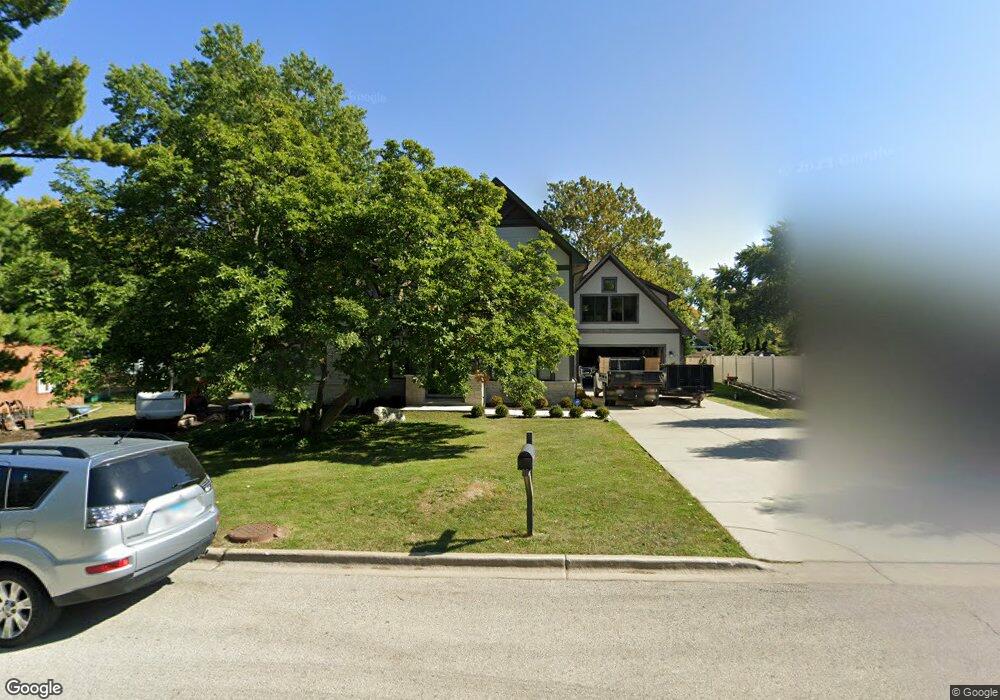

5639 S Peck Ave Countryside, IL 60525

Estimated Value: $522,000 - $607,341

4

Beds

3

Baths

2,452

Sq Ft

$231/Sq Ft

Est. Value

About This Home

This home is located at 5639 S Peck Ave, Countryside, IL 60525 and is currently estimated at $566,335, approximately $230 per square foot. 5639 S Peck Ave is a home located in Cook County with nearby schools including Highlands Elementary School, Highlands Middle School, and Lyons Township High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 27, 2024

Sold by

Strecker Michael J and Strecker Dennis J

Bought by

Michael J Strecker Revocable Trust and Strecker

Current Estimated Value

Purchase Details

Closed on

Jan 10, 2012

Sold by

Fishman Constance A and Gilmore Caroline Sue

Bought by

Strecker Michael J and Strecker Dennis J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

3.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 18, 2005

Sold by

Webb Margaret A

Bought by

Webb Margaret A and Fishman Constance A

Purchase Details

Closed on

Jul 24, 2000

Sold by

Hetzel Douglas R and Hetzel Carol A

Bought by

Webb Margaret A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Michael J Strecker Revocable Trust | -- | None Listed On Document | |

| Strecker Michael J | $180,000 | Attorneys Title Guaranty Fun | |

| Webb Margaret A | -- | -- | |

| Webb Margaret A | $143,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Strecker Michael J | $135,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,821 | $50,307 | $18,038 | $32,269 |

| 2023 | $10,453 | $50,307 | $18,038 | $32,269 |

| 2022 | $10,453 | $45,649 | $15,685 | $29,964 |

| 2021 | $9,954 | $45,648 | $15,685 | $29,963 |

| 2020 | $5,893 | $28,738 | $15,685 | $13,053 |

| 2019 | $4,768 | $24,111 | $14,116 | $9,995 |

| 2018 | $4,680 | $24,111 | $14,116 | $9,995 |

| 2017 | $4,574 | $24,111 | $14,116 | $9,995 |

| 2016 | $3,981 | $18,827 | $12,548 | $6,279 |

| 2015 | $3,886 | $18,827 | $12,548 | $6,279 |

| 2014 | $3,846 | $18,827 | $12,548 | $6,279 |

| 2013 | $5,486 | $23,748 | $12,548 | $11,200 |

Source: Public Records

Map

Nearby Homes

- 5547 S Peck Ave

- 5736 Willow Springs Rd

- 1316 W 55th St

- 5546 Laurel Ave

- 5727 Howard Ave

- 1720 W 54th Place

- 1392 W 52nd Place

- 5559 Wolf Rd

- 5811 Longview Dr Unit 2

- 1901 W Plainfield Rd

- 1140 S Stone Ave

- 5684 Wolf Rd

- 5314 Franklin Ave

- 5129 Harvey Ave

- 5808 Wolf Rd Unit 3

- 5214 Howard Ave

- 6001 Wolf Rd

- 6220 Sunset Ave

- 1001 S Brainard Ave

- 210 51st Place

- 5647 S Peck Ave

- 5631 S Peck Ave

- 5638 S Peck Ave Unit 3

- 5632 S Peck Ave

- 5625 S Peck Ave

- 5646 S Peck Ave

- 5707 S Peck Ave

- 5624 S Peck Ave

- 5704 S Peck Ave Unit 3

- 5617 S Peck Ave

- 5646 Leitch Ave

- 5632 Leitch Ave

- 5717 S Peck Ave

- 5640 Leitch Ave

- 5706 Leitch Ave

- 5624 Leitch Ave

- 5710 S Peck Ave

- 5616 S Peck Ave

- 5639 Willow Springs Rd

- 5633 Willow Springs Rd