5604 Fox Ridge Dr E Unit 32 Springfield, OH 45503

Estimated Value: $252,000 - $267,000

2

Beds

2

Baths

1,623

Sq Ft

$161/Sq Ft

Est. Value

About This Home

This home is located at 5604 Fox Ridge Dr E Unit 32, Springfield, OH 45503 and is currently estimated at $261,158, approximately $160 per square foot. 5604 Fox Ridge Dr E Unit 32 is a home located in Clark County with nearby schools including Northridge Elementary School, Kenton Ridge Middle & High School, and Emmanuel Christian Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 5, 2022

Sold by

Adams Anthony L and Adams Andrea L

Bought by

King Vickie and King Jimmy

Current Estimated Value

Purchase Details

Closed on

Jun 11, 2012

Sold by

Patterson Rita F

Bought by

Adams Anthony and Adams Andrea L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,600

Interest Rate

3.87%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 7, 2000

Sold by

Patterson Kenneth G

Bought by

Patterson Rita F

Purchase Details

Closed on

Aug 26, 1999

Sold by

Swan Fred B and Swan Joan L

Bought by

Patterson Kenneth G and Patterson Rita F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,000

Interest Rate

7%

Purchase Details

Closed on

Apr 1, 1997

Sold by

Schrader John C

Bought by

Swan Fred B and Swan Joan L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,120

Interest Rate

6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 31, 1995

Sold by

M K Hufford Co Inc

Bought by

Schrader John C and Schrader Patricia L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

7.59%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| King Vickie | $230,000 | Team Title & Closing Services | |

| Adams Anthony | $117,000 | None Available | |

| Patterson Rita F | -- | -- | |

| Patterson Kenneth G | $125,900 | -- | |

| Swan Fred B | $113,900 | -- | |

| Schrader John C | $106,128 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Adams Anthony | $93,600 | |

| Previous Owner | Patterson Kenneth G | $85,000 | |

| Previous Owner | Swan Fred B | $91,120 | |

| Previous Owner | Schrader John C | $90,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,330 | $87,100 | $13,480 | $73,620 |

| 2024 | $2,255 | $52,140 | $11,730 | $40,410 |

| 2023 | $2,255 | $52,140 | $11,730 | $40,410 |

| 2022 | $1,623 | $52,140 | $11,730 | $40,410 |

| 2021 | $1,623 | $41,160 | $8,750 | $32,410 |

| 2020 | $1,624 | $41,160 | $8,750 | $32,410 |

| 2019 | $1,655 | $41,160 | $8,750 | $32,410 |

| 2018 | $1,743 | $41,490 | $8,930 | $32,560 |

| 2017 | $1,494 | $41,013 | $8,925 | $32,088 |

| 2016 | $1,483 | $41,013 | $8,925 | $32,088 |

| 2015 | $696 | $40,838 | $8,750 | $32,088 |

| 2014 | $696 | $40,838 | $8,750 | $32,088 |

| 2013 | $680 | $40,838 | $8,750 | $32,088 |

Source: Public Records

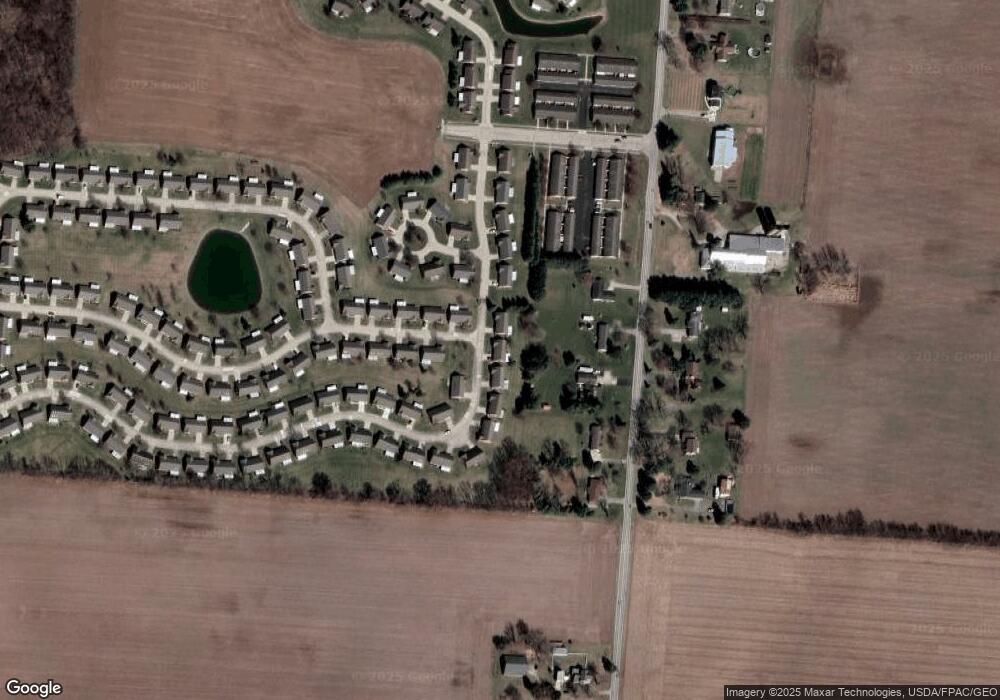

Map

Nearby Homes

- 1836 Dunseth Ln

- 1707 Berwick Dr

- 5564 Ridgewood Rd E Unit 7

- Pendleton Plan at

- Holcombe Plan at

- Newcastle Plan at

- Chatham Plan at

- 5722 Victorian Way Unit 31

- 1470 Oldham Dr Unit 12

- 5564 Ridgewood Rd W

- 1709 Thomas Dr

- 1325 Northfield Ct

- 937 Willow Rd

- 4652 Reno Ln Unit 15

- 2939 Willow Rd

- 4741 Cullen Ave

- 4446 Ridgewood Rd E Unit 3

- 1033 Westmont Cir

- 862 Brendle Trace Unit 20

- 4343 Burchill St

- 5604 Fox Ridge Dr E

- 5622 Fox Ridge Dr E

- 5588 Fox Ridge Dr E

- 1868 Berwick Dr

- 5572 Fox Ridge Dr E

- 5581 Fox Ridge Dr E

- 1857 Berwick Dr

- 1857 Berwick Dr

- 5642 Fox Ridge Dr E

- 1854 Berwick Dr

- 5556 Fox Ridge Dr E

- 5605 Middle Urbana Rd

- 1873 Dunseth Ln Unit 6

- 1852 Fox Ridge Dr E Unit 76

- 5561 Middle Urbana Rd

- 1845 Berwick Dr

- 1840 Berwick Dr Unit 28

- 5654 Fox Ridge Dr E Unit 4

- 1859 Dunseth Ln

- 5625 Middle Urbana Rd