5923 State Route 303 Mantua, OH 44255

Estimated Value: $109,000 - $318,000

3

Beds

2

Baths

1,680

Sq Ft

$139/Sq Ft

Est. Value

About This Home

This home is located at 5923 State Route 303, Mantua, OH 44255 and is currently estimated at $234,154, approximately $139 per square foot. 5923 State Route 303 is a home located in Portage County with nearby schools including James A. Garfield Elementary School, James A. Garfield Middle School, and James A. Garfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 25, 2020

Sold by

Horwath Stephen

Bought by

Stephens John and Stephens Sharon Fuery

Current Estimated Value

Purchase Details

Closed on

Mar 11, 2019

Sold by

Horwath Ruth

Bought by

Horwath Stephen

Purchase Details

Closed on

Jul 9, 2015

Sold by

Horwath Ruth and Horwath Stephen

Bought by

Horwath Stephen

Purchase Details

Closed on

Jun 28, 2012

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Horwath Ruth and Horwath Stephen

Purchase Details

Closed on

Sep 22, 2011

Sold by

Criblez Norman

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Aug 22, 2000

Sold by

Criblez Carolyn

Bought by

Criblez Norman

Purchase Details

Closed on

Oct 16, 1992

Bought by

Criblez Norman C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stephens John | $110,000 | None Available | |

| Horwath Stephen | -- | None Available | |

| Horwath Stephen | -- | Attorney | |

| Horwath Ruth | $40,000 | None Available | |

| Federal Home Loan Mortgage Corporation | $60,000 | None Available | |

| Criblez Norman | -- | -- | |

| Criblez Norman C | $17,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,171 | $63,780 | $19,780 | $44,000 |

| 2023 | $1,949 | $50,540 | $15,820 | $34,720 |

| 2022 | $1,951 | $50,540 | $15,820 | $34,720 |

| 2021 | $1,886 | $50,540 | $15,820 | $34,720 |

| 2020 | $1,356 | $44,240 | $15,050 | $29,190 |

| 2019 | $1,359 | $44,240 | $15,050 | $29,190 |

| 2018 | $1,497 | $39,550 | $15,050 | $24,500 |

| 2017 | $1,374 | $39,550 | $15,050 | $24,500 |

| 2016 | $1,329 | $39,550 | $15,050 | $24,500 |

| 2015 | $1,337 | $39,550 | $15,050 | $24,500 |

| 2014 | $1,359 | $39,550 | $15,050 | $24,500 |

| 2013 | $1,414 | $39,550 | $15,050 | $24,500 |

Source: Public Records

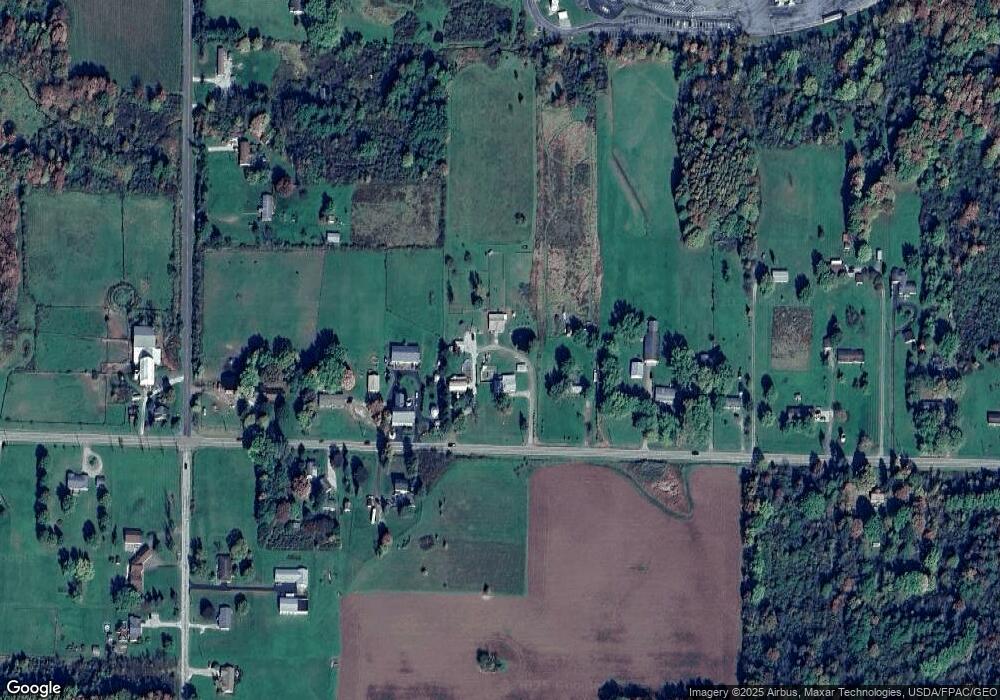

Map

Nearby Homes

- 8291 State Route 88

- 6847 State Route 303

- 4705 State Route 303

- 9091 State Route 44

- 7688 Ohio 88

- 4437 State Route 303

- 10018 Nichols Rd

- 10685 Limeridge Rd

- 6994 Hankee Rd

- 7686 Peck Rd

- 7761 Ohio 303

- 7795 Ohio 303

- 8119 State Route 44

- 9329 Infirmary Rd Unit B1

- 0 Ambler Ln Unit 5142203

- 0 Infirmary Rd

- 11131 State Route 44

- 7000 Village Way Dr

- 7050 Village Way Dr

- 4620 Pioneer Trail

- 5907 State Route 303

- 5923 Ohio 303

- 5891 State Route 303

- 5943 Ohio 303

- 5896 State Route 303

- 5868 State Route 303

- 5907 State Route 303

- 5835 State Route 303

- 9032 Limeridge Rd

- 9148 Limeridge Rd

- 9012 Limeridge Rd

- 6036 State Route 303

- 9200 Limeridge Rd

- 6037 State Route 303

- V/L Limeridge Rd

- 8992 Limeridge Rd

- 9025 Limeridge Rd

- 6043 State Route 303

- 5794 State Route 303

- 9009 Limeridge Rd