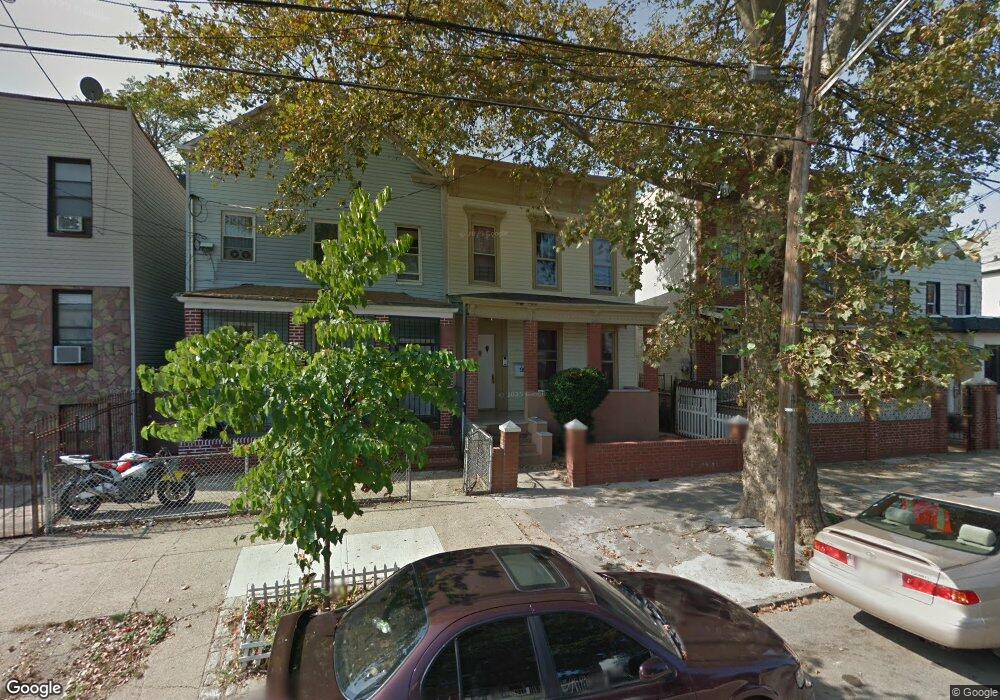

58 Bradford St Brooklyn, NY 11207

Cypress Hills NeighborhoodEstimated Value: $796,107 - $1,122,000

5

Beds

2

Baths

1,456

Sq Ft

$612/Sq Ft

Est. Value

About This Home

This home is located at 58 Bradford St, Brooklyn, NY 11207 and is currently estimated at $890,777, approximately $611 per square foot. 58 Bradford St is a home located in Kings County with nearby schools including P.S. 290 - Juan Morel Campos, Liberty Avenue Middle School, and Vista Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 13, 2017

Sold by

Jimenez Cesarina and Orona Peter

Bought by

Lema Franklin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$480,000

Outstanding Balance

$395,504

Interest Rate

4.2%

Mortgage Type

New Conventional

Estimated Equity

$495,273

Purchase Details

Closed on

May 9, 2013

Sold by

Orona Peter

Bought by

Jimenez Cesarina and Orona Peter

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$314,025

Interest Rate

3.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 23, 2013

Sold by

Pasha Fatema

Bought by

Orona Peter

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$314,025

Interest Rate

3.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 30, 2009

Sold by

Bushman Patricia M and Heyman Samuel

Bought by

Pasha Fatema

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lema Franklin | $600,000 | -- | |

| Lema Franklin | $600,000 | -- | |

| Jimenez Cesarina | -- | -- | |

| Jimenez Cesarina | -- | -- | |

| Orona Peter | $325,000 | -- | |

| Orona Peter | $325,000 | -- | |

| Pasha Fatema | $203,000 | -- | |

| Pasha Fatema | $203,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lema Franklin | $480,000 | |

| Closed | Lema Franklin | $480,000 | |

| Previous Owner | Orona Peter | $314,025 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,770 | $48,720 | $14,400 | $34,320 |

| 2024 | $2,770 | $38,460 | $14,400 | $24,060 |

| 2023 | $2,648 | $47,220 | $14,400 | $32,820 |

| 2022 | $2,460 | $38,640 | $14,400 | $24,240 |

| 2021 | $2,450 | $31,560 | $14,400 | $17,160 |

| 2020 | $1,218 | $32,460 | $14,400 | $18,060 |

| 2019 | $2,404 | $32,460 | $14,400 | $18,060 |

| 2018 | $2,093 | $10,866 | $4,289 | $6,577 |

| 2017 | $2,093 | $10,268 | $4,929 | $5,339 |

Source: Public Records

Map

Nearby Homes

- 57 Wyona St

- 2735 Fulton St

- 52 Bradford St

- 90 Wyona St

- 168 Miller Ave

- 107 Miller Ave

- 52 van Siclen Ave

- 48 van Siclen Ave

- 153 Hendrix St

- 159 Wyona St

- 14 van Siclen Ct

- 178 Highland Blvd

- 174 van Siclen Ave

- 2830 Fulton St

- 153 Highland Blvd

- 87 Schenck Ave

- 4 Crosby Ave

- 224 Highland Blvd Unit 710

- 2825 Atlantic Ave

- 124 Pennsylvania Ave

- 62 Bradford St

- 64 Bradford St

- 56 Bradford St

- 52 Bradford St Unit 1

- 2729 Fulton St

- 2737 Fulton St

- 50 Bradford St

- 53 Wyona St

- 53 Wyona St Unit 2 FL

- 49 Wyona St Unit 1

- 49 Wyona St

- 55 Wyona St Unit 1st Floor

- 55 Wyona St

- 2727 Fulton St

- 47 Wyona St

- 2725 Fulton St Unit 3

- 2725 Fulton St

- 46 Bradford St

- 43 Wyona St

- 2741 Fulton St