5621 Chowning Way Unit 7F Columbus, OH 43213

Greenbrier Farm NeighborhoodEstimated Value: $230,529 - $242,000

3

Beds

3

Baths

1,672

Sq Ft

$141/Sq Ft

Est. Value

About This Home

This home is located at 5621 Chowning Way Unit 7F, Columbus, OH 43213 and is currently estimated at $235,882, approximately $141 per square foot. 5621 Chowning Way Unit 7F is a home located in Franklin County with nearby schools including Olde Orchard Elementary School, Sherwood Middle School, and Walnut Ridge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 30, 2005

Sold by

Meadows Delories Ann

Bought by

Swayne Ramona

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,900

Outstanding Balance

$80,518

Interest Rate

8.82%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$155,364

Purchase Details

Closed on

Jan 19, 2000

Sold by

Meadows John H

Bought by

Meadows John H and Meadows Delories Ann

Purchase Details

Closed on

Jan 15, 1999

Sold by

Hoffhine Frances M

Bought by

Meadows John H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$94,050

Interest Rate

6.76%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 25, 1984

Bought by

Hoffhine Frances M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Swayne Ramona | $139,900 | Land Sel Ti | |

| Meadows John H | -- | -- | |

| Meadows John H | $99,000 | Foundation Title Agency Inc | |

| Hoffhine Frances M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Swayne Ramona | $125,900 | |

| Previous Owner | Meadows John H | $94,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,949 | $65,700 | $13,650 | $52,050 |

| 2023 | $2,911 | $65,695 | $13,650 | $52,045 |

| 2022 | $2,326 | $44,840 | $6,830 | $38,010 |

| 2021 | $2,330 | $44,840 | $6,830 | $38,010 |

| 2020 | $2,333 | $44,840 | $6,830 | $38,010 |

| 2019 | $2,092 | $34,480 | $5,250 | $29,230 |

| 2018 | $2,029 | $34,480 | $5,250 | $29,230 |

| 2017 | $2,130 | $34,480 | $5,250 | $29,230 |

| 2016 | $2,170 | $32,760 | $6,090 | $26,670 |

| 2015 | $1,970 | $32,760 | $6,090 | $26,670 |

| 2014 | $1,975 | $32,760 | $6,090 | $26,670 |

| 2013 | $1,218 | $40,950 | $7,630 | $33,320 |

Source: Public Records

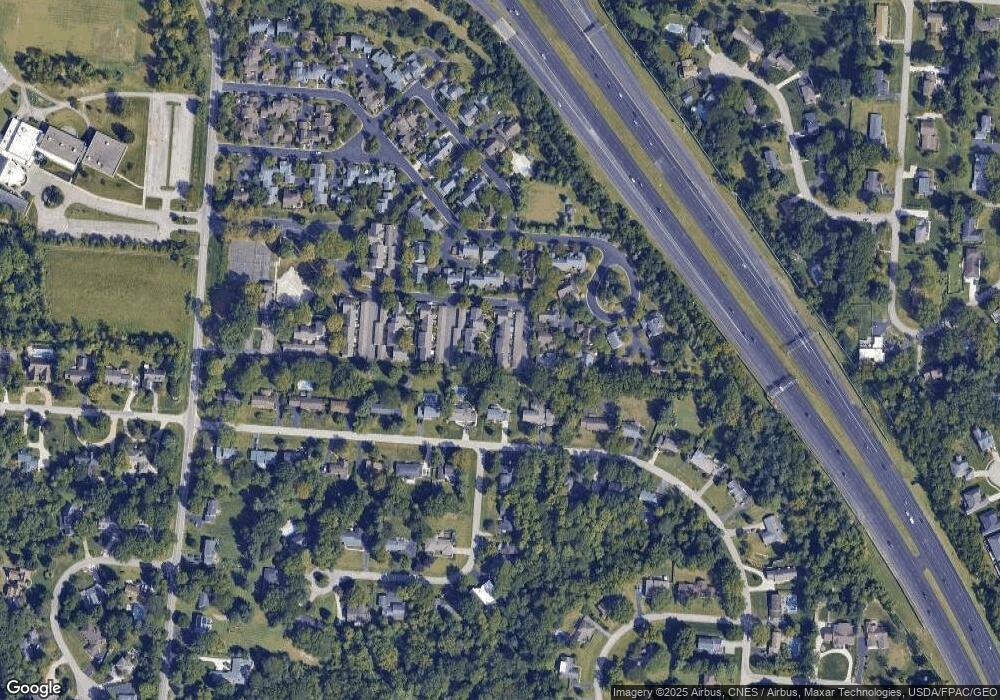

Map

Nearby Homes

- 5613 Chowning Way Unit 6B

- 5671 Bastille Place

- 5850 Forestview Dr

- 5882 Timber Dr

- 6033 McNaughten Grove Ln

- Oxford Plan at Icon Villas at McNaughten

- Ashton Plan at Icon Villas at McNaughten

- 686 Fairway Blvd

- 6040 Naughten Pond Dr

- 6052 Naughten Pond Dr

- 6056 Naughten Pond Dr

- 187 McNaughten Rd

- 110 Ironclad Dr Unit 9

- 85 Stornoway Dr W Unit 85

- 856 Cummington Rd

- 185 Prairiecreek Way Unit 185

- 807 McNaughten Rd

- 541 Woodingham Place Unit 2-C

- 557 Woodingham Place Unit 1A

- 6193 Stornoway Dr S Unit 6193

- 5623 Chowning Way Unit 7E

- 5625 Chowning Way Unit 7D

- 5627 Chowning Way

- 5619 Chowning Way Unit 7G

- 5629 Chowning Way Unit 7B

- 5617 Chowning Way Unit 7H

- 5605 Chowning Way

- 5611 Chowning Way Unit 6C

- 5611 Chowning Way Unit 6-C

- 5631 Chowning Way

- 5609 Chowning Way Unit 6D

- 5615 Chowning Way Unit 6A

- 5607 Chowning Way Unit 6E

- 5603 Chowning Way Unit 6G

- 5601 Chowning Way

- 5803 Bastille Place Unit 62

- 5805 Bastille Place Unit 63

- 5799 Bastille Place Unit 61

- 5628 Naiche Rd

- 5771 Bastille Place Unit 54