6 Self Ct Wallingford, CT 06492

Estimated Value: $687,879 - $706,000

3

Beds

2

Baths

2,548

Sq Ft

$273/Sq Ft

Est. Value

About This Home

This home is located at 6 Self Ct, Wallingford, CT 06492 and is currently estimated at $695,220, approximately $272 per square foot. 6 Self Ct is a home located in New Haven County with nearby schools including Moses Y Beach Elementary School, Rock Hill Elementary School, and Dag Hammarskjold Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 23, 2016

Sold by

Farmer Eileen

Bought by

Farmer Steven

Current Estimated Value

Purchase Details

Closed on

Feb 2, 2011

Sold by

Gasser 3Rd Alvin A

Bought by

Farmer Steven and Farmer Eileen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$396,000

Interest Rate

4.82%

Purchase Details

Closed on

Dec 8, 2004

Sold by

Baker Res Lp

Bought by

Gasser Alvin A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,000

Interest Rate

5.63%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Farmer Steven | -- | -- | |

| Farmer Steven | $495,000 | -- | |

| Gasser Alvin A | $460,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gasser Alvin A | $390,000 | |

| Previous Owner | Gasser Alvin A | $396,000 | |

| Previous Owner | Gasser Alvin A | $325,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,328 | $428,200 | $0 | $428,200 |

| 2024 | $8,560 | $279,200 | $0 | $279,200 |

| 2023 | $8,192 | $279,200 | $0 | $279,200 |

| 2022 | $8,108 | $279,200 | $0 | $279,200 |

| 2021 | $7,963 | $279,200 | $0 | $279,200 |

| 2020 | $8,579 | $293,900 | $0 | $293,900 |

| 2019 | $8,579 | $293,900 | $0 | $293,900 |

| 2018 | $8,417 | $293,900 | $0 | $293,900 |

| 2017 | $8,391 | $293,900 | $0 | $293,900 |

| 2016 | $8,197 | $293,900 | $0 | $293,900 |

| 2015 | $8,255 | $300,500 | $0 | $300,500 |

| 2014 | $8,080 | $300,500 | $0 | $300,500 |

Source: Public Records

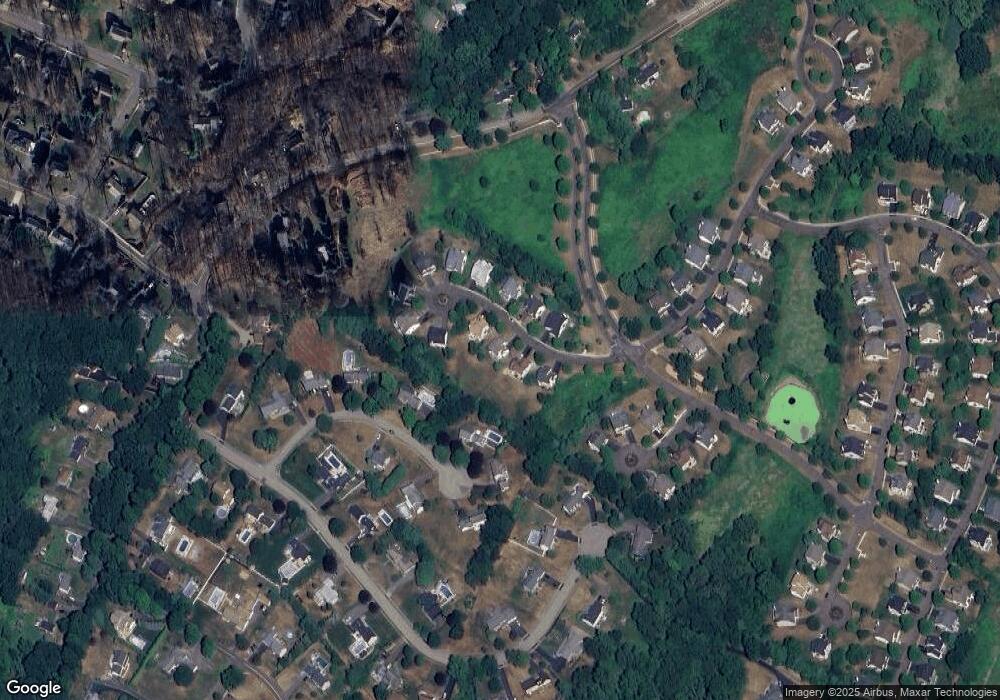

Map

Nearby Homes

- 101 Grieb Rd

- 5 Mae Ln

- 1 Dean Dr

- 5 Kish Place

- 1039 Durham Rd

- 570 N Main St

- 71 Cedar Ln

- 46 Walnut Ln

- 380 Main St Unit 3

- 380 Main St Unit 7

- 380 Main St Unit 4

- 380 Main St Unit 16

- 380 Main St Unit 13

- 380 Main St Unit 14

- 396 Main St Unit 2

- 65 Brooklawn Dr

- 85 N Colony St

- 230 Main St Unit 63

- 230 Main St Unit 18

- 16 Marie Ln

Your Personal Tour Guide

Ask me questions while you tour the home.