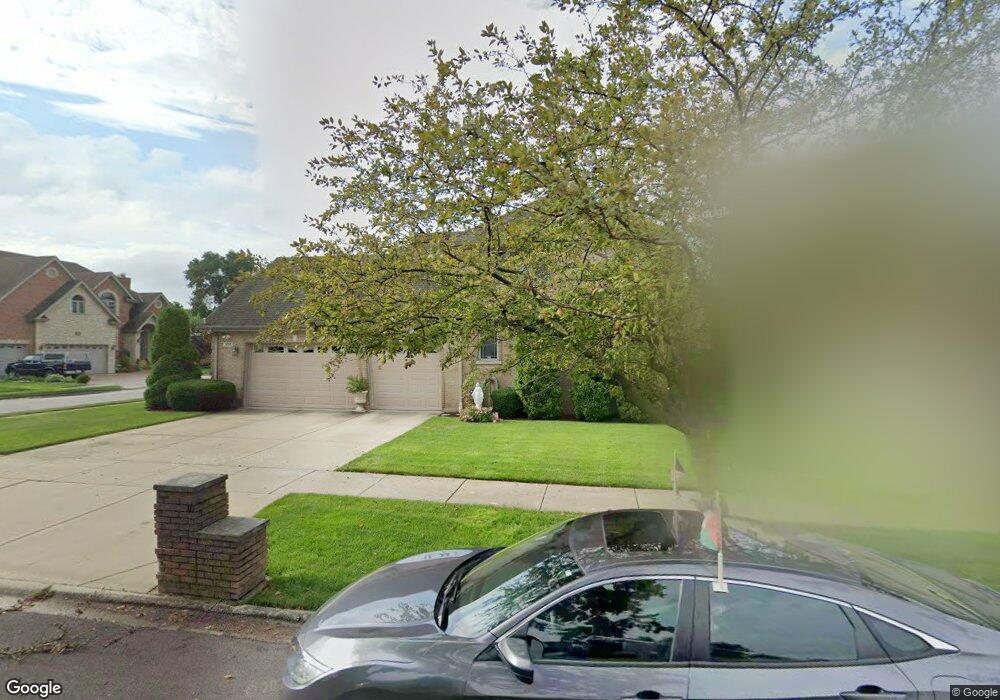

5703 W 90th St Oak Lawn, IL 60453

Estimated Value: $451,000 - $642,932

4

Beds

3

Baths

3,242

Sq Ft

$175/Sq Ft

Est. Value

About This Home

This home is located at 5703 W 90th St, Oak Lawn, IL 60453 and is currently estimated at $566,733, approximately $174 per square foot. 5703 W 90th St is a home located in Cook County with nearby schools including Harnew Elementary School, Simmons Middle School, and Oak Lawn Community High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2014

Sold by

Maciel Daniel M and Maciel Silvia

Bought by

Maciel Daniel and The Daniel Maciel Trust

Current Estimated Value

Purchase Details

Closed on

May 28, 2003

Sold by

Borzeeki Teresa and Trzebunia Adam

Bought by

Maciel Daniel M and Maciel Silvia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,000

Interest Rate

5.78%

Mortgage Type

Unknown

Purchase Details

Closed on

Feb 15, 2002

Sold by

Gilardi Angelina A

Bought by

Borzecki Teresa and Trzebunia Adam

Purchase Details

Closed on

May 18, 2001

Sold by

Cegielski Evelyn

Bought by

Gilardi Angelina A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Maciel Daniel | -- | None Available | |

| Maciel Daniel M | $450,000 | Stewart Title Of Illinois | |

| Maciel Daniel M | $450,000 | Stewart Title Of Illinois | |

| Borzecki Teresa | $90,000 | First American Title | |

| Gilardi Angelina A | $76,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Maciel Daniel M | $325,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $14,147 | $52,000 | $8,243 | $43,757 |

| 2023 | $11,535 | $52,000 | $8,243 | $43,757 |

| 2022 | $11,535 | $36,263 | $7,106 | $29,157 |

| 2021 | $11,208 | $36,263 | $7,106 | $29,157 |

| 2020 | $11,058 | $36,263 | $7,106 | $29,157 |

| 2019 | $12,675 | $42,469 | $6,537 | $35,932 |

| 2018 | $12,144 | $42,469 | $6,537 | $35,932 |

| 2017 | $12,335 | $42,469 | $6,537 | $35,932 |

| 2016 | $10,368 | $33,381 | $5,400 | $27,981 |

| 2015 | $10,958 | $35,513 | $5,400 | $30,113 |

| 2014 | $10,878 | $35,513 | $5,400 | $30,113 |

| 2013 | $8,146 | $29,715 | $5,400 | $24,315 |

Source: Public Records

Map

Nearby Homes

- 9001 Major Ave

- 5701 W 89th Place

- 5555 W 90th St

- 5840 W 90th St

- 5831 W 89th St

- 5500 W 90th St

- 5746 W 88th St

- 5905 W 89th St

- 8762 Central Ave

- 8758 Central Ave

- 5649 W 87th Place

- 9228 S 55th Ct

- 9100 Lynwood Dr

- 5368 Otto Place

- 9239 S 55th Ct

- 8743 Austin Ave

- 5316 Otto Place

- 8638 Central Ave

- 9258 Austin Ave

- 8558 Parkside Ave

- 5705 W 90th St

- 5707 W 90th St

- 5700 W 90th Place

- 9005 Major Ave

- 5725 W 90th St

- 5708 W 90th Place

- 5708 W 90th Place

- 9015 Major Ave

- 5712 W 90th Place

- 5700 W 90th St

- 5704 W 90th St

- 5721 W 90th St

- 8945 Major Ave

- 5708 W 90th St

- 9025 Major Ave

- 5712 W 90th St

- 8939 Major Ave

- 5718 W 90th Place

- 5729 W 90th St

- 9031 Major Ave