565 Red Ledges Blvd Unit 111 Heber City, UT 84032

Estimated Value: $3,129,000 - $4,435,000

--

Bed

--

Bath

3,047

Sq Ft

$1,278/Sq Ft

Est. Value

About This Home

This home is located at 565 Red Ledges Blvd Unit 111, Heber City, UT 84032 and is currently estimated at $3,894,896, approximately $1,278 per square foot. 565 Red Ledges Blvd Unit 111 is a home located in Wasatch County with nearby schools including J.R. Smith Elementary School and Wasatch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 25, 2022

Sold by

Kaszton William Fred

Bought by

Iv Blessings Trust and William Fred Kaszton And Patricia Ann (Sartori) Kaszton 1987

Current Estimated Value

Purchase Details

Closed on

Jan 4, 2021

Sold by

Kaszton William and Kaszton Patricia

Bought by

Kaszton William F and Kaszton Patricia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$2,437,000

Interest Rate

3.12%

Mortgage Type

Construction

Purchase Details

Closed on

Jul 15, 2019

Sold by

Chrirstensen Ladd E

Bought by

Kaszton William and Kaszton Patricia

Purchase Details

Closed on

Jun 29, 2009

Sold by

Red Ledges Land Development Inc

Bought by

Lee Michael and Lee Barbara

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Iv Blessings Trust | -- | First American Title | |

| Kaszton William F | -- | Us Title Insurance Agency | |

| Kaszton William | -- | Summit Escrow & Title | |

| Lee Michael | -- | Founders Title Company Heber |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kaszton William F | $2,437,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $39,649 | $3,856,950 | $700,000 | $3,156,950 |

| 2024 | $39,649 | $3,896,948 | $675,000 | $3,221,948 |

| 2023 | $39,649 | $3,277,500 | $500,000 | $2,777,500 |

| 2022 | $17,261 | $1,706,100 | $500,000 | $1,206,100 |

| 2021 | $4,458 | $350,000 | $350,000 | $0 |

| 2020 | $2,982 | $228,000 | $228,000 | $0 |

| 2019 | $2,825 | $228,000 | $0 | $0 |

| 2018 | $2,825 | $228,000 | $0 | $0 |

| 2017 | $2,841 | $228,000 | $0 | $0 |

| 2016 | $2,917 | $228,000 | $0 | $0 |

| 2015 | $2,782 | $228,000 | $228,000 | $0 |

| 2014 | $2,807 | $228,000 | $228,000 | $0 |

Source: Public Records

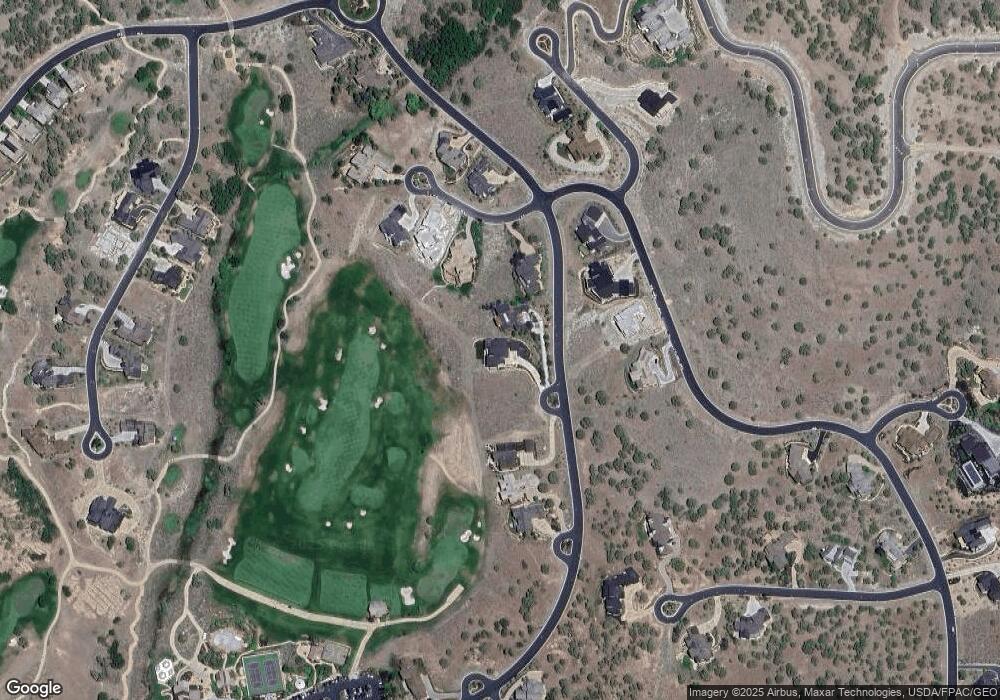

Map

Nearby Homes

- 623 N Ibapah Peak Dr

- 623 N Ibapah Peak Dr Unit 179

- 657 N Ibapah Peak Dr

- 2884 E Brown Duck Mountain Cir

- 2884 E Brown Duck Mountain Cir Unit 104

- 680 N Pinto Knoll Cir Unit 523

- 680 N Pinto Knoll Cir

- 3052 E Horse Mountain Cir

- 3052 E Horse Mountain Cir Unit 192

- 311 Red Ledges Blvd

- 311 Red Ledges Blvd Unit 120

- 295 Red Ledges Blvd

- 295 Red Ledges Blvd Unit 121

- 767 N Pinto Knoll Cir Unit 526

- 310 Red Ledges Blvd

- 3120 E Horse Mountain Cir Unit 195

- 3120 E Horse Mountain Cir

- 787 Red Ledges Blvd

- 645 N Red Mountain Ct

- 444 N Ibapah Peak Dr

- 565 Red Ledges Blvd

- 565 Red Ledges Blvd

- 565 Red Ledges Blvd Unit 111

- 565 Red Ledges Blvd Unit 111

- 561 N Red Ledges Blvd

- 551 Red Ledges Blvd

- 551 Red Ledges Blvd Unit 112

- 565 N Red Ledges Blvd

- 537 Red Ledges Blvd Unit 113

- 601 N Red Ledges Blvd Unit 110

- 601 N Red Ledges Blvd

- 511 Red Ledges Blvd

- 511 Red Ledges Blvd Unit 114

- 511 N Red Ledges Blvd (Lot 114) Unit 114

- 511 N Red Ledges Blvd (Lot 114)

- 605 Ibapah Peak Dr

- 605 N Ibapah Peak Dr (Lot 180)

- 623 N Ibapah Peak Drive (Lot 179) Dr

- 481 N Red Ledges Blvd

- 2930 E Brown Duck Mountain Cir