5725 Bernath Ct Unit 4 Toledo, OH 43615

Reynolds Corners NeighborhoodEstimated Value: $116,471 - $121,000

2

Beds

1

Bath

1,060

Sq Ft

$112/Sq Ft

Est. Value

About This Home

This home is located at 5725 Bernath Ct Unit 4, Toledo, OH 43615 and is currently estimated at $118,368, approximately $111 per square foot. 5725 Bernath Ct Unit 4 is a home located in Lucas County with nearby schools including Holloway Elementary School, Springfield Middle School, and Springfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 26, 2003

Sold by

Azizi Mustafa and Azizi Torpekai

Bought by

Kosinski Linda L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,660

Outstanding Balance

$35,598

Interest Rate

6.33%

Mortgage Type

Unknown

Estimated Equity

$82,770

Purchase Details

Closed on

Nov 17, 2000

Sold by

Dettinger James J and Dettinger Laurine S

Bought by

Azizi Mustafa and Azizi Torpekai

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,000

Interest Rate

7.87%

Purchase Details

Closed on

Nov 18, 1997

Sold by

Gibson John

Bought by

Dettinger James J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$53,200

Interest Rate

7.43%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 27, 1993

Sold by

Szmania Kenneth J

Purchase Details

Closed on

Feb 22, 1990

Sold by

Prala Thomas L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kosinski Linda L | $78,000 | -- | |

| Azizi Mustafa | $62,500 | -- | |

| Dettinger James J | $56,000 | -- | |

| -- | $50,000 | -- | |

| -- | $52,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kosinski Linda L | $75,660 | |

| Previous Owner | Azizi Mustafa | $55,000 | |

| Previous Owner | Dettinger James J | $53,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $421 | $24,430 | $2,240 | $22,190 |

| 2023 | $523 | $16,310 | $1,645 | $14,665 |

| 2022 | $544 | $16,310 | $1,645 | $14,665 |

| 2021 | $549 | $16,310 | $1,645 | $14,665 |

| 2020 | $730 | $17,955 | $1,400 | $16,555 |

| 2019 | $703 | $17,955 | $1,400 | $16,555 |

| 2018 | $695 | $17,955 | $1,400 | $16,555 |

| 2017 | $795 | $18,690 | $2,030 | $16,660 |

| 2016 | $811 | $53,400 | $5,800 | $47,600 |

| 2015 | $810 | $53,400 | $5,800 | $47,600 |

| 2014 | $660 | $18,690 | $2,030 | $16,660 |

| 2013 | $660 | $18,690 | $2,030 | $16,660 |

Source: Public Records

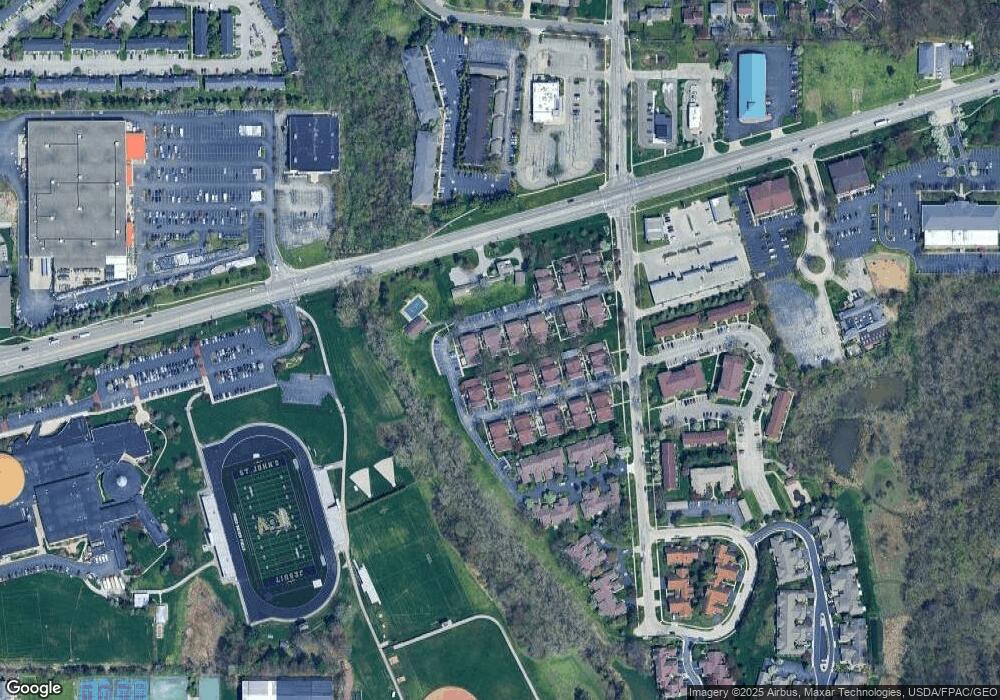

Map

Nearby Homes

- 5705 Aspen Dr

- 5662 Bernath Ct Unit E

- 5615 Baronswood Cir

- 1562 Saddlebrook Ct Unit B

- 1533 Eaglebrook Rd

- 1183 Hidden Ridge Rd

- 1187 Hidden Ridge Rd Unit A

- 1144 Bernath Pkwy Unit D

- 5560 Greenridge Dr

- 5860 Cresthaven Ln

- 5150 Norton Place

- 5222 Mardone Dr

- 715 S Holland Sylvania Rd

- 5702 Angola Rd

- 5026 Geer Ln

- 38 Walnut Creek Dr

- 4860 Eastwick Dr

- 1104 S Reynolds Rd

- 4866 Airport Hwy

- 2001 Perrysburg Holland Rd

- 5727 Bernath Ct

- 5727 Bernath Ct Unit KL

- 5729 Bernath Ct Unit 5ARH

- 5723 Bernath Ct

- 5717 Bernath Ct

- 5733 Bernath Ct Unit GR

- 5719 Bernath Ct Unit F

- 5726 Aspen Dr Unit 20R

- 5731 Bernath Ct

- 5724 Aspen Dr Unit 19TL

- 5720 Aspen Dr Unit 16

- 5720 Aspen Dr

- 5730 Aspen Dr Unit 17C

- 5736 Aspen Dr Unit 24

- 5735 Bernath Ct

- 5722 Aspen Dr Unit 14

- 5737 Bernath Ct Unit GL

- 5711 Bernath Ct Unit KL

- 5715 Bernath Ct Unit H

- 5713 Bernath Ct