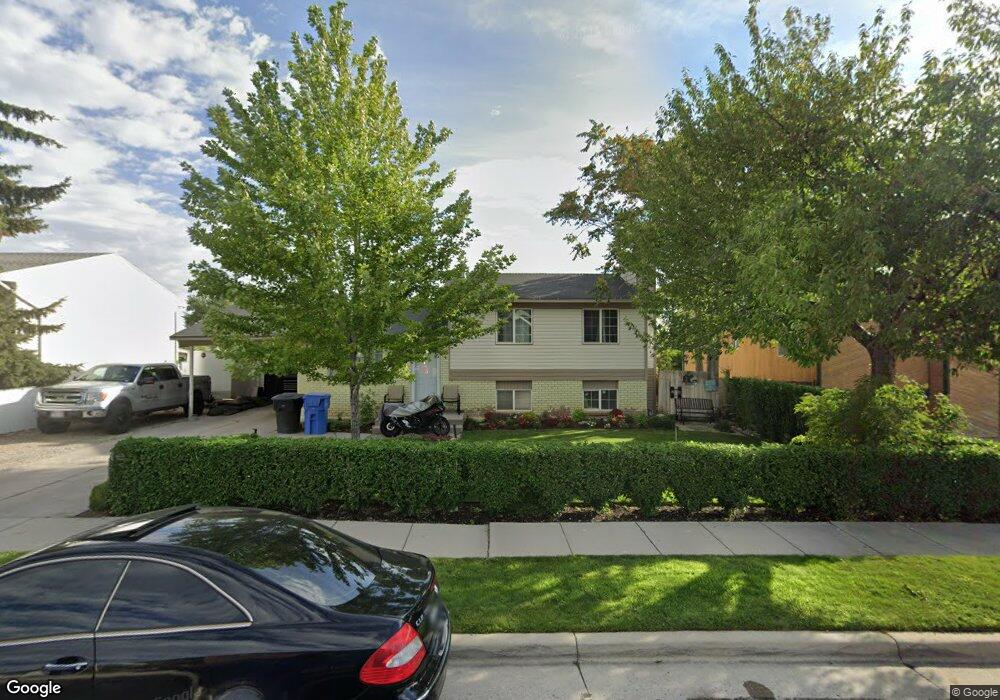

5916 W Jargon Way Salt Lake City, UT 84118

Estimated Value: $429,000 - $447,000

4

Beds

2

Baths

1,560

Sq Ft

$280/Sq Ft

Est. Value

About This Home

This home is located at 5916 W Jargon Way, Salt Lake City, UT 84118 and is currently estimated at $437,512, approximately $280 per square foot. 5916 W Jargon Way is a home located in Salt Lake County with nearby schools including Thomas W Bacchus School, Thomas Jefferson Jr High School, and Kearns High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 23, 2015

Sold by

Zamora Cortes Roberto Jorge and Vianey Salas Alanas Gaudalupe

Bought by

Castro Carrillo Patricia and Rodriguez Castro Jesus

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,884

Outstanding Balance

$135,951

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$301,561

Purchase Details

Closed on

Apr 14, 2005

Sold by

Long Deborah A

Bought by

Zamora Cortes Roberto Jorge and Vianey Salas Alanas Guadalupe

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$6,037

Interest Rate

5.87%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Mar 30, 1998

Sold by

Hansen Barbara J

Bought by

Long Deborah A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,436

Interest Rate

7.06%

Mortgage Type

FHA

Purchase Details

Closed on

May 23, 1996

Sold by

Jesse H Jones & Associates

Bought by

Hansen Barbara J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Castro Carrillo Patricia | -- | Us Title | |

| Zamora Cortes Roberto Jorge | -- | 1St National Title Ins | |

| Long Deborah A | -- | -- | |

| Hansen Barbara J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Castro Carrillo Patricia | $168,884 | |

| Previous Owner | Zamora Cortes Roberto Jorge | $6,037 | |

| Previous Owner | Zamora Cortes Roberto Jorge | $119,630 | |

| Previous Owner | Long Deborah A | $108,436 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,143 | $408,500 | $100,300 | $308,200 |

| 2024 | $3,143 | $385,300 | $94,500 | $290,800 |

| 2023 | $2,980 | $351,200 | $90,900 | $260,300 |

| 2022 | $2,985 | $363,600 | $89,100 | $274,500 |

| 2021 | $2,716 | $296,900 | $68,500 | $228,400 |

| 2020 | $2,419 | $244,800 | $62,600 | $182,200 |

| 2019 | $2,309 | $232,600 | $62,600 | $170,000 |

| 2018 | $2,236 | $213,800 | $62,600 | $151,200 |

| 2017 | $1,971 | $197,700 | $58,700 | $139,000 |

| 2016 | $1,504 | $186,600 | $58,700 | $127,900 |

| 2015 | $1,615 | $147,300 | $70,900 | $76,400 |

| 2014 | $1,534 | $145,800 | $70,900 | $74,900 |

Source: Public Records

Map

Nearby Homes

- 5663 S China Clay Cir

- 5929 W Dry Bone Cir

- 5716 Trowbridge Way

- 5749 S Mirador Ct

- 5818 W Plumbago Ave

- 5733 W Plumbago Ave

- 5752 S Izapa Cove

- 5563 S Copper City Dr

- 5768 Lodestone Ave

- 5745 Lodestone Ave

- 5927 S 5665 W

- 5648 Lodestone Ave

- 5751 W Chantilly Cir

- 6103 S 6105 W

- 5888 S Stone Bluff Way

- 5940 S Woodview Dr

- 6149 Trowbridge Way

- 5657 S Woodview Dr Unit 424

- 5627 Walnut Ridge Cir

- 5480 W Sun Ridge Ct

- 5916 Jargon Way

- 5906 W Jargon Way

- 5926 Jargon Way

- 5906 Jargon Way

- 5778 S Westbench Dr

- 5778 Westbench Dr

- 5792 Westbench Dr

- 5792 S Westbench Dr

- 5808 S Westbench Dr

- 5779 Copper City Dr

- 5779 S Copper City Dr

- 5808 Westbench Dr

- 5917 Jargon Way

- 5917 W Jargon Way

- 5771 Copper City Dr

- 5771 S Copper City Dr

- 5927 Jargon Way

- 5907 Jargon Way

- 5770 Westbench Dr

- 5801 S Copper City Dr