5706 Sanderling Ln Unit 5706 Westerville, OH 43081

Estimated Value: $276,603 - $291,000

2

Beds

2

Baths

1,237

Sq Ft

$231/Sq Ft

Est. Value

About This Home

This home is located at 5706 Sanderling Ln Unit 5706, Westerville, OH 43081 and is currently estimated at $285,401, approximately $230 per square foot. 5706 Sanderling Ln Unit 5706 is a home located in Franklin County with nearby schools including Avalon Elementary School, Northgate Intermediate, and Woodward Park Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 6, 2015

Sold by

Button Cheryl L and The Adams Keystone Preservatio

Bought by

Swords Paul E and Swords Constance G

Current Estimated Value

Purchase Details

Closed on

Feb 25, 2015

Sold by

Adams Barbara A and Button Cheryl L

Bought by

Button Cheryl L and Adams Keystone Preservation Tr

Purchase Details

Closed on

Nov 19, 2014

Sold by

Adams David R

Bought by

Button Cheryl L and The Adams Keystone Preservatio

Purchase Details

Closed on

Dec 21, 2000

Sold by

Adams David R and Adams Barbara A

Bought by

Adams David R and Adams Barbara A

Purchase Details

Closed on

Aug 18, 2000

Sold by

M H Murphy Development Company

Bought by

Adams David R and Adams Barbara A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Swords Paul E | $133,900 | Chicago Title | |

| Button Cheryl L | -- | Chicago Title | |

| Button Cheryl L | -- | None Available | |

| Adams David R | -- | None Available | |

| Adams David R | -- | -- | |

| Adams David R | $132,200 | Chicago Title |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,578 | $89,530 | $16,800 | $72,730 |

| 2023 | $3,560 | $89,530 | $16,800 | $72,730 |

| 2022 | $2,609 | $59,050 | $10,150 | $48,900 |

| 2021 | $2,613 | $59,050 | $10,150 | $48,900 |

| 2020 | $2,617 | $59,050 | $10,150 | $48,900 |

| 2019 | $2,124 | $43,760 | $7,530 | $36,230 |

| 2018 | $1,060 | $43,760 | $7,530 | $36,230 |

| 2017 | $1,841 | $43,760 | $7,530 | $36,230 |

| 2016 | $2,718 | $41,030 | $7,320 | $33,710 |

| 2015 | $971 | $41,030 | $7,320 | $33,710 |

| 2014 | $1,946 | $41,030 | $7,320 | $33,710 |

| 2013 | $1,024 | $43,190 | $7,700 | $35,490 |

Source: Public Records

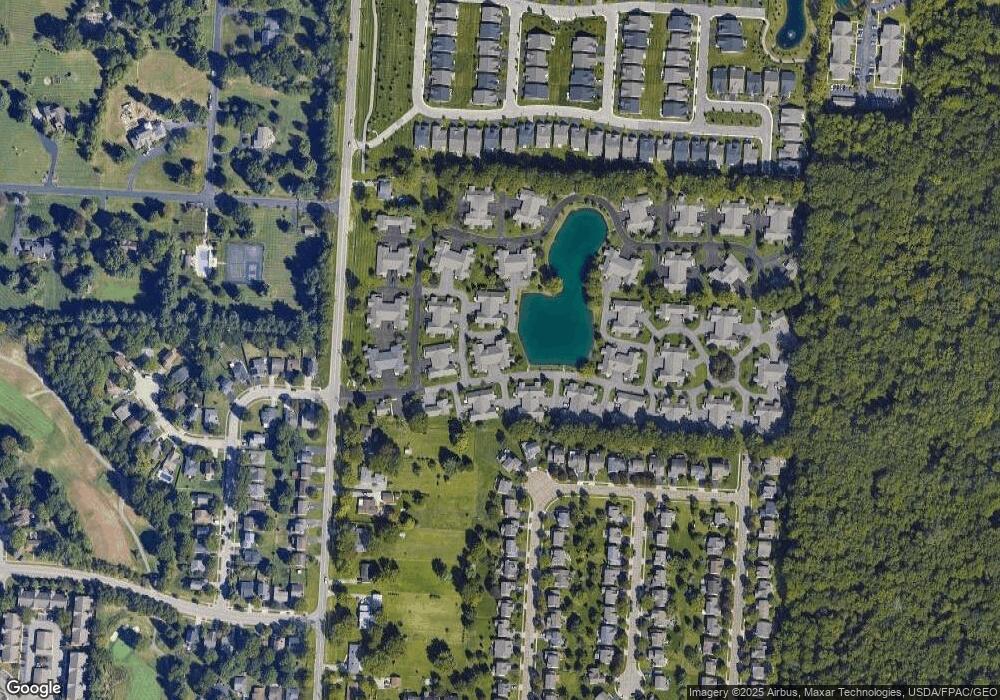

Map

Nearby Homes

- 6081 Warbling Ln

- 5353 Bulleit Dr Unit 49

- 5852 Edge of Village Unit 5852

- 4948 Nordley Village Unit 4948

- 5285 Highpointe Lakes Dr Unit 201

- 5211 Highpointe Lakes Dr Unit 7301

- 5211 Highpointe Lakes Dr Unit 7105

- 5189 Highpointe Lakes Dr Unit 8201

- 5339 Highpointe Lakes Dr Unit 402

- 5393 Rufford St Unit 5393

- 5177 Highpointe Lakes Dr Unit 9202

- 5177 Highpointe Lakes Dr Unit 9104

- 5641 Godetia St

- 5623 Godetia St

- 5709 Zinnia Rd

- 5450 Nottinghamshire Ln

- 5925 Lakemont Dr

- 5468 Nottinghamshire Ln

- 0 N Hamilton Rd

- 5518 Seclusion Dr

- 6018 Blendon Chase Dr Unit 6018

- 5704 Sanderling Ln Unit 5704

- 6016 Blendon Chase Dr Unit 6016

- 5714 Sanderling Ln Unit 5714

- 5716 Sanderling Ln Unit 5716

- 5712 Sanderling Ln Unit 5712

- 5718 Sanderling Ln Unit 5718

- 5711 Sanderling Ln Unit 5711

- 6019 Blendon Chase Dr Unit 6019

- 6029 Blendon Chase Dr Unit 6029

- 5703 Sanderling Ln Unit 5703

- 5701 Sanderling Ln Unit 5701

- 6017 Blendon Chase Dr Unit 6017

- 6031 Blendon Chase Dr Unit 6031

- 5713 Sanderling Ln Unit 5713

- 5668 Willet Ln Unit 5668

- 6021 Blendon Chase Dr Unit 6021

- 5710 Sanderling Ln

- 5710 Sanderling Ln Unit 31-571

- 5662 Willet Ln Unit 5662