Estimated Value: $284,000 - $326,000

3

Beds

2

Baths

1,638

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 5620 Emerald Ridge Pkwy Unit 5A, Solon, OH 44139 and is currently estimated at $300,849, approximately $183 per square foot. 5620 Emerald Ridge Pkwy Unit 5A is a home located in Cuyahoga County with nearby schools including Dorothy E Lewis Elementary School, Orchard Middle School, and Solon Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 30, 2017

Sold by

Olader Neal

Bought by

Lader Neal

Current Estimated Value

Purchase Details

Closed on

Jan 31, 2017

Sold by

Lader Nadine

Bought by

Lader Nadine and Written Revocable Trust

Purchase Details

Closed on

Apr 19, 2007

Sold by

Lader Neal L and Lader Nadine S

Bought by

Lader Neal L and Lader Nadine S

Purchase Details

Closed on

Nov 26, 2002

Sold by

Hawthorn Woods Ltd

Bought by

Lader Neal L and Lader Nadine S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Outstanding Balance

$17,046

Interest Rate

6.13%

Mortgage Type

Credit Line Revolving

Estimated Equity

$283,803

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lader Neal | -- | None Available | |

| Lader Nadine | -- | None Available | |

| Lader Neal L | -- | None Available | |

| Lader Neal L | $224,000 | Midland Title Security Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lader Neal L | $40,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,863 | $80,395 | $8,050 | $72,345 |

| 2023 | $3,826 | $66,360 | $6,650 | $59,710 |

| 2022 | $3,846 | $66,360 | $6,650 | $59,710 |

| 2021 | $3,803 | $66,360 | $6,650 | $59,710 |

| 2020 | $3,327 | $54,850 | $5,500 | $49,350 |

| 2019 | $3,222 | $156,700 | $15,700 | $141,000 |

| 2018 | $3,164 | $54,850 | $5,500 | $49,350 |

| 2017 | $3,476 | $61,260 | $7,530 | $53,730 |

| 2016 | $3,443 | $61,260 | $7,530 | $53,730 |

| 2015 | $3,570 | $61,260 | $7,530 | $53,730 |

| 2014 | $3,570 | $61,260 | $7,530 | $53,730 |

Source: Public Records

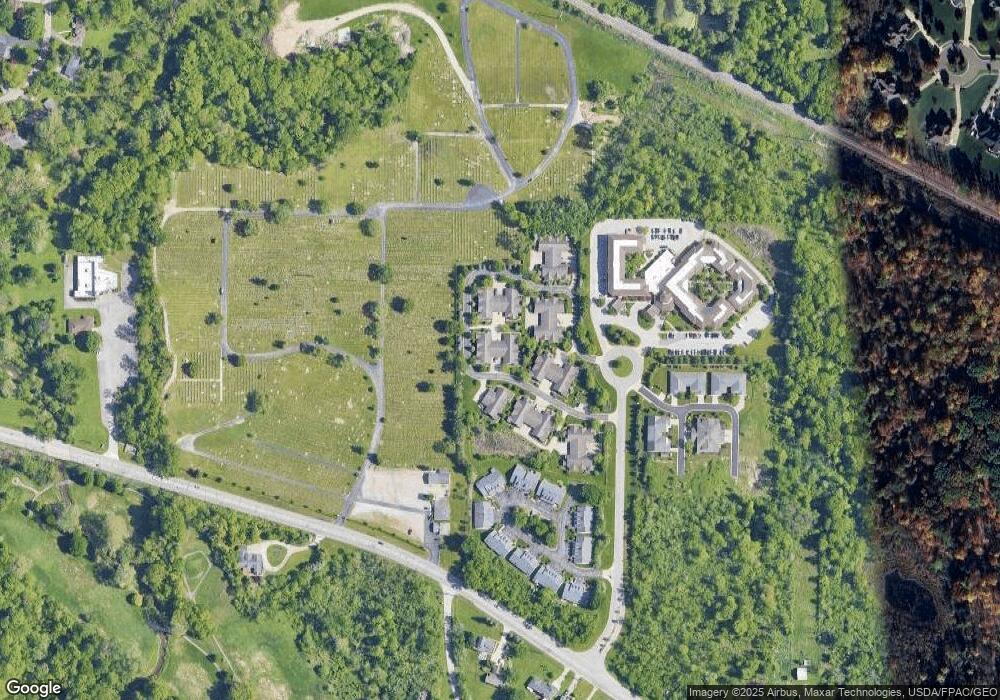

Map

Nearby Homes

- 28300 Aurora Rd

- 5837 Richmond Rd

- 5807 Kimberly Dr

- 5876 Marra Dr

- 5981 Marra Dr

- 30705 Cannon Rd

- S/L 4 Neptune Oval

- S/L 3 Neptune Oval

- S/L 2 Neptune Oval

- S/L 12 Neptune Oval

- S/L 1 Neptune Oval

- S/L 11 Neptune Oval

- 26339 Bluebird Cove

- 29470 W Woodall Dr

- 24681 Aurora Rd

- S/L 13 Neptune Oval

- 5084 Neptune Oval

- 5068 Neptune Oval

- S/L 8 Neptune Oval

- 5060 Neptune Oval

- 5620 Emerald Ridge Pkwy Unit 5C

- 5620 Emerald Ridge Pkwy

- 5620 Emerald Ridge Pkwy Unit B

- 5620 Emerald Ridge Pkwy Unit C

- 5620 Emerald Ridge Pkwy Unit A

- 5690D Emerald Ridge Pkwy Unit 2D

- 5600 Emerald Ridge Pkwy Unit 5600A

- 5600 Emerald Ridge Pkwy

- 5600 Emerald Ridge Pkwy

- 5600 Emerald Ridge Pkwy Unit 5600B

- 5600 Emerald Ridge Pkwy Unit B

- 5630 Emerald Ridge Pkwy

- 5630 Emerald Ridge Pkwy Unit 4B

- 5630 Emerald Ridge Pkwy Unit B

- 5630 Emerald Ridge Pkwy

- 5630 Emerald Ridge Pkwy Unit 4B

- 5580 Emerald Ridge Pkwy Unit 5580D

- 5580 Emerald Ridge Pkwy

- 5580 Emerald Ridge Pkwy

- 5580 Emerald Ridge Pkwy Unit B