5956 Thunder Gulch Dr Unit 4-5956 New Albany, OH 43054

Central College NeighborhoodEstimated Value: $230,822 - $247,000

2

Beds

3

Baths

1,500

Sq Ft

$158/Sq Ft

Est. Value

About This Home

This home is located at 5956 Thunder Gulch Dr Unit 4-5956, New Albany, OH 43054 and is currently estimated at $237,456, approximately $158 per square foot. 5956 Thunder Gulch Dr Unit 4-5956 is a home located in Franklin County with nearby schools including Avalon Elementary School, Northgate Intermediate, and Woodward Park Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 6, 2018

Sold by

Frederick George E and Frederick Joan

Bought by

Phillips Matthew C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,910

Outstanding Balance

$109,348

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$128,108

Purchase Details

Closed on

Mar 4, 2010

Sold by

Homewood Corporation

Bought by

Horn Randy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,180

Interest Rate

5.5%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 20, 2009

Sold by

Graham Nicholas T and Graham Katie L

Bought by

Homewood Corporation

Purchase Details

Closed on

May 20, 2005

Sold by

New Albany Park Ltd

Bought by

Graham Nicholas T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,350

Interest Rate

5.91%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Phillips Matthew C | $139,900 | First Ohio Title Insurance | |

| Horn Randy A | $94,900 | Hummel Titl | |

| Homewood Corporation | $112,000 | Hummel Titl | |

| Graham Nicholas T | $111,900 | Connor Land |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Phillips Matthew C | $125,910 | |

| Previous Owner | Horn Randy A | $93,180 | |

| Previous Owner | Graham Nicholas T | $109,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,300 | $73,540 | $13,480 | $60,060 |

| 2023 | $3,258 | $73,535 | $13,475 | $60,060 |

| 2022 | $2,416 | $46,590 | $8,650 | $37,940 |

| 2021 | $2,421 | $46,590 | $8,650 | $37,940 |

| 2020 | $2,424 | $46,590 | $8,650 | $37,940 |

| 2019 | $2,174 | $35,840 | $6,650 | $29,190 |

| 2018 | $1,992 | $35,840 | $6,650 | $29,190 |

| 2017 | $2,173 | $35,840 | $6,650 | $29,190 |

| 2016 | $1,999 | $30,180 | $4,520 | $25,660 |

| 2015 | $1,815 | $30,180 | $4,520 | $25,660 |

| 2014 | $1,819 | $30,180 | $4,520 | $25,660 |

| 2013 | $8 | $280 | $280 | $0 |

Source: Public Records

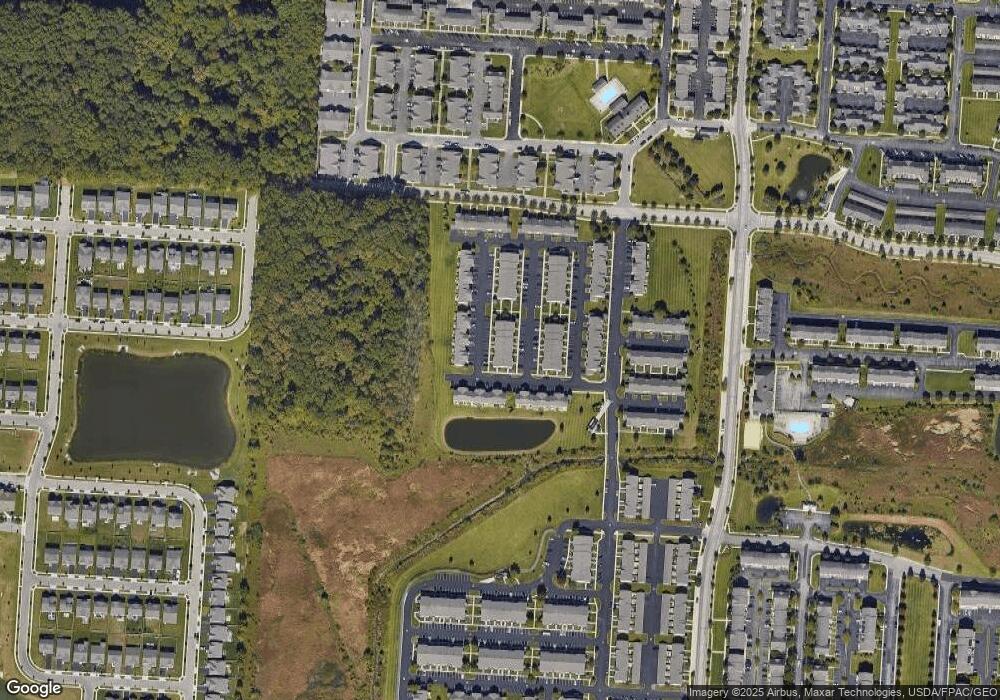

Map

Nearby Homes

- 5982 Silver Charms Way Unit 32

- 7099 Fonso Dr

- 7095 Donerail Dr Unit 52

- 7007 Monarchos Dr

- 7083 Gallant Fox Dr Unit 4

- 5829 Andrew John Dr Unit 3

- 7016 Churchill Downs Dr

- 5777 Colts Gate Dr Unit 44

- 6058 Avatar Dr Unit 13

- 6044 Phar Lap Dr Unit 18

- 5730 Colts Gate Dr Unit 43

- 6746 Morningside Heights Place

- 6092 Phar Lap Dr Unit 16

- 7168 Normanton Dr

- 7231 Winterbek Ave

- 7234 Normanton Dr

- 6950 Harlem Rd

- 5981 Niahway St Unit 57

- 5974 Lawthorn Dr Unit 71

- 6001 E Walnut St

- 5956 Thunder Gulch Dr

- 5954 Thunder Gulch Dr

- 5954 Thunder Gulch Dr Unit 34

- 5958 Thunder Gulch Dr

- 5958 Thunder Gulch Dr Unit B

- 5958 Thunder Gulch Dr Unit 4-5958

- 5957 Silver Charms Way

- 5959 Silver Charms Way

- 5959 Silver Charms Way Unit B

- 5955 Silver Charms Way

- 5952 Thunder Gulch Dr

- 5952 Thunder Gulch Dr Unit 34-595

- 5960 Thunder Gulch Dr

- 5960 Thunder Gulch Dr Unit 34-596

- 5960 Thunder Gulch Dr Unit 4-5960

- 5953 Silver Charms Way

- 5953 Silver Charms Way Unit 4-5953

- 7032 Cavalcade Dr

- 7032 Cavalcade Dr Unit 34-703

- 5961 Silver Charms Way