5902 Hanley Close Unit 54 Milford, OH 45150

Estimated Value: $147,000 - $175,000

--

Bed

--

Bath

--

Sq Ft

566

Sq Ft Lot

About This Home

This home is located at 5902 Hanley Close Unit 54, Milford, OH 45150 and is currently estimated at $162,407. 5902 Hanley Close Unit 54 is a home located in Clermont County with nearby schools including Milford Senior High School, St. Andrew - St. Elizabeth Ann Seton School, and St. Mark's Lutheran School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 18, 2014

Sold by

Owens Michael D and Owens Katherine N

Bought by

Us Bank Na

Current Estimated Value

Purchase Details

Closed on

Aug 30, 2005

Sold by

Boggs Gregory L

Bought by

Owens Michael D and Owens Katherine N

Purchase Details

Closed on

Sep 22, 2004

Sold by

Gilbert Shannon L

Bought by

Priest Faye

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,000

Interest Rate

5.93%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 29, 2001

Sold by

Chaney Beverly

Bought by

Gilbert Shannon L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,750

Interest Rate

6.88%

Mortgage Type

FHA

Purchase Details

Closed on

May 12, 1998

Sold by

Stickler R Ernest

Bought by

Kiskadden Doris and Chaney Beverly

Purchase Details

Closed on

Jan 11, 1995

Sold by

Beuke Al F

Bought by

Stickler Ernest R and Stickler June E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Us Bank Na | $50,000 | None Available | |

| Owens Michael D | $110,000 | -- | |

| Priest Faye | $105,000 | -- | |

| Gilbert Shannon L | $93,500 | -- | |

| Kiskadden Doris | $85,000 | -- | |

| Stickler Ernest R | $76,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Priest Faye | $84,000 | |

| Previous Owner | Gilbert Shannon L | $90,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $56 | $1,190 | $350 | $840 |

| 2023 | $56 | $1,190 | $350 | $840 |

| 2022 | $68 | $1,090 | $250 | $840 |

| 2021 | $68 | $1,090 | $250 | $840 |

| 2020 | $65 | $1,090 | $250 | $840 |

| 2019 | $108 | $1,720 | $250 | $1,470 |

| 2018 | $108 | $1,720 | $250 | $1,470 |

| 2017 | $106 | $1,720 | $250 | $1,470 |

| 2016 | $106 | $1,540 | $210 | $1,330 |

| 2015 | $104 | $1,540 | $210 | $1,330 |

| 2014 | $99 | $1,540 | $210 | $1,330 |

| 2013 | $89 | $1,340 | $180 | $1,160 |

Source: Public Records

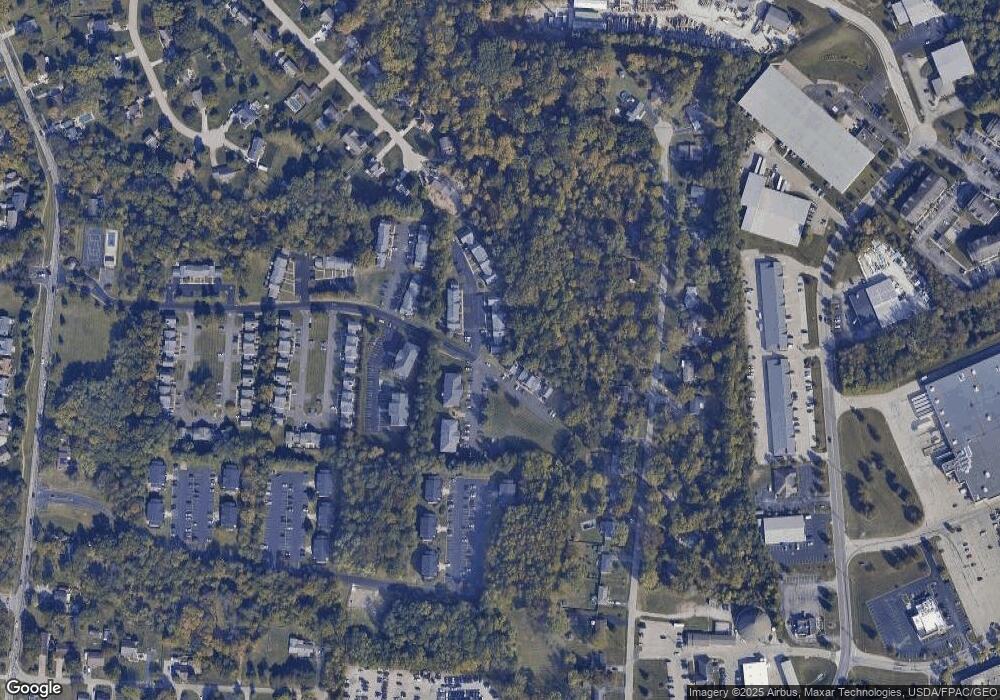

Map

Nearby Homes

- 1010 Newberry Ave

- 977 Newberry Ave

- 5897 Cook Rd

- 957 Tarragon Ln

- 1706 Cottontail Dr

- 2403 Traverse Creek Dr

- 1007 Valley View Dr

- 1139 Willowwood Dr

- 5612 Flagstone Way

- 1093 Broadview Place

- 5884 Stonebridge Cir

- 5880 Stonebridge Cir

- 1201 Sorrel Ln

- 5942 Pinto Place

- 5975 Buckwheat Rd

- 6077 Branch Hill Guinea Pike

- 1197 Ronlee Dr

- 772 Price Knoll Ln

- 5702 Sherwood Dr

- 6211 Cook Rd

- 5902 Hanley Close Unit 54

- 5902 Hanley Close

- 2100 Cooks Grant Dr Unit 55

- 2100 Cooks Grant Dr Unit 55

- 2100 Cooks Grant Dr

- 2016 Cooks Grant

- 5904 Hanley Close Unit 53

- 5904 Hanley Close

- 5906 Hanley Close Unit 52

- 5908 Hanley Close Unit 51

- 2102 Cooks Grant Dr Unit 56

- 2102 Cooks Grant Dr

- 5910 Hanley Close

- 5910 Hanley Close

- 2104 Cooks Grant Dr Unit 57

- 2106 Cooks Grant Dr

- 5899 Hanley Close

- 5891 Hanley Close Unit 132

- 5912 Hanley Close

- 5912 Hanley Close