5820 Crest Oak Way Cumming, GA 30028

Estimated Value: $440,000 - $480,000

4

Beds

3

Baths

2,314

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 5820 Crest Oak Way, Cumming, GA 30028 and is currently estimated at $452,871, approximately $195 per square foot. 5820 Crest Oak Way is a home located in Forsyth County with nearby schools including Silver City Elementary School, North Forsyth Middle School, and North Forsyth High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 26, 2023

Sold by

Freo Progress Llc

Bought by

Horton Oldavid Scott

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$363,298

Outstanding Balance

$351,899

Interest Rate

6.33%

Mortgage Type

FHA

Estimated Equity

$100,972

Purchase Details

Closed on

Sep 9, 2021

Sold by

Progress Residential Borrower 5 Llc

Bought by

Freo Progress Llc

Purchase Details

Closed on

Sep 30, 2014

Sold by

Freo Georgia Llc

Bought by

Progress Residential 2014 1 Bo

Purchase Details

Closed on

Oct 24, 2013

Sold by

Almont Homes Ne Inc

Bought by

Freo Georgia Llc

Purchase Details

Closed on

Dec 28, 2012

Sold by

Peachtree Shoals Builders

Bought by

Almont Homes Ne Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Horton Oldavid Scott | $370,000 | -- | |

| Freo Progress Llc | -- | -- | |

| Progress Residential 2014 1 Bo | -- | -- | |

| Freo Georgia Llc | $185,500 | -- | |

| Almont Homes Ne Inc | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Horton Oldavid Scott | $363,298 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,629 | $182,388 | $52,000 | $130,388 |

| 2024 | $3,629 | $148,000 | $44,040 | $103,960 |

| 2023 | $3,891 | $158,076 | $36,000 | $122,076 |

| 2022 | $2,800 | $105,212 | $18,000 | $87,212 |

| 2021 | $2,905 | $105,212 | $18,000 | $87,212 |

| 2020 | $2,905 | $105,212 | $18,000 | $87,212 |

| 2019 | $2,753 | $99,544 | $18,000 | $81,544 |

| 2018 | $2,723 | $98,476 | $18,000 | $80,476 |

| 2017 | $2,426 | $87,416 | $18,000 | $69,416 |

| 2016 | $2,257 | $81,336 | $15,200 | $66,136 |

| 2015 | $2,080 | $74,816 | $15,200 | $59,616 |

| 2014 | $1,600 | $71,096 | $12,000 | $59,096 |

Source: Public Records

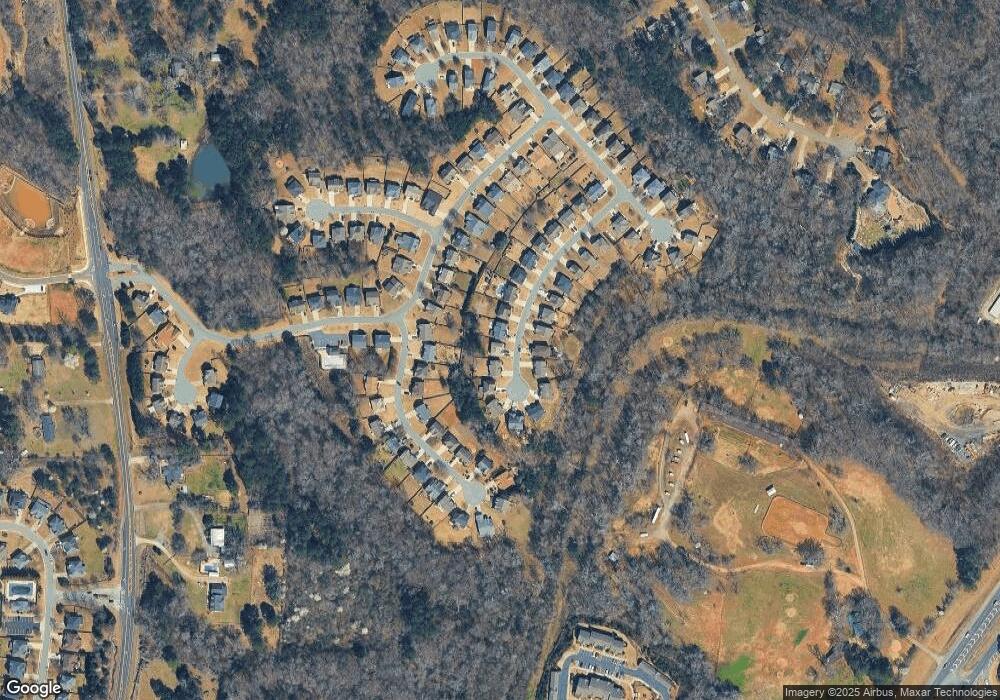

Map

Nearby Homes

- 5260 Birch Valley Rd

- 5375 Julep Ct

- 5240 Birch Valley Rd

- 5405 Julep Ct

- 5415 Julep Ct

- 5210 Birch Valley Rd

- 5720 Millstone Dr

- 5030 Mundy Dr

- 5315 Hopewell Manor Dr

- 4950 Fieldstone View Cir

- 4810 Hopewell Manor Dr

- 5270 Mundy Ct

- 5340 Mundy Ct

- 5040 Fieldstone Bend Dr Unit 1

- 5525 Hubbard Town Rd

- 5430 Settingdown Rd

- 5450 Settingdown Rd

- 5260 Fieldgate Ridge Dr

- 5470 Settingdown Rd

- 0 Ga 400 Hwy Unit 10418657

- 5820 Crest Oak Way Unit 5820

- 5820 Crest Oak Way

- 5830 Crest Oak Way

- 5810 Crest Oak Way

- 5825 Crest Oak Way

- 5815 Crest Oak Way

- 5840 Crest Oak Way

- 5790 Crest Oak Way

- 5795 Crest Oak Way

- 5850 Crest Oak Way

- 5785 Crest Oak Way

- 5835 Crest Oak Way

- 5835 Crest Oak Way Unit 5835

- 5780 Crest Oak Way

- 5855 Crest Oak Way

- 5845 Crest Oak Way

- 5775 Crest Oak Way

- 5415 Manor Park Dr

- 5475 Manor Park Dr Unit 5475

- 5475 Manor Park Dr