Estimated Value: $438,000 - $481,000

3

Beds

2

Baths

1,366

Sq Ft

$337/Sq Ft

Est. Value

About This Home

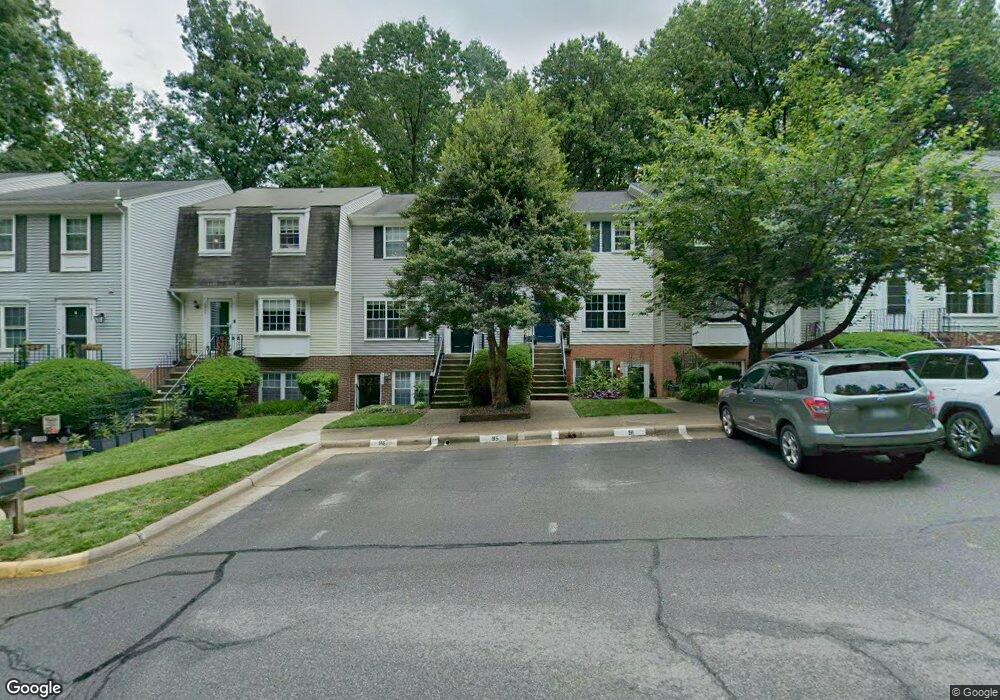

This home is located at 5931 First Landing Way, Burke, VA 22015 and is currently estimated at $459,801, approximately $336 per square foot. 5931 First Landing Way is a home located in Fairfax County with nearby schools including Bonnie Brae Elementary School, James W Robinson, Jr. Secondary School, and Fairfax Baptist Temple Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 29, 2019

Sold by

Hudson Frank and Hudson Megan

Bought by

Flores Roxana Del Carmen and Bendana David Hernando

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,581

Outstanding Balance

$264,356

Interest Rate

3.8%

Mortgage Type

New Conventional

Estimated Equity

$195,445

Purchase Details

Closed on

Jul 26, 2012

Sold by

Velez Charneco Marie

Bought by

Hudson Frank

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$228,554

Interest Rate

3.74%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 20, 2007

Sold by

Polant Laura Marian

Bought by

Velez-Charneco Marie Beatrice

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$302,256

Interest Rate

6.42%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Flores Roxana Del Carmen | $331,000 | Pruitt Title Llc | |

| Hudson Frank | $234,900 | -- | |

| Velez-Charneco Marie Beatrice | $307,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Flores Roxana Del Carmen | $300,581 | |

| Previous Owner | Hudson Frank | $228,554 | |

| Previous Owner | Velez-Charneco Marie Beatrice | $302,256 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,542 | $419,510 | $84,000 | $335,510 |

| 2024 | $4,542 | $392,070 | $78,000 | $314,070 |

| 2023 | $4,296 | $380,650 | $76,000 | $304,650 |

| 2022 | $3,921 | $342,930 | $69,000 | $273,930 |

| 2021 | $3,984 | $339,530 | $68,000 | $271,530 |

| 2020 | $3,791 | $320,310 | $64,000 | $256,310 |

| 2019 | $3,791 | $320,310 | $64,000 | $256,310 |

| 2018 | $3,322 | $288,910 | $58,000 | $230,910 |

| 2017 | $3,421 | $294,620 | $59,000 | $235,620 |

| 2016 | $3,314 | $286,040 | $57,000 | $229,040 |

| 2015 | $3,192 | $286,040 | $57,000 | $229,040 |

| 2014 | $2,544 | $228,430 | $46,000 | $182,430 |

Source: Public Records

Map

Nearby Homes

- 6154 Martins Landing Ct

- 5950 Powells Landing Rd

- 5918 Cove Landing Rd Unit 204

- 5976 Annaberg Place Unit 168

- 5819 Cove Landing Rd Unit 303

- 10330 Luria Commons Ct Unit 1B

- 5806 Cove Landing Rd Unit 304

- 10205 Quiet Pond Terrace

- 5602 Summer Oak Way

- 10278 Colony Park Dr

- 5674 Oak Tanager Ct

- 9983 Hemlock Woods Ln

- 10449 Calumet Grove Dr

- 10434 Calumet Grove Dr

- 5515 Cheshire Meadows Way

- 5947 New England Woods Dr

- 5453 Cheshire Meadows Way

- 5922 New England Woods Dr

- 5508 La Cross Ct

- 5703 Oak Stake Ct

- 5937 First Landing Way

- 5937 First Landing Way Unit 96

- 5945 First Landing Way Unit 92

- 5943 First Landing Way Unit 93

- 5939 First Landing Way Unit 95

- 5945 First Landing Way

- 5943 First Landing Way

- 5939 First Landing Way

- 5929 First Landing Way

- 5929 First Landing Way Unit 99

- 5933 First Landing Way Unit 98

- 5931 First Landing Way Unit 97

- 5941 First Landing Way Unit 91

- 5941 First Landing Way

- 5933 First Landing Way

- 5949 First Landing Way

- 5947 First Landing Way

- 5935 First Landing Way

- 5951 First Landing Way

- 5758 First Landing Way Unit 102