5630 NW 117th Ave Unit 33 Coral Springs, FL 33076

Wyndham Lakes NeighborhoodEstimated Value: $496,000 - $553,000

4

Beds

2

Baths

1,952

Sq Ft

$269/Sq Ft

Est. Value

About This Home

This home is located at 5630 NW 117th Ave Unit 33, Coral Springs, FL 33076 and is currently estimated at $526,055, approximately $269 per square foot. 5630 NW 117th Ave Unit 33 is a home located in Broward County with nearby schools including Eagle Ridge Elementary School, Coral Springs Middle School, and Marjory Stoneman Douglas High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2024

Sold by

Lee Emily Erin and Manos Emily E

Bought by

Carona Wilson and Lambert Jordan Lambert

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$424,000

Outstanding Balance

$419,659

Interest Rate

6.49%

Mortgage Type

New Conventional

Estimated Equity

$106,396

Purchase Details

Closed on

May 9, 2013

Sold by

Liebowitz Ian

Bought by

Manos Emily E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

3.56%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 13, 2004

Sold by

Porvin Mitchell A and Porvin Lori J

Bought by

Liebowitz Ian

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,000

Interest Rate

6.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 2, 1999

Sold by

Available Not

Bought by

Available Not

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carona Wilson | $530,000 | Priority Title | |

| Manos Emily E | $190,000 | Real Title Insurance Agency | |

| Liebowitz Ian | $242,500 | -- | |

| Available Not | $150,300 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Carona Wilson | $424,000 | |

| Previous Owner | Manos Emily E | $135,000 | |

| Previous Owner | Liebowitz Ian | $194,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,488 | $478,270 | $36,490 | $441,780 |

| 2024 | $4,323 | $466,060 | $36,490 | $429,570 |

| 2023 | $4,323 | $205,110 | $0 | $0 |

| 2022 | $4,101 | $199,140 | $0 | $0 |

| 2021 | $3,876 | $193,340 | $0 | $0 |

| 2020 | $3,747 | $190,680 | $0 | $0 |

| 2019 | $3,679 | $186,400 | $0 | $0 |

| 2018 | $3,485 | $182,930 | $0 | $0 |

| 2017 | $3,392 | $179,170 | $0 | $0 |

| 2016 | $3,221 | $175,490 | $0 | $0 |

| 2015 | $3,261 | $174,280 | $0 | $0 |

| 2014 | $3,226 | $172,900 | $0 | $0 |

| 2013 | -- | $172,400 | $36,490 | $135,910 |

Source: Public Records

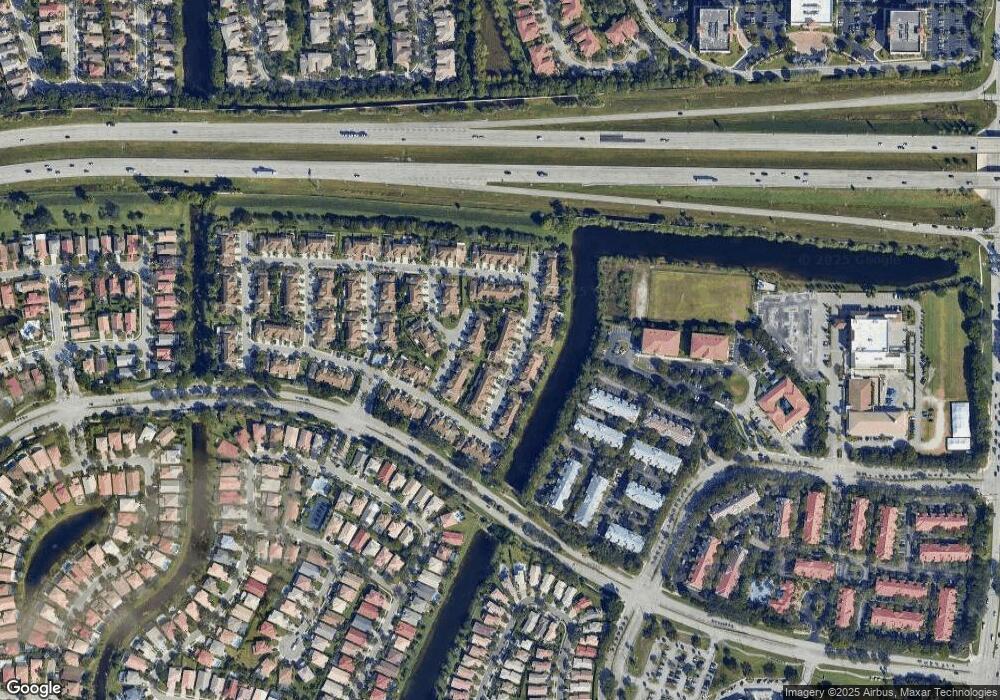

Map

Nearby Homes

- 11766 NW 57th St Unit 72

- 11876 NW 55th St

- 11655 NW 54th St

- 12056 NW 56th St

- 5640 NW 120th Terrace

- 5926 NW 117th Dr Unit 9B

- 5382 NW 120th Ave

- 11955 NW 57th Manor

- 5747 NW 119th Dr

- 5724 NW 120th Ave

- 12130 NW 56th Ct

- 5445 NW 122nd Dr

- 5285 NW 117th Ave

- 5334 NW 120th Ave

- 5782 NW 119th Dr

- 5255 NW 117th Ave

- 12205 NW 56th Ct

- 12250 NW 57th St

- 11600 NW 52nd Ct

- 5067 NW 120th Ave

- 5630 NW 117th Ave Unit 1

- 5634 NW 117th Ave

- 5626 NW 117th Ave

- 5638 NW 117th Ave Unit 31

- 5622 NW 117th Ave

- 5642 NW 117th Ave Unit 30

- 5627 NW 118th Dr

- 5631 NW 118th Dr Unit 26

- 5623 NW 118th Dr Unit 24

- 5618 NW 117th Ave

- 5635 NW 118th Dr

- 5633 NW 117th Ave

- 5646 NW 117th Ave

- 5646 NW 117th Ave Unit 5646

- 5637 NW 117th Ave

- 5625 NW 117th Ave Unit 5625

- 5625 NW 117th Ave Unit 47

- 5619 NW 118th Dr

- 5639 NW 118th Dr Unit 28

- 5614 NW 117th Ave