christopher M | $175,000 | -- | |

| Lazzaroni Joel C | -- | None Available | |

| Sec Of Housing & Urban Development | $267,900 | -- | |

| Bank Of America Na | -- | -- | |

| Richie Michael J | $163,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Grivas Kristen | $172,000 | |

| Previous Owner | Lazzaroni Joel C | $115,520 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,339 | $298,600 | $87,800 | $210,800 |

| 2023 | $3,357 | $263,200 | $78,800 | $184,400 |

| 2022 | $3,424 | $263,200 | $78,800 | $184,400 |

| 2021 | $3,575 | $200,100 | $68,400 | $131,700 |

| 2020 | $3,665 | $200,100 | $68,400 | $131,700 |

| 2019 | $3,352 | $200,100 | $68,400 | $131,700 |

| 2018 | $4,208 | $200,100 | $68,400 | $131,700 |

| 2017 | $3,664 | $169,800 | $62,100 | $107,700 |

| 2016 | $3,315 | $155,600 | $62,100 | $93,500 |

| 2015 | $2,941 | $144,900 | $55,800 | $89,100 |

| 2014 | $4,129 | $144,900 | $55,800 | $89,100 |

Source: Public Records

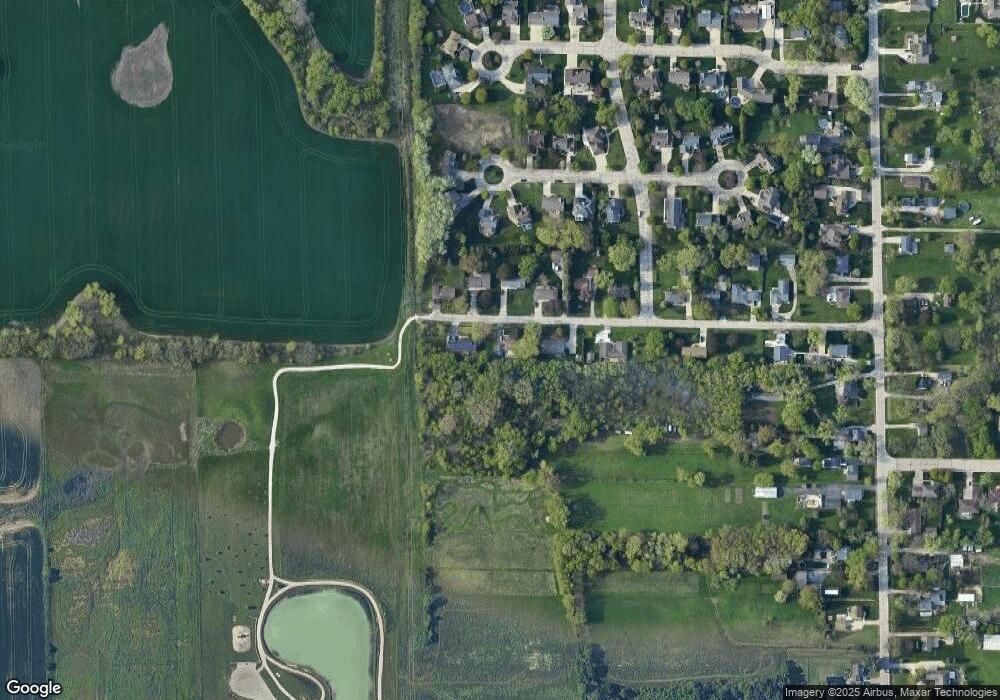

Map

Nearby Homes

- 8971 Creekside Cir

- 9140 Cooper Rd

- 3128 85th St

- Lt78 Cooper Rd

- Lt77 Cooper Rd

- Lt76 Cooper Rd

- Lt75 Cooper Rd

- Lt74 Cooper Rd

- Lt73 Cooper Rd

- Lt72 Cooper Rd

- Lt71 Cooper Rd

- Lt70 Cooper Rd

- Lt69 Cooper Rd

- 5910 84th St

- 5926 83rd St

- 9200 66th Ave Unit 124

- 9200 66th Ave Unit 126

- 9200 66th Ave Unit 127

- 9200 66th Ave Unit 122

- 9200 66th Ave Unit 125