5803 Lockwood Commons St Unit 13 Milford, OH 45150

Estimated Value: $166,457 - $197,000

--

Bed

--

Bath

--

Sq Ft

218

Sq Ft Lot

About This Home

This home is located at 5803 Lockwood Commons St Unit 13, Milford, OH 45150 and is currently estimated at $180,864. 5803 Lockwood Commons St Unit 13 is a home located in Clermont County with nearby schools including Milford Senior High School, St. Andrew - St. Elizabeth Ann Seton School, and St. Mark's Lutheran School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 7, 2022

Sold by

Doon Marsha

Bought by

Davis Dana M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,825

Outstanding Balance

$159,210

Interest Rate

6.25%

Mortgage Type

New Conventional

Estimated Equity

$21,654

Purchase Details

Closed on

Apr 26, 2010

Sold by

Nadezhda Kruglov Alex and Nadezhda Rashkovetskaya

Bought by

Cook Linda G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,369

Interest Rate

5.05%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 20, 2001

Sold by

Grate Thomas C

Bought by

Kruglov Alex

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,772

Interest Rate

7.06%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 30, 1993

Purchase Details

Closed on

May 7, 1992

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davis Dana M | $173,500 | -- | |

| Davis Dana M | $173,500 | -- | |

| Cook Linda G | $90,000 | Attorney | |

| Kruglov Alex | $99,000 | -- | |

| -- | $76,000 | -- | |

| -- | $75,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Davis Dana M | $164,825 | |

| Closed | Davis Dana M | $164,825 | |

| Previous Owner | Cook Linda G | $88,369 | |

| Previous Owner | Kruglov Alex | $96,772 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $56 | $1,190 | $350 | $840 |

| 2023 | $56 | $1,190 | $350 | $840 |

| 2022 | $68 | $1,090 | $250 | $840 |

| 2021 | $68 | $1,090 | $250 | $840 |

| 2020 | $65 | $1,090 | $250 | $840 |

| 2019 | $112 | $1,790 | $250 | $1,540 |

| 2018 | $112 | $1,790 | $250 | $1,540 |

| 2017 | $107 | $1,790 | $250 | $1,540 |

| 2016 | $106 | $1,540 | $210 | $1,330 |

| 2015 | $104 | $1,540 | $210 | $1,330 |

| 2014 | $99 | $1,540 | $210 | $1,330 |

| 2013 | $89 | $1,340 | $180 | $1,160 |

Source: Public Records

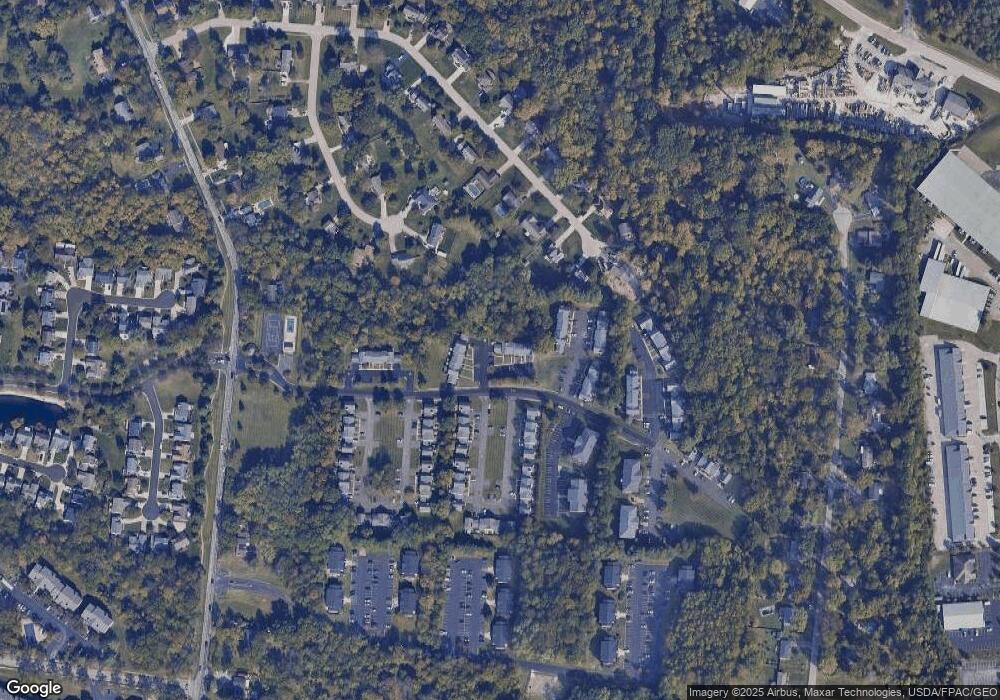

Map

Nearby Homes

- 1010 Newberry Ave

- 977 Newberry Ave

- 5897 Cook Rd

- 957 Tarragon Ln

- 1706 Cottontail Dr

- 5612 Flagstone Way

- 1007 Valley View Dr

- 5884 Stonebridge Cir

- 5880 Stonebridge Cir

- 2403 Traverse Creek Dr

- 1139 Willowwood Dr

- 1093 Broadview Place

- 1201 Sorrel Ln

- 772 Price Knoll Ln

- 5942 Pinto Place

- 6211 Cook Rd

- 1113 Clover Field Dr

- 5702 Sherwood Dr

- 5975 Buckwheat Rd

- 6077 Branch Hill Guinea Pike

- 5803 Lockwood Commons St Unit 13

- 5803 Lockwood Commons St Unit 13

- 5803 Lockwood Commons St

- 5805 Lockwood Commons St Unit 14

- 5807 Lockwood Commons St Unit 15

- 5809 Lockwood Commons St

- 5811 Lockwood Commons St

- 5813 Lockwood Commons St Unit 18

- 5801 Lockwood Commons St Unit 12

- 5799 Lockwood Commons St Unit 11

- 5797 Lockwood Commons St

- 5795 Lockwood Commons St

- 5793 Lockwood Commons St

- 5793 Lockwood Commons St

- 5815 Ashby Ct

- 5815 Ashby Ct

- 5791 Lockwood Commons St

- 5791 Lockwood Commons St

- 5817 Ashby Ct Unit G11

- 5817 Ashby Ct Unit G11