573 Le Parc Cir Unit 76 Buffalo Grove, IL 60089

Estimated Value: $309,000 - $355,000

--

Bed

2

Baths

1,414

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 573 Le Parc Cir Unit 76, Buffalo Grove, IL 60089 and is currently estimated at $323,519, approximately $228 per square foot. 573 Le Parc Cir Unit 76 is a home located in Lake County with nearby schools including Meridian Middle School, Earl Pritchett School, and Aptakisic Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 20, 1997

Sold by

Oganisian Vladimir

Bought by

Wright Brennan P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,750

Interest Rate

7.93%

Mortgage Type

Balloon

Purchase Details

Closed on

Feb 27, 1995

Sold by

Leparc Umbrella Assn

Bought by

Oganisian Valeri

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

9.13%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 30, 1994

Sold by

Solomon Stewart A and Solomon Terri J Parker

Bought by

Board Of Directors Leparc Umbrella Assn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wright Brennan P | $137,500 | -- | |

| Oganisian Valeri | $134,000 | -- | |

| Board Of Directors Leparc Umbrella Assn | $128,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Wright Brennan P | $123,750 | |

| Previous Owner | Oganisian Valeri | $80,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,556 | $86,227 | $21,013 | $65,214 |

| 2023 | $7,556 | $81,361 | $19,827 | $61,534 |

| 2022 | $6,955 | $77,186 | $18,810 | $58,376 |

| 2021 | $6,705 | $76,354 | $18,607 | $57,747 |

| 2020 | $6,575 | $76,614 | $18,670 | $57,944 |

| 2019 | $6,404 | $76,331 | $18,601 | $57,730 |

| 2018 | $4,853 | $59,280 | $20,218 | $39,062 |

| 2017 | $4,786 | $57,896 | $19,746 | $38,150 |

| 2016 | $4,605 | $55,440 | $18,908 | $36,532 |

| 2015 | $4,490 | $51,847 | $17,683 | $34,164 |

| 2014 | $4,314 | $49,544 | $18,992 | $30,552 |

| 2012 | $4,279 | $49,643 | $19,030 | $30,613 |

Source: Public Records

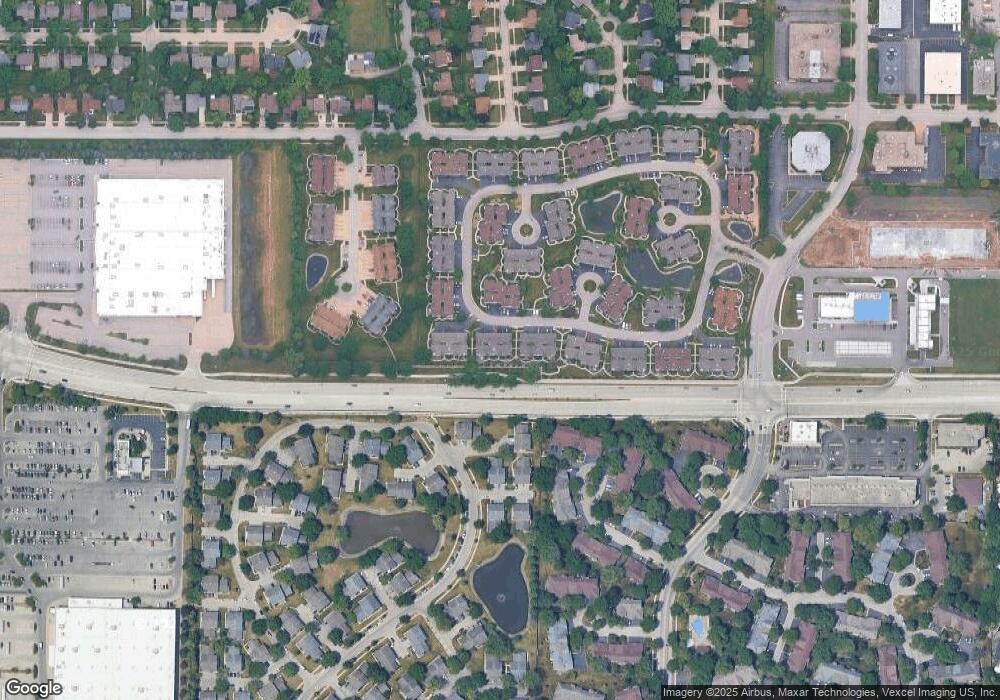

Map

Nearby Homes

- 473 Le Parc Cir Unit 126

- 1239 Oboe Ct Unit 33

- 1242 Nova Ct Unit 24

- 1050 Driftwood Ct Unit 1

- 220 Osage Ln

- 588 Fairway View Dr Unit 2E

- 550 Greystone Ln Unit A2

- 586 Fairway View Dr Unit 1A

- 1059 Southbury Ln Unit 1

- 640 Mchenry Rd Unit 301

- 20665 N Weiland Rd

- 823 Cambridge Place Unit 119

- 1142 Inverrary Ln Unit D-86

- 25 Crestview Terrace

- 928 Woodland Dr

- 36 Crestview Terrace

- 1500 Canbury Ct Unit 11373

- 1600 Brittany Ct Unit C-2

- 10 Old Oak Dr Unit 103

- 400 E Dundee Rd Unit 207C

- 575 Le Parc Cir Unit 71

- 571 Le Parc Cir Unit 75

- 565 Le Parc Cir Unit 74

- 563 Le Parc Cir Unit 73

- 561 Le Parc Cir Unit 72

- 581 Le Parc Cir Unit 62

- 583 Le Parc Cir Unit 63

- 585 Le Parc Cir Unit 64

- 591 Le Parc Cir Unit 65

- 555 Le Parc Cir Unit 81

- 593 Le Parc Cir Unit 66

- 553 Le Parc Cir Unit 86

- 595 Le Parc Cir Unit 61

- 551 Le Parc Cir Unit 85

- 545 Le Parc Cir Unit 84

- 562 Le Parc Cir Unit 246

- 564 Le Parc Cir Unit 245

- 574 Le Parc Cir Unit 242

- 572 Le Parc Cir Unit 243

- 570 Le Parc Cir Unit 244