5729 Krause Ln Unit 19 Austin, TX 78738

Estimated Value: $1,645,552 - $3,389,000

4

Beds

5

Baths

3,661

Sq Ft

$686/Sq Ft

Est. Value

About This Home

This home is located at 5729 Krause Ln Unit 19, Austin, TX 78738 and is currently estimated at $2,511,138, approximately $685 per square foot. 5729 Krause Ln Unit 19 is a home located in Travis County with nearby schools including Lake Pointe Elementary School, Bee Cave Middle School, and Lake Travis High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 27, 2019

Sold by

Boehme Thomas J and Boehme Susan N

Bought by

Frazee Richard Charles and Frazee Deborah Jane

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Outstanding Balance

$167,628

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$2,343,510

Purchase Details

Closed on

Aug 20, 2018

Sold by

Boehme Thomas J and Boehme Susan N

Bought by

Boehme Thomas J and Boehme Susan N

Purchase Details

Closed on

May 28, 2008

Sold by

Discovery Builders Austin Llc

Bought by

Boehme Thomas J and Boehme Susan N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,000,000

Interest Rate

5.89%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Frazee Richard Charles | -- | Heritage Title | |

| Boehme Thomas J | -- | None Available | |

| Boehme Thomas J | -- | Heritage Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Frazee Richard Charles | $350,000 | |

| Previous Owner | Boehme Thomas J | $1,000,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $21,950 | $1,746,321 | -- | -- |

| 2023 | $24,618 | $1,766,742 | $348,786 | $1,417,956 |

| 2022 | $35,326 | $1,782,326 | $348,786 | $1,433,540 |

| 2021 | $35,006 | $1,650,621 | $348,786 | $1,301,835 |

| 2020 | $39,622 | $1,751,357 | $348,786 | $1,402,571 |

| 2018 | $28,492 | $1,170,620 | $339,071 | $1,263,430 |

| 2017 | $26,092 | $1,064,200 | $125,000 | $939,200 |

| 2016 | $26,345 | $1,074,501 | $125,000 | $949,501 |

| 2015 | $23,747 | $1,028,324 | $125,000 | $959,806 |

| 2014 | $23,747 | $934,840 | $125,000 | $809,840 |

Source: Public Records

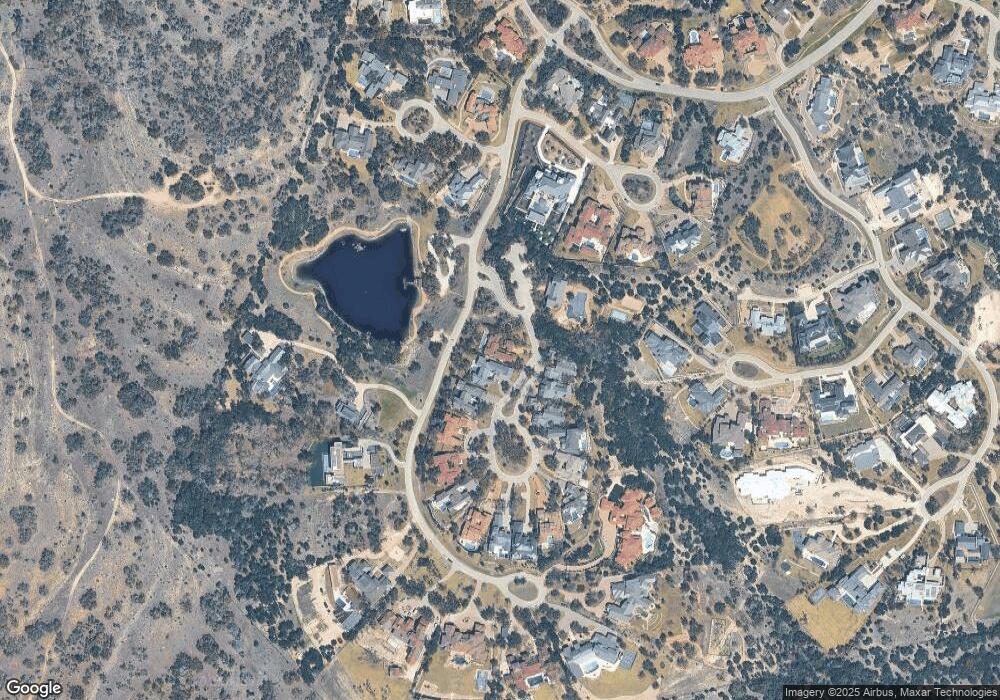

Map

Nearby Homes

- 12625 Maidenhair Ln Unit 33

- 12625 Maidenhair Ln Unit 36

- TBD Overlook Pass

- 0 Overlook Pass

- 5101 and 5109 Honey Daisy Way

- 4908 Honey Daisy Way

- 12625 Maidenhair #31 Ln

- 12717 Flowering Senna Bend

- 12201 Flowering Senna Bend

- 12801 Flowering Senna Bend

- 12716 Little Blue Stem Cove

- 11949 Overlook Pass

- 12900 Hacienda Ridge

- 4501 Spanish Oaks Club Blvd Unit 9

- 4501 Spanish Oaks Club Blvd Unit 1

- 13424 Saddle Back Pass

- 4816 Pecan Chase

- 13603 Overland Pass

- 13436 State Highway 71

- 4020 Texas Wildlife Trail

- 5729 Krause Ln Unit 14

- 5729 Krause Ln Unit 6

- 5729 Krause Ln Unit 3A

- 5729 Krause Ln Unit 12

- 5729 Krause Ln Unit 18

- 5729 Krause Ln Unit 17

- 5729 Krause Ln Unit 5

- 5729 Krause Ln Unit 1A

- 5729 Krause Ln Unit 5A

- 5729 Krause Ln Unit 4A

- 5729 Krause Ln Unit 2

- 12017 Kirkland Ct

- 5608 Krause Ln

- 12101 Rayner Place

- 12025 Kirkland Ct

- 5616 Laceback Terrace

- 12009 Kirkland Ct

- 12625 Maidenhair Ln Unit 31

- 12625 Maidenhair Ln Unit 37

- 12625 Maidenhair Ln Unit 39