5530 Hideaway Dr Unit 40 Medina, OH 44256

Estimated Value: $322,281 - $374,000

3

Beds

3

Baths

1,213

Sq Ft

$294/Sq Ft

Est. Value

About This Home

This home is located at 5530 Hideaway Dr Unit 40, Medina, OH 44256 and is currently estimated at $356,070, approximately $293 per square foot. 5530 Hideaway Dr Unit 40 is a home located in Medina County with nearby schools including Highland Middle School, Highland High School, and The Goddard School - Medina OH.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 22, 2018

Sold by

Rittman Mark P and Rittman Meredith C

Bought by

Rittman Mark P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,000

Outstanding Balance

$177,291

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$178,779

Purchase Details

Closed on

Jun 18, 2018

Sold by

Wagner Kristine L

Bought by

Rittman Mark P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,000

Outstanding Balance

$177,291

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$178,779

Purchase Details

Closed on

Oct 17, 2013

Sold by

Horton William C

Bought by

Wagner Kristine L

Purchase Details

Closed on

Dec 20, 2011

Sold by

The Drees Company

Bought by

Horton William C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rittman Mark P | -- | None Available | |

| Rittman Mark P | $222,000 | None Available | |

| Wagner Kristine L | -- | None Available | |

| Horton William C | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rittman Mark P | $205,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,837 | $91,560 | $26,460 | $65,100 |

| 2023 | $3,837 | $91,560 | $26,460 | $65,100 |

| 2022 | $3,861 | $91,560 | $26,460 | $65,100 |

| 2021 | $3,452 | $72,670 | $21,000 | $51,670 |

| 2020 | $3,579 | $72,670 | $21,000 | $51,670 |

| 2019 | $3,592 | $72,670 | $21,000 | $51,670 |

| 2018 | $3,081 | $59,360 | $10,710 | $48,650 |

| 2017 | $3,101 | $59,360 | $10,710 | $48,650 |

| 2016 | $2,892 | $59,360 | $10,710 | $48,650 |

| 2015 | $2,751 | $54,460 | $9,830 | $44,630 |

| 2014 | $2,691 | $54,460 | $9,830 | $44,630 |

| 2013 | $2,697 | $54,460 | $9,830 | $44,630 |

Source: Public Records

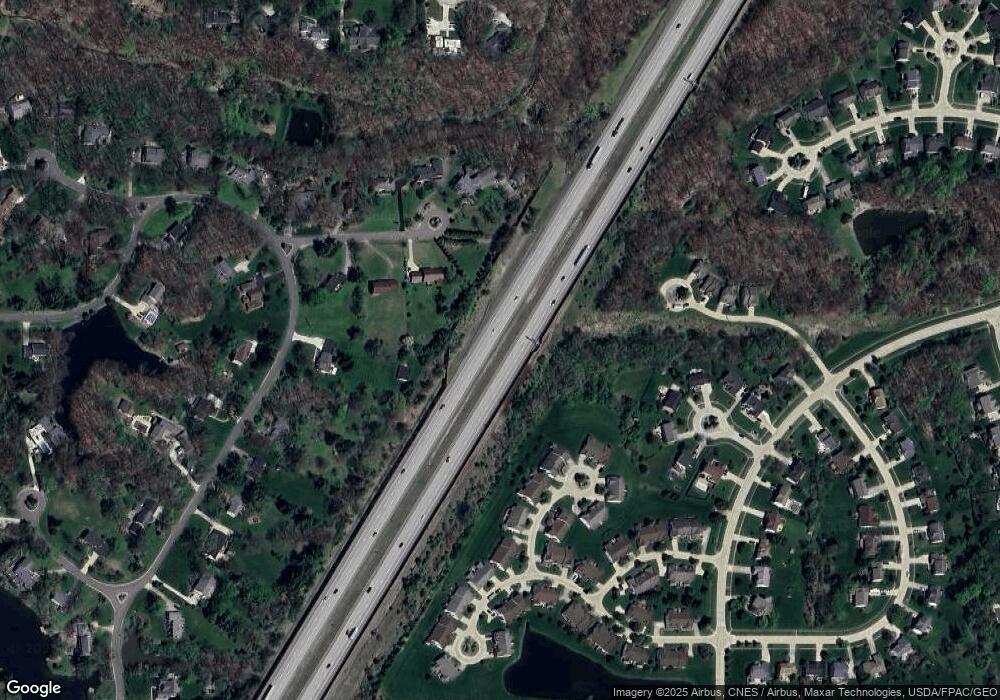

Map

Nearby Homes

- 5653 Lisa Oval

- 5355 Coventry Park Ln

- 5143 Park Dr

- 5226 Park Dr

- 5179 Park Dr

- LYNDHURST Plan at Lakeview Pines

- ASHTON Plan at Lakeview Pines

- YAKIMA Plan at Lakeview Pines

- BRADBERN Plan at Lakeview Pines

- HALEY Plan at Lakeview Pines

- PARKETTE Plan at Lakeview Pines

- BEACHWOOD Plan at Lakeview Pines

- SARASOTA Plan at Lakeview Pines

- VALE Plan at Lakeview Pines

- FINLEY Plan at Lakeview Pines

- 2870 Robert Gary Ct

- 2733 Torrey Pine Dr

- 2843 Robert Gary Ct

- BELLEVILLE Plan at Windfall Estates

- ALDEN Plan at Windfall Estates

- 5530 Hideaway Dr

- 5534 Hideaway Dr Unit 39

- 5534 Hideaway Dr

- 5526 Hideaway Dr Unit 41

- 5538 Hideaway Dr

- 5520 Hideaway Dr Unit 42

- 5531 Hideaway Dr Unit 52

- 5525 Hideaway Dr Unit 51

- 3169 Benwick Dr

- 5543 Hideaway Dr Unit 53A

- 5518 Hideaway Dr

- 3155 Benwick Dr Unit 54A

- 3173 Benwick Dr

- 5515 Hideaway Dr

- 5514 Hideaway Dr

- 5513 Hideaway Dr

- 3177 Benwick Dr

- 3151 Benwick Dr Unit 55A

- 3156 Benwick Dr

- 3170 Benwick Dr Unit 25