588 Deadwood Trail Unit 651 Locust Grove, GA 30248

Estimated Value: $387,000 - $424,000

4

Beds

3

Baths

2,471

Sq Ft

$162/Sq Ft

Est. Value

About This Home

This home is located at 588 Deadwood Trail Unit 651, Locust Grove, GA 30248 and is currently estimated at $400,886, approximately $162 per square foot. 588 Deadwood Trail Unit 651 is a home located in Henry County with nearby schools including Unity Grove Elementary School, Locust Grove Middle School, and Locust Grove High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 19, 2023

Sold by

Hall Constance Ann

Bought by

The Constance A Hall Rev Liv Tr

Current Estimated Value

Purchase Details

Closed on

Feb 14, 2014

Sold by

Capshaw Development Co Llc

Bought by

Hall Constance A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,641

Interest Rate

4.25%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 17, 2013

Sold by

Henry Development Co Llc

Bought by

Capshaw Development Co Llc

Purchase Details

Closed on

Sep 28, 2012

Sold by

Kfr Homes Llc

Bought by

Henry Development Co Llc

Purchase Details

Closed on

Jul 20, 2012

Sold by

Fdic

Bought by

Hamilton State Bank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The Constance A Hall Rev Liv Tr | -- | -- | |

| Hall Constance A | $179,900 | -- | |

| Capshaw Development Co Llc | -- | -- | |

| Henry Development Co Llc | -- | -- | |

| Hamilton State Bank | -- | -- | |

| Kfr Homes Llc | $301,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hall Constance A | $176,641 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,689 | $173,480 | $18,000 | $155,480 |

| 2024 | $6,689 | $159,960 | $15,996 | $143,964 |

| 2023 | $4,167 | $151,520 | $14,800 | $136,720 |

| 2022 | $4,065 | $125,800 | $14,800 | $111,000 |

| 2021 | $3,586 | $105,560 | $14,800 | $90,760 |

| 2020 | $3,383 | $96,960 | $12,000 | $84,960 |

| 2019 | $3,285 | $92,800 | $12,000 | $80,800 |

| 2018 | $3,419 | $87,000 | $12,000 | $75,000 |

| 2016 | $2,868 | $72,640 | $10,000 | $62,640 |

| 2015 | $2,928 | $71,960 | $9,930 | $62,030 |

| 2014 | $242 | $5,000 | $5,000 | $0 |

Source: Public Records

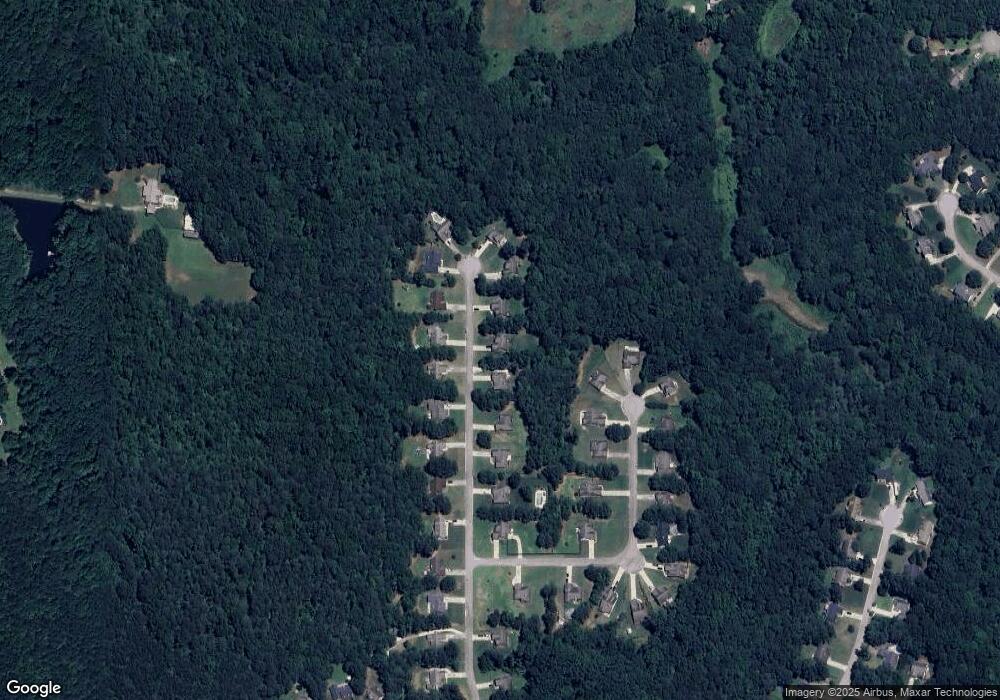

Map

Nearby Homes

- 143 Kimbell Farm Dr

- 121, 125, 129 Case Dr

- 521 Deadwood Trail

- 601 Amerigo Ct

- 1000 Coan Dr

- 1126 Old Jackson Rd

- 218 Baxter Ln

- 100 Harbin Trail

- 281 Laney Dr

- 995 Old Jackson Rd

- 705 S Bethany Rd

- 705 Seabolt Rd

- 604 Onieda Dr

- 767 Old Jackson Rd

- 215 Laney Rd

- 201 Nina Cir

- 678 Seabolt Rd

- 125 Laney Ct

- 1171 King Mill Rd

- 560 Coan Dr

- 588 Deadwood Trail

- 592 Deadwood Trail Unit 650

- 592 Deadwood Trail

- 584 Deadwood Trail

- 584 Deadwood Trail Unit 652

- 580 Deadwood Trail

- 580 Deadwood Trail Unit 653

- 596 Deadwood Trail Unit 649

- 589 Deadwood Trail

- 585 Deadwood Trail

- 1037 Ezekiel Way

- 1037 Ezekiel Way Unit 661

- 1035 Ezekiel Way

- 1035 Ezekiel Way Unit 660

- 593 Deadwood Trail

- 597 Deadwood Trail

- 581 Deadwood Trail Unit 642

- 581 Deadwood Trail

- 576 Deadwood Trail

- 576 Deadwood Trail Unit 654