5910 McCart Ranch Rd Elizabeth, CO 80107

Estimated Value: $1,476,308 - $1,550,000

5

Beds

3

Baths

4,694

Sq Ft

$325/Sq Ft

Est. Value

About This Home

This home is located at 5910 McCart Ranch Rd, Elizabeth, CO 80107 and is currently estimated at $1,523,827, approximately $324 per square foot. 5910 McCart Ranch Rd is a home located in Elbert County with nearby schools including Elizabeth High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 5, 2022

Sold by

Gantt Rene D

Bought by

Gantt Rene D

Current Estimated Value

Purchase Details

Closed on

May 4, 2011

Sold by

Folino William F and Folino Debra G

Bought by

Gantt Rene D and Mccracken Tom L

Purchase Details

Closed on

Mar 15, 2006

Sold by

Crow Faith E

Bought by

Folino William F and Folino Debra G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$480,000

Interest Rate

6.19%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 19, 2003

Sold by

Soderbeck Wade and Soderbeck Shannel

Bought by

Folino William F and Folino Debra G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,700

Interest Rate

4.75%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gantt Rene D | -- | -- | |

| Gantt Rene D | -- | -- | |

| Gantt Rene D | $560,000 | Land Title Guarantee Company | |

| Folino William F | -- | Land Title Guarantee Company | |

| Folino William F | $503,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Folino William F | $480,000 | |

| Previous Owner | Folino William F | $322,700 | |

| Closed | Folino William F | $79,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,571 | $55,460 | $480 | $54,980 |

| 2023 | $3,571 | $55,460 | $480 | $54,980 |

| 2022 | $3,197 | $48,230 | $470 | $47,760 |

| 2021 | $3,886 | $50,380 | $510 | $49,870 |

| 2020 | $3,945 | $50,840 | $500 | $50,340 |

| 2019 | $3,948 | $50,840 | $500 | $50,340 |

| 2018 | $3,591 | $45,730 | $470 | $45,260 |

| 2017 | $3,596 | $45,730 | $470 | $45,260 |

| 2016 | $2,858 | $35,660 | $440 | $35,220 |

| 2015 | $2,907 | $35,660 | $440 | $35,220 |

| 2014 | $2,907 | $35,150 | $400 | $34,750 |

Source: Public Records

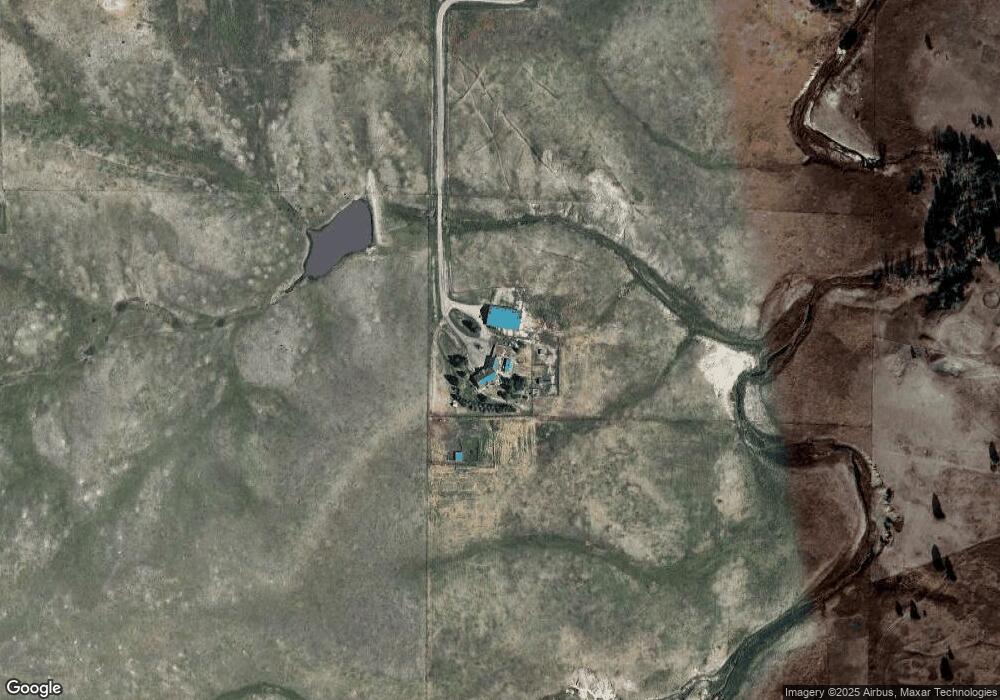

Map

Nearby Homes

- 5910 McCart Ranch Cir

- 0 County Road 25 Unit 2 REC8347785

- 0 County Road 25 Unit REC8082356

- 30886 County Road 17 21

- 7385 Pine Crest Dr

- 7573 Pine Crest Dr

- 4625 County Road 124

- 33591 Bow Meadows Cir

- 29684 County Road 17-21

- 34101 Columbine Trail E

- 34200 Columbine Trail W

- 34188 Goldenrod Cir

- 34050 Forest Park Dr

- 1353 S Elbert St

- 29326 County Road 17 21

- 33163 Expertise Trail Unit 8

- 33233 Expertise Trail Unit 7

- 34358 Goldenrod Cir

- 34295 Southern Cross Trail

- 1059 S Elbert St

- 6361 Arrowhead Trail

- 31900 Jenny Cir

- 6395 Arrowhead Trail

- 6423 Arrowhead Trail

- 6451 Arrowhead Trail

- 28242 Stone Horse Ranch Cir

- 6327 Arrowhead Trail

- 6479 Arrowhead Trail

- 6414 Arrowhead Trail

- 6435 Arrowhead Trail

- 5900 McCart Ranch Rd

- 6342 Arrowhead Trail

- 5755 Private Road 126

- 32210 Jenny Cir

- 6507 Arrowhead Trail

- 6281 Arrowhead Trail

- 6480 Arrowhead Trail

- 6526 Arrowhead Trail

- 6541 Arrowhead Trail

- 6188 Arrowhead Trail