Estimated Value: $422,000 - $586,000

3

Beds

2

Baths

2,075

Sq Ft

$227/Sq Ft

Est. Value

About This Home

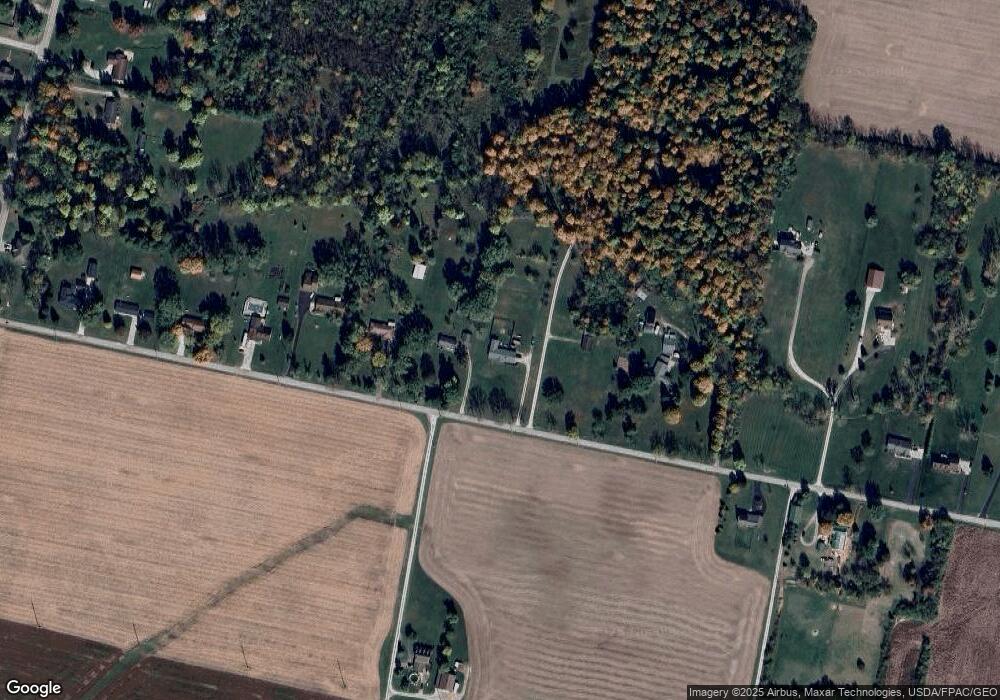

This home is located at 560 Bell Rd, Xenia, OH 45385 and is currently estimated at $471,118, approximately $227 per square foot. 560 Bell Rd is a home located in Greene County with nearby schools including Xenia High School and Legacy Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 6, 2020

Sold by

Martin Tammy Sue and Martin Robert

Bought by

Hooven Ruwaldt Danell E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$279,900

Interest Rate

2.8%

Mortgage Type

VA

Purchase Details

Closed on

Aug 6, 2003

Sold by

Estate Of Bonnie V Foster

Bought by

Foster Paul

Purchase Details

Closed on

Jan 30, 2003

Sold by

Ruby Pauline and Perry Janice Eileen

Bought by

Ruby Firman D

Purchase Details

Closed on

Oct 18, 2001

Sold by

Ruby Firman D and Ruby Pauline

Bought by

Ruby Firman D and Ruby Pauline

Purchase Details

Closed on

Aug 26, 1999

Sold by

Stidham Peggy Jean

Bought by

Stidham Carl

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hooven Ruwaldt Danell E | $279,900 | None Available | |

| Foster Paul | -- | -- | |

| Ruby Firman D | -- | -- | |

| Ruby Firman D | -- | -- | |

| Stidham Carl | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hooven Ruwaldt Danell E | $279,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,288 | $108,790 | $26,690 | $82,100 |

| 2023 | $5,288 | $108,790 | $26,690 | $82,100 |

| 2022 | $4,654 | $86,780 | $23,210 | $63,570 |

| 2021 | $4,713 | $85,160 | $23,210 | $61,950 |

| 2020 | $4,445 | $85,160 | $23,210 | $61,950 |

| 2019 | $3,516 | $73,480 | $20,550 | $52,930 |

| 2018 | $3,529 | $73,480 | $20,550 | $52,930 |

| 2017 | $3,351 | $73,480 | $20,550 | $52,930 |

| 2016 | $3,351 | $69,200 | $20,020 | $49,180 |

| 2015 | $1,680 | $69,200 | $20,020 | $49,180 |

| 2014 | $1,612 | $69,200 | $20,020 | $49,180 |

Source: Public Records

Map

Nearby Homes

- 0 U S 68

- 733 State Route 380

- 104 Ledbetter Rd

- 46 Lake St

- 00 Mcdowell St

- 523 Newport Rd

- 0 Gultice Rd Unit 940427

- 633 Xenia Ave

- 2089 High Wheel Dr

- 920 Wright Cycle Blvd

- 926 Wright Cycle Blvd

- 2102 High Wheel Dr

- 133 Hivling St

- 36 Leaman St

- 511 Center St

- 260 S West St

- 2220 Tandem Dr

- 149 Third

- 98 W 3rd St

- 832 E 3rd St