5712 Desert Sky Way Unit 2 Las Vegas, NV 89149

Estimated Value: $415,564 - $456,000

3

Beds

3

Baths

1,793

Sq Ft

$243/Sq Ft

Est. Value

About This Home

This home is located at 5712 Desert Sky Way Unit 2, Las Vegas, NV 89149 and is currently estimated at $436,141, approximately $243 per square foot. 5712 Desert Sky Way Unit 2 is a home located in Clark County with nearby schools including Dean Lamar Allen Elementary School, Edmundo "Eddie" Escobedo, Sr. Middle School, and Centennial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 24, 2014

Sold by

Villafana Henry

Bought by

Villafana Henry

Current Estimated Value

Purchase Details

Closed on

Sep 23, 2013

Sold by

Villafana Marina

Bought by

Villafana Henry

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,000

Interest Rate

4.46%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 13, 2003

Sold by

Agbunag Rufino R and Agbunag Romana N

Bought by

Lesko Ryan R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,600

Interest Rate

6.99%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Villafana Henry | -- | None Available | |

| Villafana Henry | -- | First American Title | |

| Villafana Henry | $170,000 | First American Title Paseo | |

| Lesko Ryan R | $182,000 | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Villafana Henry | $136,000 | |

| Previous Owner | Lesko Ryan R | $145,600 | |

| Closed | Lesko Ryan R | $36,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,448 | $83,414 | $34,300 | $49,114 |

| 2024 | $1,406 | $83,414 | $34,300 | $49,114 |

| 2023 | $1,406 | $76,859 | $29,750 | $47,109 |

| 2022 | $1,365 | $67,213 | $23,800 | $43,413 |

| 2021 | $1,325 | $63,911 | $22,400 | $41,511 |

| 2020 | $1,284 | $63,827 | $22,400 | $41,427 |

| 2019 | $1,246 | $59,934 | $18,900 | $41,034 |

| 2018 | $1,210 | $53,862 | $14,350 | $39,512 |

| 2017 | $1,766 | $53,411 | $13,650 | $39,761 |

| 2016 | $1,147 | $51,025 | $10,850 | $40,175 |

| 2015 | $1,144 | $45,673 | $9,450 | $36,223 |

| 2014 | $1,110 | $32,382 | $5,950 | $26,432 |

Source: Public Records

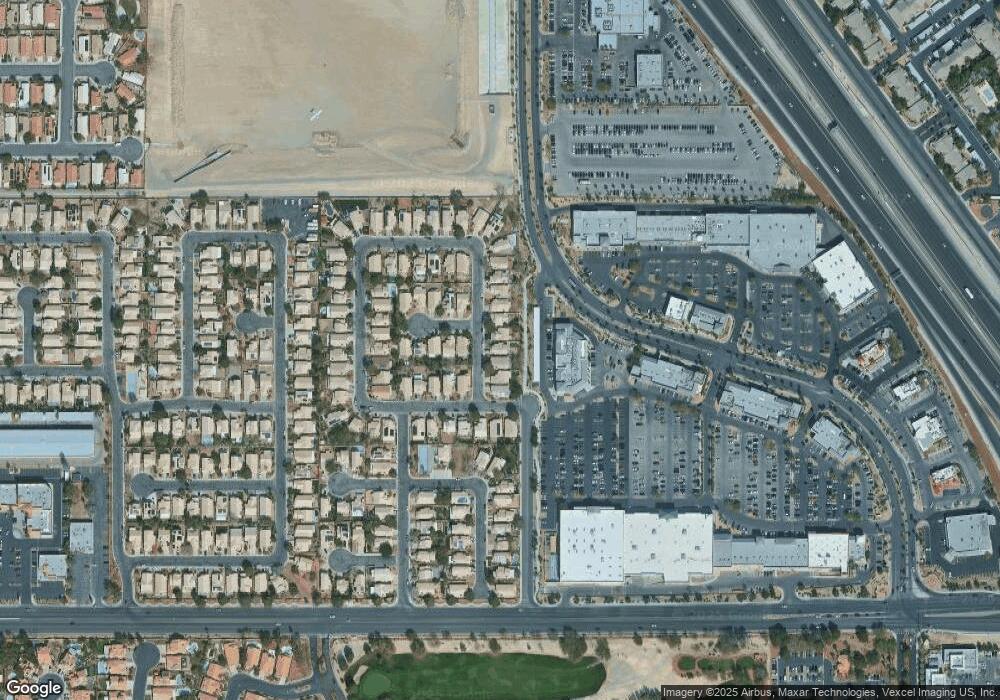

Map

Nearby Homes

- 5732 Desert Sky Way

- 5600 Bolton Bay Way

- 5708 Berwick Falls Ln

- 7721 Beach Falls Ct

- 7804 Wind Drift Rd

- 7633 Valley Green Dr Unit 202

- 7632 Rolling View Dr Unit 202

- 7625 Rolling View Dr Unit 202

- 7837 Mission Point Ln

- 7844 Quill Gordon Ave

- 5421 Painted Sunrise Dr

- 7849 March Brown Ave

- 5401 Painted Sunrise Dr

- 6013 Pebble Grey Ln

- 5704 Burdel St

- 5329 La Patera Ln

- 5481 Painted Mirage Rd

- 5509 Big Sky Ln

- 7908 Painted Rock Ln

- 5901 Silver Heights St

- 5716 Desert Sky Way

- 5708 Desert Sky Way

- 5720 Desert Sky Way

- 5720 Desert Sky Way Unit n

- 5704 Desert Sky Way

- 7613 Desert Cactus Cir

- 5724 Desert Sky Way

- 5700 Desert Sky Way

- 7612 Desert Breeze Ave

- 7617 Desert Cactus Cir

- 5728 Desert Sky Way

- 7612 Desert Cactus Cir

- 7616 Desert Breeze Ave Unit 2

- 7621 Desert Cactus Cir

- 7616 Desert Cactus Cir Unit 2

- 7620 Desert Breeze Ave

- 7605 Desert Breeze Ave

- 7601 Desert Breeze Ave

- 7625 Desert Cactus Cir

- 7609 Desert Breeze Ave