60 Anoka Ln Unit Lots 59-60 Hide A Way Hills, OH 43107

Estimated Value: $279,000 - $296,000

2

Beds

1

Bath

1,164

Sq Ft

$247/Sq Ft

Est. Value

About This Home

This home is located at 60 Anoka Ln Unit Lots 59-60, Hide A Way Hills, OH 43107 and is currently estimated at $288,062, approximately $247 per square foot. 60 Anoka Ln Unit Lots 59-60 is a home located in Hocking County with nearby schools including Chieftain Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 1, 2023

Sold by

Kelley Benjamin & Jamie St Clair

Bought by

Senecal Theodore and Senecal Leah

Current Estimated Value

Purchase Details

Closed on

Aug 15, 2018

Sold by

Carmichael Patrick B

Bought by

Ayres Jeffrey Alan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,958

Interest Rate

3.25%

Mortgage Type

Assumption

Purchase Details

Closed on

Nov 28, 2012

Sold by

Carmichael Patrick B

Bought by

Carmichael Patrick B and Ayres Jeffrey A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,887

Interest Rate

3.4%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 9, 2012

Sold by

Young Cynthia Marie and Miller Ruth Evelyn

Bought by

Carmichael Patrick B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,887

Interest Rate

3.4%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Senecal Theodore | $270,000 | None Listed On Document | |

| Senecal Theodore | $270,000 | None Listed On Document | |

| Ayres Jeffrey Alan | -- | Valmer Land Title Agency Box | |

| Carmichael Patrick B | -- | None Available | |

| Carmichael Patrick B | $122,100 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ayres Jeffrey Alan | $104,958 | |

| Previous Owner | Carmichael Patrick B | $119,887 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,488 | $38,770 | $10,300 | $28,470 |

| 2023 | $1,488 | $38,770 | $10,300 | $28,470 |

| 2022 | $1,490 | $38,770 | $10,300 | $28,470 |

| 2021 | $1,485 | $36,090 | $7,560 | $28,530 |

| 2020 | $1,486 | $36,090 | $7,560 | $28,530 |

| 2019 | $1,486 | $36,090 | $7,560 | $28,530 |

| 2018 | $1,244 | $30,700 | $6,460 | $24,240 |

| 2017 | $1,217 | $30,700 | $6,460 | $24,240 |

| 2016 | $1,208 | $30,700 | $6,460 | $24,240 |

| 2015 | $1,320 | $32,400 | $4,850 | $27,550 |

| 2014 | $1,320 | $32,400 | $4,850 | $27,550 |

| 2013 | $1,326 | $32,400 | $4,850 | $27,550 |

Source: Public Records

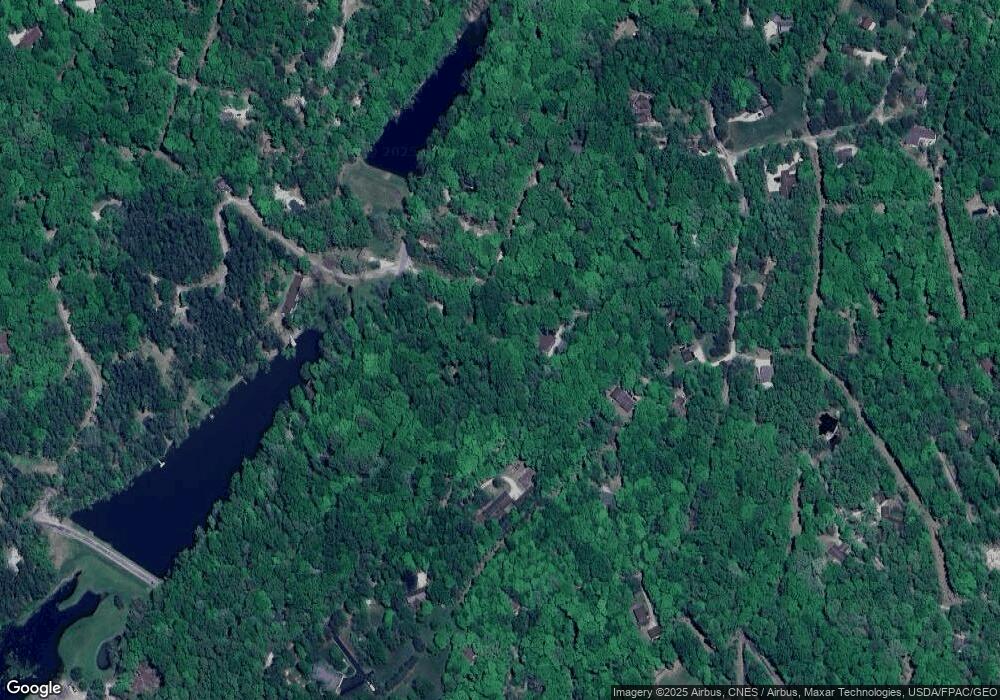

Map

Nearby Homes

- 1756 Mohican Ln

- 408 Mohican Ln

- 599-600 Navajo Ln

- 4 Hide A Way Hills Ln

- Reserve A Osage Ln

- 1832 Piegan Ct

- 144 Hide-A-way Rd

- 721 Natchez Ln

- 201 Apache Ln

- 901 Kato Ct

- 1275 Taos Ln

- 917 Kato Ct

- 2098 Maya Ln

- 1060 Fox Ln

- 1201 Taos Ln

- 1015 Taos Ln

- 317 Winnebago Ln

- 1893 Beaver Ln

- 849 Papago Ln

- 2091 Bearclaw Ct