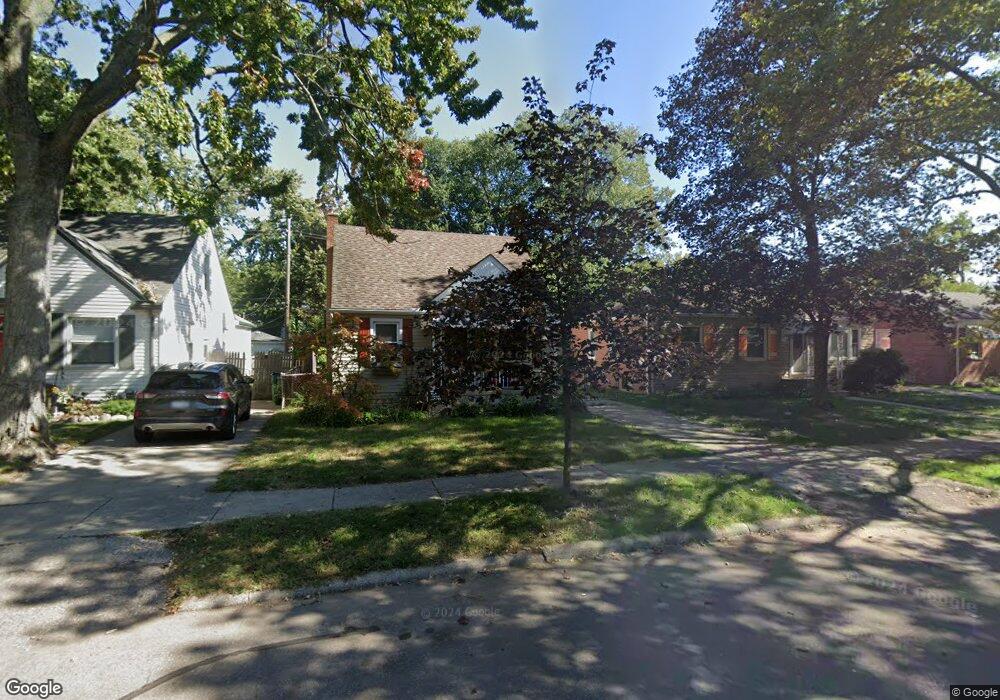

564 Gardendale St Unit Bldg-Unit Ferndale, MI 48220

Estimated Value: $246,000 - $313,000

3

Beds

1

Bath

920

Sq Ft

$289/Sq Ft

Est. Value

About This Home

This home is located at 564 Gardendale St Unit Bldg-Unit, Ferndale, MI 48220 and is currently estimated at $265,578, approximately $288 per square foot. 564 Gardendale St Unit Bldg-Unit is a home located in Oakland County with nearby schools including Ferndale Lower Elementary Campus, Ferndale Upper Elementary Campus, and Ferndale Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 18, 2018

Sold by

Elder Mark

Bought by

Call Claire Renee and Johnson Nicholas Dale

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$161,280

Outstanding Balance

$139,773

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$125,805

Purchase Details

Closed on

Jan 22, 2004

Sold by

Boulier Randy and Sirva Relocation Llc

Bought by

Elder Mark

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,400

Interest Rate

4.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 29, 1998

Sold by

Chouinard Martin

Bought by

Boulier Randy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,600

Interest Rate

6.8%

Purchase Details

Closed on

Oct 24, 1994

Sold by

Getz Marla A

Bought by

Ghouinard Martin

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Call Claire Renee | $179,200 | None Available | |

| Elder Mark | $153,000 | -- | |

| Boulier Randy | $104,000 | -- | |

| Ghouinard Martin | $42,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Call Claire Renee | $161,280 | |

| Previous Owner | Elder Mark | $122,400 | |

| Previous Owner | Boulier Randy | $93,600 | |

| Closed | Ghouinard Martin | -- | |

| Closed | Elder Mark | $30,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,671 | $96,190 | $0 | $0 |

| 2023 | $3,566 | $91,000 | $0 | $0 |

| 2022 | $3,586 | $83,180 | $0 | $0 |

| 2021 | $3,608 | $73,550 | $0 | $0 |

| 2020 | $3,418 | $69,040 | $0 | $0 |

| 2019 | $3,474 | $61,240 | $0 | $0 |

| 2018 | $2,649 | $52,750 | $0 | $0 |

| 2017 | $2,610 | $52,880 | $0 | $0 |

| 2016 | $2,576 | $48,680 | $0 | $0 |

| 2015 | -- | $45,900 | $0 | $0 |

| 2014 | -- | $38,830 | $0 | $0 |

| 2011 | -- | $36,840 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 559 Gardendale St

- 395 Glendale Ln

- 415 Laprairie St

- 695 Livernois St

- 855 Allen St

- 404 Laprairie St

- 228 Kensington Ave

- 210 Saint Louis St

- 918 Saint Louis St

- 378 Fielding St

- 243 Edgewood Place

- 768 Pinecrest Dr

- 20441 Gardendale St

- 20417 Gardendale St

- 2836 Woodstock Dr

- 964 W Marshall St

- 482 W 8 Mile Rd

- 457 W Bennett

- 546 Leroy St

- 295 W Webster St

- 564 Gardendale St

- 574 Gardendale St

- 554 Gardendale St

- 584 Gardendale St

- 544 Gardendale St

- 563 Meadowdale St Unit Bldg-Unit

- 563 Meadowdale St

- 553 Meadowdale St

- 573 Meadowdale St

- 594 Gardendale St

- 583 Meadowdale St

- 534 Gardendale St

- 563 Gardendale St

- 573 Gardendale St

- 593 Meadowdale St

- 545 Meadowdale St

- 604 Gardendale St

- 583 Gardendale St

- 533 Meadowdale St

- 524 Gardendale St