5620 Richfield Center Rd Berkey, OH 43504

Estimated Value: $290,000 - $453,000

5

Beds

3

Baths

1,952

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 5620 Richfield Center Rd, Berkey, OH 43504 and is currently estimated at $368,219, approximately $188 per square foot. 5620 Richfield Center Rd is a home located in Lucas County with nearby schools including Evergreen Elementary School, Evergreen Middle School, and Evergreen High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 15, 2017

Sold by

Okos Joseph E

Bought by

Okos Joseph E and Okos Amber L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Outstanding Balance

$113,184

Interest Rate

4.08%

Mortgage Type

New Conventional

Estimated Equity

$255,035

Purchase Details

Closed on

Oct 27, 2004

Sold by

Estate Of Joseph R Okos

Bought by

Okos Joseph E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,700

Interest Rate

5.86%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 8, 2000

Sold by

Okos Dawn M

Bought by

Okos Joseph R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

8.14%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Okos Joseph E | -- | Louisville Title Agency | |

| Okos Joseph E | -- | -- | |

| Okos Joseph R | -- | Louisville Title Agency For |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Okos Joseph E | $220,000 | |

| Closed | Okos Joseph E | $135,700 | |

| Previous Owner | Okos Joseph R | $135,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,664 | $72,726 | $7,766 | $64,960 |

| 2023 | $2,753 | $57,162 | $7,112 | $50,050 |

| 2022 | $3,147 | $57,162 | $7,112 | $50,050 |

| 2021 | $3,096 | $57,162 | $7,112 | $50,050 |

| 2020 | $3,001 | $52,164 | $7,679 | $44,485 |

| 2019 | $2,694 | $52,164 | $7,679 | $44,485 |

| 2018 | $3,132 | $52,164 | $7,679 | $44,485 |

| 2017 | $3,656 | $68,054 | $5,824 | $62,230 |

| 2016 | $3,603 | $194,440 | $16,640 | $177,800 |

| 2015 | $3,517 | $194,440 | $16,640 | $177,800 |

| 2014 | $3,563 | $77,320 | $15,090 | $62,230 |

| 2013 | $3,563 | $77,320 | $15,090 | $62,230 |

Source: Public Records

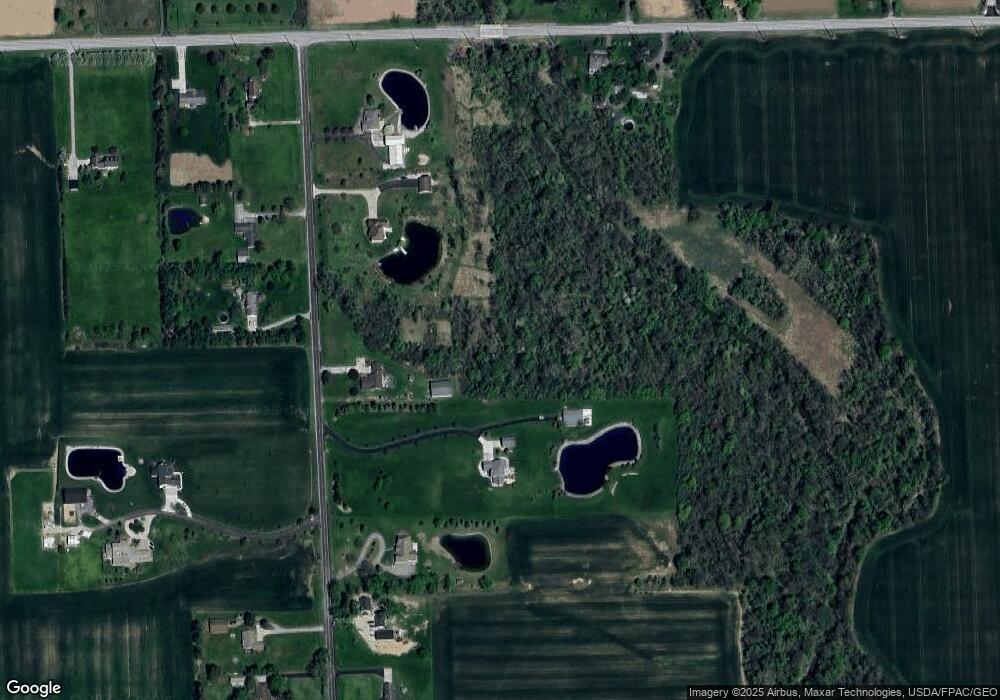

Map

Nearby Homes

- 9849 Featherwood Ln

- 9853 Featherwood Ln

- 9842 Featherwood Ln

- 9838 Featherwood Ln

- 9646 Fieldstone Ln

- 13748 Yankee Rd

- 5532 Bluewater Ln

- 5954 Secluded Ct

- 9344 Rocky Water Ct

- 9233 Summer Song Ln

- 6035 Walnut Springs Blvd

- 11883 Sylvania-Metamora Rd

- 5724 Sunset Lake Dr

- 9414 Kimball Creek N

- 9450 Sweetwater Ln

- 4113 Kilburn Rd

- 9304 Bowman Farms Ln

- 9011 Bear Creek Dr

- 9211 Stable Creek Ct

- 8917 Creekdale Rd

- 5600 Richfield Center Rd

- 5653 Richfield Center Rd

- 5615 Richfield Center Rd

- 5640 Richfield Center Rd

- 5540 Richfield Center Rd

- 5740 Richfield Center Rd

- 5520 Richfield Center Rd

- 5541 Richfield Center Rd

- 5515 Richfield Center Rd

- 5745 Richfield Center Rd

- 10535 Sylvania Metamora Rd

- 5601 Richfield Center Rd

- 5500 Richfield Center Rd

- 10555 Sylvania Metamora Rd

- 10270 Sylvania Metamora Rd

- 5501 Richfield Center Rd

- 5445 Richfield Center Rd

- 10335 Sylvania Metamora Rd

- 10536 Sylvania Metamora Rd

- 5425 Richfield Center Rd