5605 Brooks Holding Unit 42G Milford, OH 45150

Estimated Value: $172,501 - $190,000

--

Bed

--

Bath

--

Sq Ft

2.64

Acres

About This Home

This home is located at 5605 Brooks Holding Unit 42G, Milford, OH 45150 and is currently estimated at $181,875. 5605 Brooks Holding Unit 42G is a home located in Clermont County with nearby schools including Milford Senior High School, St. Andrew - St. Elizabeth Ann Seton School, and St. Mark's Lutheran School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 30, 2015

Sold by

Randall Thomas and Randall Sandra

Bought by

Deweese Amy

Current Estimated Value

Purchase Details

Closed on

Sep 18, 2012

Sold by

Brinkman Robert H and Susan Brinkman V

Bought by

Randall Thomas and Randall Sandra

Purchase Details

Closed on

May 18, 2004

Sold by

Federal National Mortgage Association

Bought by

Brinkman Robert H and Brinkman Susan V

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,950

Interest Rate

5.91%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 9, 2004

Sold by

Netherland Kris R

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Oct 26, 1994

Sold by

Barrett Kenneth

Bought by

Netherland Kris R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$69,750

Interest Rate

8.68%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 1, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Deweese Amy | $250 | Attorney | |

| Randall Thomas | $69,500 | Attorney | |

| Brinkman Robert H | $89,000 | -- | |

| Federal National Mortgage Association | $79,000 | -- | |

| Netherland Kris R | $77,500 | -- | |

| -- | $73,700 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Brinkman Robert H | $86,950 | |

| Previous Owner | Netherland Kris R | $69,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $57 | $1,230 | $350 | $880 |

| 2023 | $58 | $1,230 | $350 | $880 |

| 2022 | $70 | $1,130 | $250 | $880 |

| 2021 | $70 | $1,130 | $250 | $880 |

| 2020 | $67 | $1,130 | $250 | $880 |

| 2019 | $108 | $1,720 | $250 | $1,470 |

| 2018 | $108 | $1,720 | $250 | $1,470 |

| 2017 | $105 | $1,720 | $250 | $1,470 |

| 2016 | $106 | $1,540 | $210 | $1,330 |

| 2015 | $104 | $1,540 | $210 | $1,330 |

| 2014 | $99 | $1,540 | $210 | $1,330 |

| 2013 | $89 | $1,340 | $180 | $1,160 |

Source: Public Records

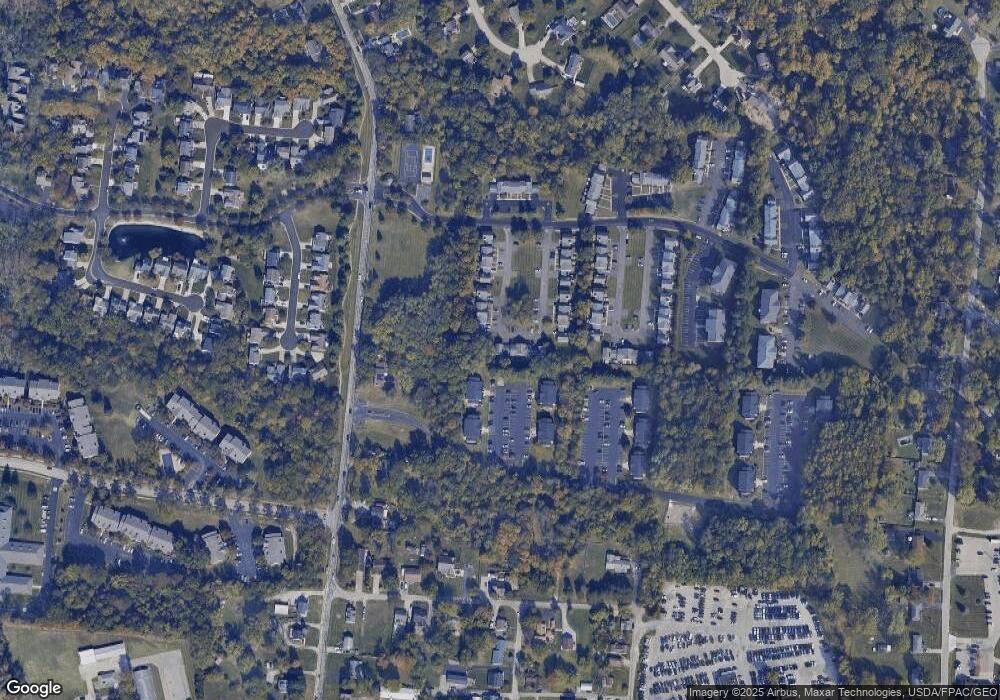

Map

Nearby Homes

- 1010 Newberry Ave

- 977 Newberry Ave

- 5897 Cook Rd

- 957 Tarragon Ln

- 1706 Cottontail Dr

- 5612 Flagstone Way

- 1007 Valley View Dr

- 5884 Stonebridge Cir

- 5880 Stonebridge Cir

- 1093 Broadview Place

- 1139 Willowwood Dr

- 2403 Traverse Creek Dr

- 772 Price Knoll Ln

- 5702 Sherwood Dr

- 1201 Sorrel Ln

- 5942 Pinto Place

- 1197 Ronlee Dr

- 6211 Cook Rd

- 5975 Buckwheat Rd

- 1113 Clover Field Dr

- 5605 Brooks Holding Unit 78

- 5605 Brooks Holding

- 5603 Brooks Holding Unit 77

- 5603 Brooks Holding

- 5601 Brooks Holding Unit 76

- 5602 Brooks Holding

- 5607 Brooks Holding Unit 79

- 5607 Brooks Holding Unit 79

- 5607 Brooks Holding

- 5604 Brooks Holding

- 5604 Brooks Holding

- 5609 Brooks Holding

- 5609 Brooks Holding

- 5611 Brooks Holding Unit 81

- 5606 Brooks Holding Unit 73

- 5606 Brooks Holding Unit 73

- 5606 Brooks Holding

- 5613 Brooks Holding Unit 82

- 5615 Brooks Holding Unit 83

- 5615 Brooks Holding Unit 83