57 Sheila Ln Valparaiso, IN 46385

Porter County NeighborhoodEstimated Value: $541,000 - $858,000

4

Beds

4

Baths

2,881

Sq Ft

$234/Sq Ft

Est. Value

About This Home

This home is located at 57 Sheila Ln, Valparaiso, IN 46385 and is currently estimated at $675,366, approximately $234 per square foot. 57 Sheila Ln is a home located in Porter County with nearby schools including Morgan Township Elementary School and Morgan Township Middle/High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 4, 2008

Sold by

Snider Farms Inc

Bought by

Stoner Timothy W and Stoner Laura M

Current Estimated Value

Purchase Details

Closed on

Jan 31, 2006

Sold by

Oconnor Builders Inc

Bought by

Stoner Timothy W and Stoner Laura M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Interest Rate

6.37%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

May 25, 2005

Sold by

Stoner Timothy William and Stoner Laura M

Bought by

Oconnor Ronald W

Purchase Details

Closed on

May 5, 2005

Sold by

Stoner Timothy William and Stoner Laura M

Bought by

Stoner Timothy William and Stoner Laura M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stoner Timothy W | -- | Chicago Title Insurance Co | |

| Stoner Timothy W | -- | Ticor Title Ins | |

| Oconnor Builders Inc | -- | Ticor Title Ins | |

| Oconnor Ronald W | -- | -- | |

| Stoner Timothy William | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Stoner Timothy W | $220,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,847 | $592,100 | $42,000 | $550,100 |

| 2023 | $3,707 | $534,400 | $36,700 | $497,700 |

| 2022 | $3,603 | $481,100 | $36,300 | $444,800 |

| 2021 | $3,370 | $422,000 | $36,000 | $386,000 |

| 2020 | $3,039 | $385,300 | $31,500 | $353,800 |

| 2019 | $2,922 | $359,100 | $31,800 | $327,300 |

| 2018 | $2,743 | $344,500 | $31,900 | $312,600 |

| 2017 | $2,689 | $342,900 | $32,200 | $310,700 |

| 2016 | $2,433 | $322,000 | $33,000 | $289,000 |

| 2014 | $2,501 | $311,500 | $32,100 | $279,400 |

| 2013 | -- | $295,200 | $32,100 | $263,100 |

Source: Public Records

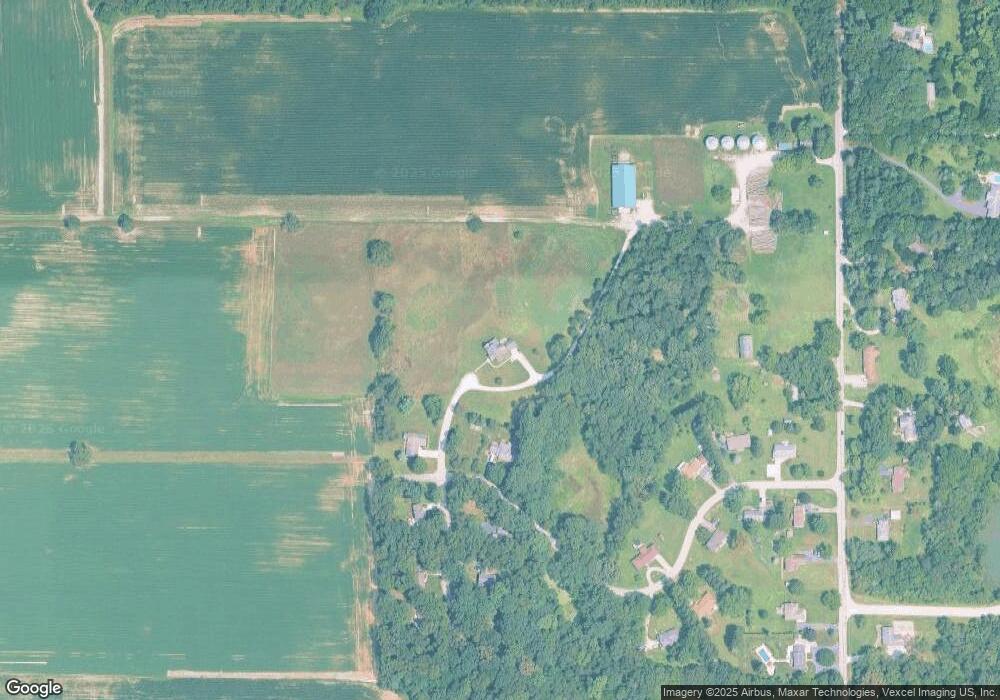

Map

Nearby Homes

- 0 Smoke Rd

- 48 E Division Rd

- 3152 Heavilin Rd

- 501 Eagle Ct

- 2655 Vivante Dr

- 3359 Blue Jay Dr

- 2658 Arran Quay Terrace

- 2054 Lawndale Dr

- 183 Cimarron Dr

- 2551 Saint Road 2

- 1954 Lawndale Dr

- 1284 Rowley St

- 1556 Smoke Rd

- 1952 Galena Ct

- 16 S 200 W

- 1659 Tippecanoe Ct

- 1465 Clark Rd

- 3251 Mockingbird Ln

- 3353 Field Hawk Dr

- 1658 Clifty Creek Ct