6 Kristyn Ln North Reading, MA 01864

Estimated Value: $944,478 - $1,155,000

3

Beds

3

Baths

2,072

Sq Ft

$494/Sq Ft

Est. Value

About This Home

This home is located at 6 Kristyn Ln, North Reading, MA 01864 and is currently estimated at $1,023,870, approximately $494 per square foot. 6 Kristyn Ln is a home located in Middlesex County with nearby schools including E Ethel Little School, North Reading Middle School, and North Reading High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 19, 2015

Sold by

Connor Russell and Brady-Connor Donna

Bought by

Connor Brady Ft

Current Estimated Value

Purchase Details

Closed on

Sep 13, 2002

Sold by

Murtagh Cynthia S

Bought by

Connor Russell and Connor Donna Brady

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$303,000

Interest Rate

6.48%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 29, 1994

Sold by

Melanson Dev Grp Inc

Bought by

Murtagh Kevin M and Murtagh Cynthia J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Connor Brady Ft | -- | -- | |

| Connor Russell | $555,000 | -- | |

| Murtagh Kevin M | $239,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Murtagh Kevin M | $300,000 | |

| Previous Owner | Murtagh Kevin M | $317,000 | |

| Previous Owner | Connor Russell | $303,000 | |

| Previous Owner | Murtagh Kevin M | $177,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,391 | $872,200 | $479,700 | $392,500 |

| 2024 | $10,897 | $824,900 | $432,400 | $392,500 |

| 2023 | $10,842 | $775,000 | $424,100 | $350,900 |

| 2022 | $10,205 | $680,300 | $382,900 | $297,400 |

| 2021 | $5,831 | $615,600 | $329,800 | $285,800 |

Source: Public Records

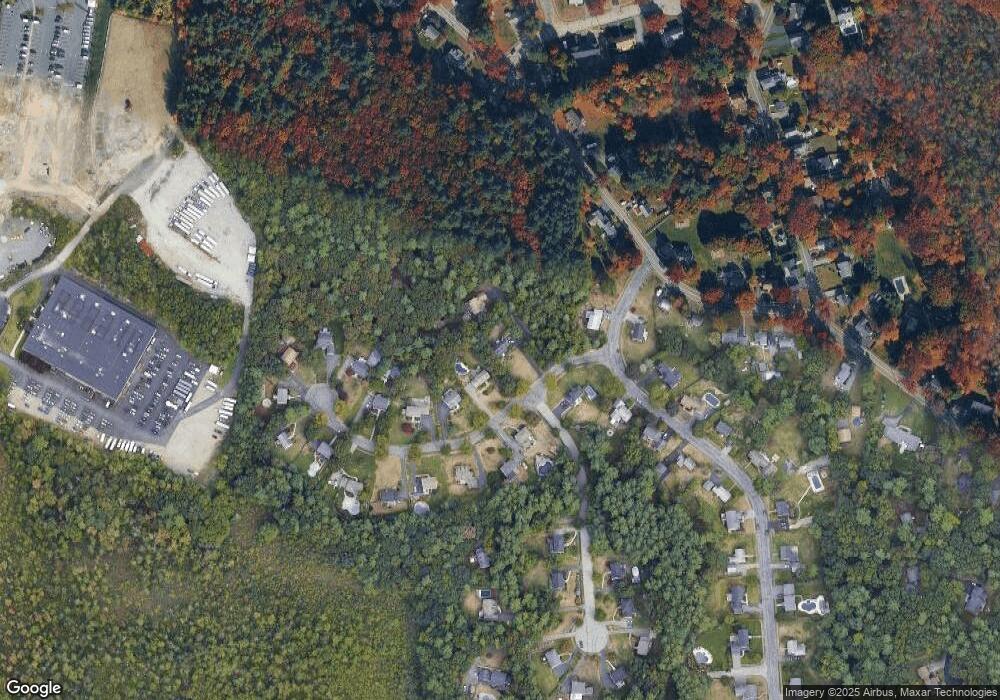

Map

Nearby Homes

- 7 W Village Dr

- 98 Lilah Ln

- 37 Eames St

- 220 Martins Landing Unit 309

- 260 Martins Landing Unit 508

- 260 Martins Landing Unit 103

- 320 Martins Landing Unit 108

- 320 Martins Landing Unit 109

- 320 Martins Landing Unit 110

- 320 Martins Landing Unit 303

- 320 Martins Landing Unit 102

- 320 Martins Landing Unit 103

- 320 Martins Landing Unit 2410

- 320 Martins Landing Unit 403

- 320 Martins Landing Unit 2201

- 320 Martins Landing Unit 112

- 320 Martins Landing Unit 206

- 320 Martins Landing Unit 2307

- 320 Martins Landing Unit 302

- 320 Martins Landing Unit 212