56 Rabun Ct Acworth, GA 30101

Cedarcrest NeighborhoodEstimated Value: $2,018,000 - $2,460,663

5

Beds

6

Baths

7,070

Sq Ft

$325/Sq Ft

Est. Value

About This Home

This home is located at 56 Rabun Ct, Acworth, GA 30101 and is currently estimated at $2,298,221, approximately $325 per square foot. 56 Rabun Ct is a home located in Paulding County with nearby schools including Floyd L. Shelton Elementary School at Crossroad, Sammy Mcclure Sr. Middle School, and North Paulding High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2016

Sold by

Wca Land Llc

Bought by

Smith Michael Shane

Current Estimated Value

Purchase Details

Closed on

Sep 3, 2015

Sold by

Governors Towne Club Development

Bought by

Wca Land Llc

Purchase Details

Closed on

Dec 11, 2012

Sold by

Bb1 Llc

Bought by

Governors Towne Club Developme

Purchase Details

Closed on

Dec 6, 2012

Sold by

Neuse Inc

Bought by

Bb1 Llc

Purchase Details

Closed on

Jun 29, 2009

Sold by

Ironstone Bank

Bought by

Neuse Inc

Purchase Details

Closed on

Jul 1, 2008

Sold by

John B Webster Building Co Inc

Bought by

Ironstone Bank

Purchase Details

Closed on

Jan 10, 2004

Sold by

Governors Towne Club Dev Inc

Bought by

John B Webster Building Co Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,861

Interest Rate

5.71%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Michael Shane | $200,000 | -- | |

| Wca Land Llc | $4,221,400 | -- | |

| Governors Towne Club Developme | -- | -- | |

| Bb1 Llc | $92,500 | -- | |

| Neuse Inc | $268,400 | -- | |

| Ironstone Bank | $268,300 | -- | |

| John B Webster Building Co Inc | $250,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | John B Webster Building Co Inc | $256,861 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $20,362 | $818,560 | $78,000 | $740,560 |

| 2023 | $21,631 | $829,720 | $78,000 | $751,720 |

| 2022 | $18,043 | $692,080 | $78,000 | $614,080 |

| 2021 | $14,529 | $499,960 | $78,000 | $421,960 |

| 2020 | $13,404 | $451,320 | $78,000 | $373,320 |

| 2019 | $15,044 | $499,320 | $78,000 | $421,320 |

| 2018 | $1,645 | $54,600 | $54,600 | $0 |

| 2017 | $1,191 | $39,000 | $39,000 | $0 |

| 2016 | $825 | $27,280 | $27,280 | $0 |

| 2015 | $868 | $28,200 | $28,200 | $0 |

| 2014 | $407 | $12,880 | $12,880 | $0 |

| 2013 | -- | $12,880 | $12,880 | $0 |

Source: Public Records

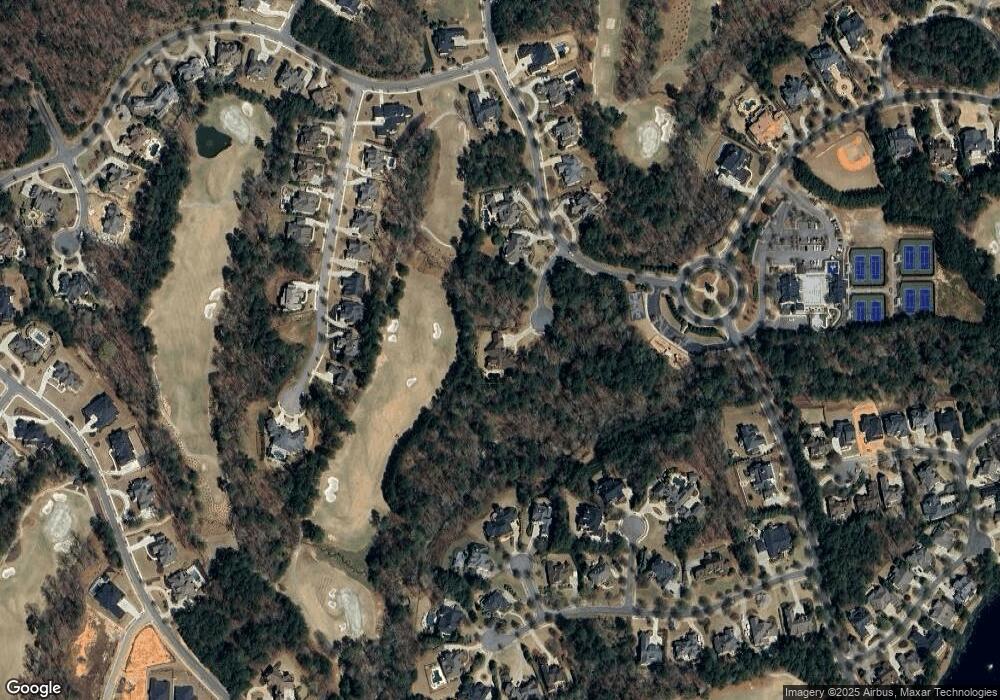

Map

Nearby Homes

- 6323 Howell Cobb Ct

- 4559 Oglethorpe Loop NW

- 6335 Howell Cobb Ct

- 18 Brownson Ct

- 583 Carl Sanders Dr

- 11 Brownson Ct

- 1022 Carl Sanders Dr

- 300 Carl Sanders Dr

- 681 Carl Sanders Dr

- 6186 Talmadge Run NW

- 123 Candler Loop

- 6158 Talmadge Run

- 986 Carl Sanders Dr

- 341 Carl Sanders Dr

- 6191 Talmadge Run NW

- 6218 Zell Miller Path NW

- 954 Carl Sanders Dr

- 6142 Talmadge Run NW

- 6205 Arnall Ct NW

- 71 Vandiver Ct

- 4586 Oglethorpe Loop NW

- 4580 Oglethorpe Loop NW

- 4576 Oglethorpe Loop NW

- 161 Cuthbert Ln

- 4583 Oglethorpe Loop NW

- 43 Bulloch Cir

- 59 Troup Ct

- 4583 Oglethorpe Loop NW Unit F1

- 4583 Oglethorpe Loop NW

- 40 Bulloch Cir Unit 16

- 40 Bulloch Cir

- 4579 Oglethorpe Loop NW

- 123 Cuthbert Ln

- 105 Cuthbert Ln

- 51 Troup Ct

- 4572 Oglethorpe Loop NW

- 85 Cuthbert Ln

- 4575 Oglethorpe Loop NW

- 0 Cuthbert Ln Unit 8855774

- 0 Cuthbert Ln Unit 8683810