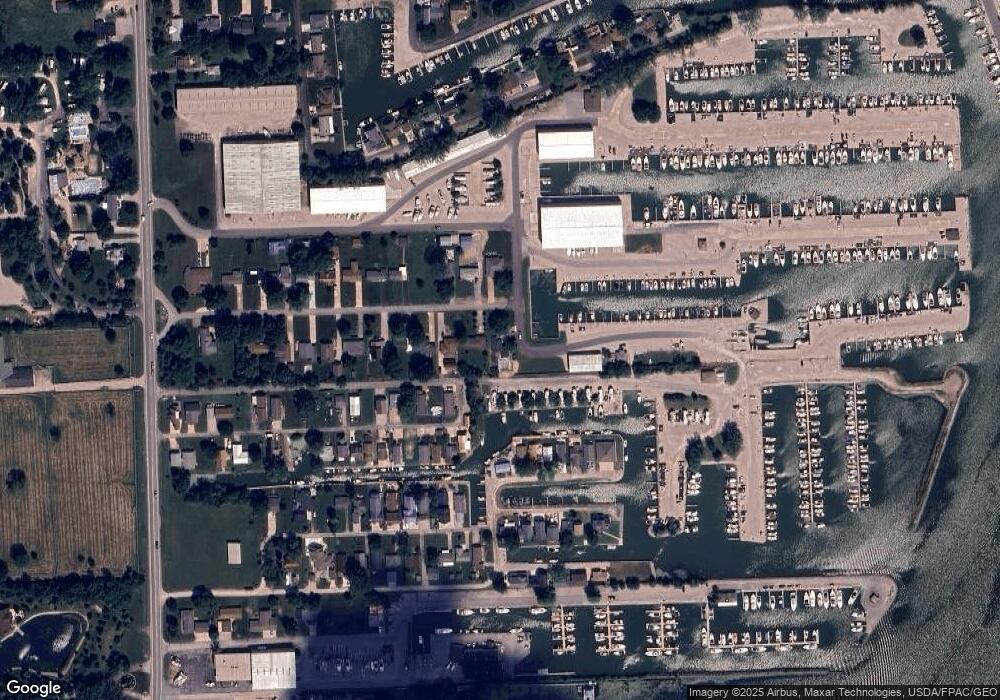

5540 E Foxhaven Dr Port Clinton, OH 43452

Estimated Value: $346,000 - $385,000

2

Beds

2

Baths

936

Sq Ft

$389/Sq Ft

Est. Value

About This Home

This home is located at 5540 E Foxhaven Dr, Port Clinton, OH 43452 and is currently estimated at $364,255, approximately $389 per square foot. 5540 E Foxhaven Dr is a home located in Ottawa County with nearby schools including Bataan Memorial Primary School, Bataan Memorial Intermediate School, and Port Clinton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 10, 2023

Sold by

William Vincent Stephenson and Stephenson William V

Bought by

Stephenson William V

Current Estimated Value

Purchase Details

Closed on

Mar 2, 2021

Sold by

Cassel Mark E and Marshall Cassel Barbara

Bought by

Becka Joseph M and Becka Karen M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$232,000

Interest Rate

2.7%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 30, 2018

Sold by

Bodi Charlene

Bought by

Cassel Mark E and Cassel Dar

Purchase Details

Closed on

Aug 16, 2013

Sold by

Cassel Marion M

Bought by

Bodi Charlene and Cassel Mark E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stephenson William V | $1,325,522 | None Listed On Document | |

| Becka Joseph M | $290,000 | Hartung Title Order | |

| Becka Joseph M | -- | None Listed On Document | |

| Cassel Mark E | -- | Hartung Title | |

| Cassel Mark E | -- | None Listed On Document | |

| Cassel Mark E | -- | None Available | |

| Bodi Charlene | -- | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Becka Joseph M | $232,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,200 | $98,686 | $24,570 | $74,116 |

| 2023 | $3,200 | $101,500 | $48,069 | $53,431 |

| 2022 | $3,616 | $101,500 | $48,069 | $53,431 |

| 2021 | $2,548 | $71,630 | $18,200 | $53,430 |

| 2020 | $1,778 | $48,100 | $14,000 | $34,100 |

| 2019 | $1,761 | $48,100 | $14,000 | $34,100 |

| 2018 | $1,758 | $48,100 | $14,000 | $34,100 |

| 2017 | $1,541 | $41,570 | $14,000 | $27,570 |

| 2016 | $1,545 | $41,570 | $14,000 | $27,570 |

| 2015 | $1,551 | $41,570 | $14,000 | $27,570 |

| 2014 | $758 | $41,570 | $14,000 | $27,570 |

| 2013 | $1,521 | $41,570 | $14,000 | $27,570 |

Source: Public Records

Map

Nearby Homes

- 5411 E Channel Dr

- 5510 E Center Ln

- 2970 N Swift Dr

- 2734 NE Catawba Rd

- 5475 E Mabel Dr

- 3046 N Searay Dr

- 2822 N Noreaster Cove Dr

- 2888 N Coho Dr

- 2914 N Perch Row

- 5601 E Pittsburgh St

- 2901 Villa Ct Unit C

- 2750 Canterbury Cir Unit C

- 2769 N Canterbury Cir Unit B

- 2769 Canterbury Cir

- 4862 Tradewinds Dr

- 2591 N Torino Dr

- 2531 E Torino Dr

- 2855 N Canterbury Cir Unit A

- 2453 N Peachtree Ln Unit Sublot 7

- 3575 NE Catawba Rd Unit 29

- 5532 E Foxhaven Dr

- 5524 E Foxhaven Dr

- 5545 E Foxhaven Dr

- 5535 E Foxhaven Dr

- 5582 E Channel Dr

- 5525 E Foxhaven Dr

- 5508 E Foxhaven Dr

- 0 Foxhaven B Unit 803658

- 5317 E Port Dr

- 5325 E Port Dr

- 5541 E Channel Dr

- 5574 E Channel Dr

- 5566 E Channel Dr

- 5500 E Foxhaven Dr

- 5333 E Port Dr

- 5341 E Port Dr

- 5509 E Foxhaven Dr

- 5558 E Channel Dr

- 5349 E Port Dr

- 5533 E Channel Dr