5630 Laurel Oak Dr Unit 12 Suwanee, GA 30024

Estimated Value: $1,245,000 - $1,372,000

6

Beds

7

Baths

6,420

Sq Ft

$204/Sq Ft

Est. Value

About This Home

This home is located at 5630 Laurel Oak Dr Unit 12, Suwanee, GA 30024 and is currently estimated at $1,307,641, approximately $203 per square foot. 5630 Laurel Oak Dr Unit 12 is a home located in Forsyth County with nearby schools including Sharon Elementary School, South Forsyth Middle School, and Lambert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 14, 2020

Sold by

Paterson Bryan Alexander

Bought by

Paterson Bryan Alexander and Paterson Lindsay

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$510,400

Outstanding Balance

$453,146

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$854,495

Purchase Details

Closed on

Aug 16, 2013

Sold by

Fitzgerald Timothy G

Bought by

Althardt Gregory Steven

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$347,500

Interest Rate

3.44%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 16, 1997

Sold by

Marrett Homes L P

Bought by

Fitzgerald Timothy G and Fitzgerald Jean G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$377,900

Interest Rate

7%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Paterson Bryan Alexander | -- | -- | |

| Paterson Bryan Alexander | $834,000 | -- | |

| Althardt Gregory Steven | $647,500 | -- | |

| Fitzgerald Timothy G | $419,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Paterson Bryan Alexander | $510,400 | |

| Closed | Paterson Bryan Alexander | $124,800 | |

| Closed | Paterson Bryan Alexander | $510,400 | |

| Previous Owner | Althardt Gregory Steven | $347,500 | |

| Previous Owner | Fitzgerald Timothy G | $377,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,207 | $530,724 | $100,000 | $430,724 |

| 2024 | $10,207 | $468,160 | $80,000 | $388,160 |

| 2023 | $9,272 | $432,244 | $72,000 | $360,244 |

| 2022 | $8,935 | $304,008 | $50,000 | $254,008 |

| 2021 | $8,305 | $304,008 | $50,000 | $254,008 |

| 2020 | $7,978 | $305,884 | $50,000 | $255,884 |

| 2019 | $7,889 | $301,016 | $50,000 | $251,016 |

| 2018 | $7,754 | $293,644 | $40,000 | $253,644 |

| 2017 | $7,741 | $291,632 | $40,000 | $251,632 |

| 2016 | $7,741 | $291,632 | $40,000 | $251,632 |

| 2015 | $7,551 | $281,992 | $40,000 | $241,992 |

| 2014 | $6,572 | $251,540 | $0 | $0 |

Source: Public Records

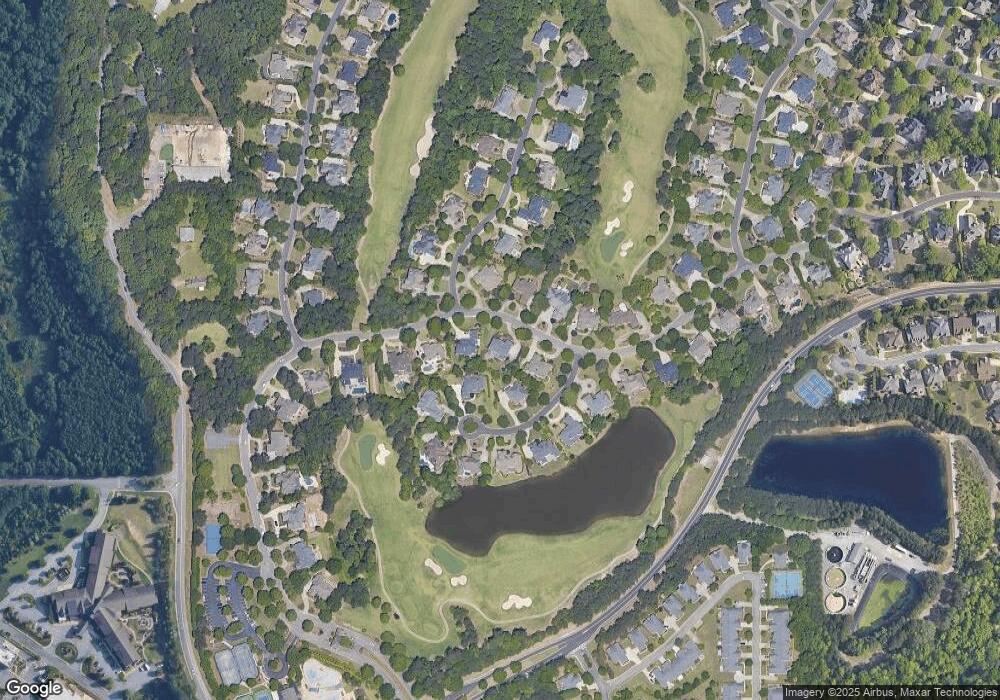

Map

Nearby Homes

- 5625 Buckleigh Pointe

- 5235 Villa Lake Ct

- 6005 Oakbury Ln

- 5995 Ettington Dr

- 335 Pintail Ct

- 6010 Somerset Ct

- 5060 Brent Knoll Ln Unit 1

- 6505 Caldwell Ct

- 3415 Fox Hollow Way

- 3440 Commander Cove

- 3470 Commander Cove

- 3485 Vermillion View

- 3430 Commander Cove

- 3510 Vermillion View

- 4790 Ashwell Ln

- 7025 Blackthorn Ln

- 4815 Ashwell Ln Unit 2

- 10225 Worthington Manor

- 3150 Thistle Trail

- 6930 Blackthorn Ln

- 5630 Laurel Oak Dr

- 5610 Laurel Oak Dr

- 5640 Laurel Oak Dr

- 5730 Winsley Cir

- 5760 Winsley Cir

- 5625 Laurel Oak Dr

- 5635 Laurel Oak Dr

- 5635 Laurel Oak Dr Unit 1

- 5540 Laurel Oak Dr Unit 1

- 5620 Buckleigh Pointe

- 5620 Buckleigh Unit 1

- 5620 Buckleigh

- 5620 Buckleigh Pte

- 5705 Laurel Oak Dr

- 5705 Laurel Oak Dr

- 5770 Winsley Cir

- 5715 Winsley Cir

- 5725 Winsley Cir

- 5630 Buckleigh Pointe

- 5530 Laurel Oak Dr