5817 Hallridge Cir Unit 35 Columbus, OH 43232

Livingston-McNaughten NeighborhoodEstimated Value: $96,000 - $151,790

2

Beds

2

Baths

1,122

Sq Ft

$115/Sq Ft

Est. Value

About This Home

This home is located at 5817 Hallridge Cir Unit 35, Columbus, OH 43232 and is currently estimated at $128,948, approximately $114 per square foot. 5817 Hallridge Cir Unit 35 is a home located in Franklin County with nearby schools including Oakmont Elementary School, Yorktown Middle School, and Independence High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 25, 2017

Sold by

Scott Nicole

Bought by

Bando Woldesillassie Zegeye Masresha and Bando Agijo Zenebech

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$38,320

Outstanding Balance

$31,806

Interest Rate

4.03%

Mortgage Type

New Conventional

Estimated Equity

$97,142

Purchase Details

Closed on

Dec 18, 2014

Sold by

Clare Glenn Jr William K and Clare Glenn

Bought by

Scott Nicole

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$28,000

Interest Rate

3.97%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 18, 1992

Bought by

Glenn William K

Purchase Details

Closed on

Jan 1, 1987

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bando Woldesillassie Zegeye Masresha | $47,900 | Northwest Advantage Title Ag | |

| Scott Nicole | $35,500 | First Ohio Title Ins Box | |

| Glenn William K | $38,500 | -- | |

| -- | $39,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bando Woldesillassie Zegeye Masresha | $38,320 | |

| Previous Owner | Scott Nicole | $28,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,318 | $29,370 | $4,200 | $25,170 |

| 2023 | $1,301 | $29,370 | $4,200 | $25,170 |

| 2022 | $993 | $19,150 | $2,280 | $16,870 |

| 2021 | $995 | $19,150 | $2,280 | $16,870 |

| 2020 | $996 | $19,150 | $2,280 | $16,870 |

| 2019 | $894 | $14,740 | $1,750 | $12,990 |

| 2018 | $786 | $14,740 | $1,750 | $12,990 |

| 2017 | $821 | $14,740 | $1,750 | $12,990 |

| 2016 | $749 | $11,310 | $1,790 | $9,520 |

| 2015 | $680 | $11,310 | $1,790 | $9,520 |

| 2014 | $701 | $11,310 | $1,790 | $9,520 |

| 2013 | $495 | $16,170 | $2,555 | $13,615 |

Source: Public Records

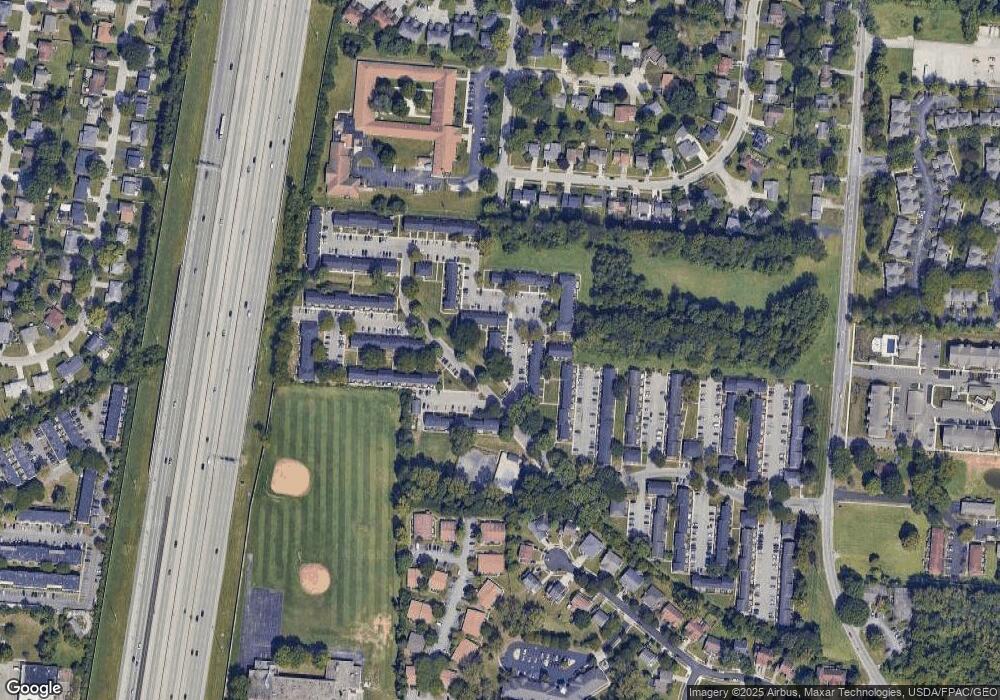

Map

Nearby Homes

- 5781 Hallridge Cir Unit B

- 5794 Hallridge Cir

- 5750 Hallridge Cir

- 1603 Hallworth Ct Unit 16038

- 1481 Riverton Ct E

- 5596 Autumn Chase Dr

- 1826-1828 Bairsford Dr

- 1888 Birkdale Dr

- 5366 Yorkshire Village Ln Unit B-22

- 1759 Lonsdale Rd

- 1624 Coppertree Ln

- 1859 Woodette Rd

- 1334 Manor Dr

- 1550 Idlewild Dr

- 1328 Manor Dr

- 1942 Bairsford Dr Unit 944

- 0 Radekin Rd Unit 225029852

- 5337 Ivyhurst Dr

- 1324 Idlewild Dr

- 5227 Ivyhurst Dr

- 5817 Hallridge Cir

- 5815 Hallridge Cir

- 5819 Hallridge Cir

- 5813 Hallridge Cir Unit 58133

- 5811 Hallridge Cir

- 5807 Hallridge Cir

- 5809 Hallridge Cir Unit 5809

- 5805 Hallridge Cir

- 5803 Hallridge Cir

- 5801 Hallridge Cir Unit 5801

- 5858 Hallridge Cir

- 5854 Hallridge Cir

- 5860 Hallridge Cir

- 5856 Hallridge Cir Unit 5856

- 5868 Hallridge Cir Unit 5868

- 5866 Hallridge Cir

- 5862 Hallridge Cir

- 5864 Hallridge Cir

- 5852 Hallridge Cir

- 5850 Hallridge Cir