Estimated Value: $279,000 - $310,000

2

Beds

3

Baths

1,280

Sq Ft

$230/Sq Ft

Est. Value

About This Home

This home is located at 60 Orangewood W, Derby, CT 06418 and is currently estimated at $293,891, approximately $229 per square foot. 60 Orangewood W is a home located in New Haven County with nearby schools including Derby Middle School, Derby High School, and Southern Connecticut Hebrew Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 14, 2004

Sold by

Bruder Michael C and Richard Nadine

Bought by

Miller Joanne C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Interest Rate

6.08%

Purchase Details

Closed on

Jul 31, 1998

Sold by

Krystofik Sharon and Krystofik Mary

Bought by

Bruder Michael C and Richard Nadine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,700

Interest Rate

6.92%

Mortgage Type

Unknown

Purchase Details

Closed on

Oct 15, 1997

Sold by

Krystofik Mary L

Bought by

Krystofik Ronald J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miller Joanne C | $190,000 | -- | |

| Bruder Michael C | $86,000 | -- | |

| Krystofik Ronald J | $70,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Krystofik Ronald J | $137,000 | |

| Closed | Krystofik Ronald J | $152,000 | |

| Previous Owner | Krystofik Ronald J | $81,700 | |

| Previous Owner | Krystofik Ronald J | $62,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,593 | $106,330 | $0 | $106,330 |

| 2024 | $4,593 | $106,330 | $0 | $106,330 |

| 2023 | $4,104 | $106,330 | $0 | $106,330 |

| 2022 | $4,104 | $106,330 | $0 | $106,330 |

| 2021 | $4,104 | $106,330 | $0 | $106,330 |

| 2020 | $4,330 | $98,700 | $0 | $98,700 |

| 2019 | $4,133 | $98,700 | $0 | $98,700 |

| 2018 | $3,886 | $98,700 | $0 | $98,700 |

| 2017 | $3,886 | $98,700 | $0 | $98,700 |

| 2016 | $3,886 | $98,700 | $0 | $98,700 |

| 2015 | $4,080 | $114,170 | $0 | $114,170 |

| 2014 | $4,080 | $114,170 | $0 | $114,170 |

Source: Public Records

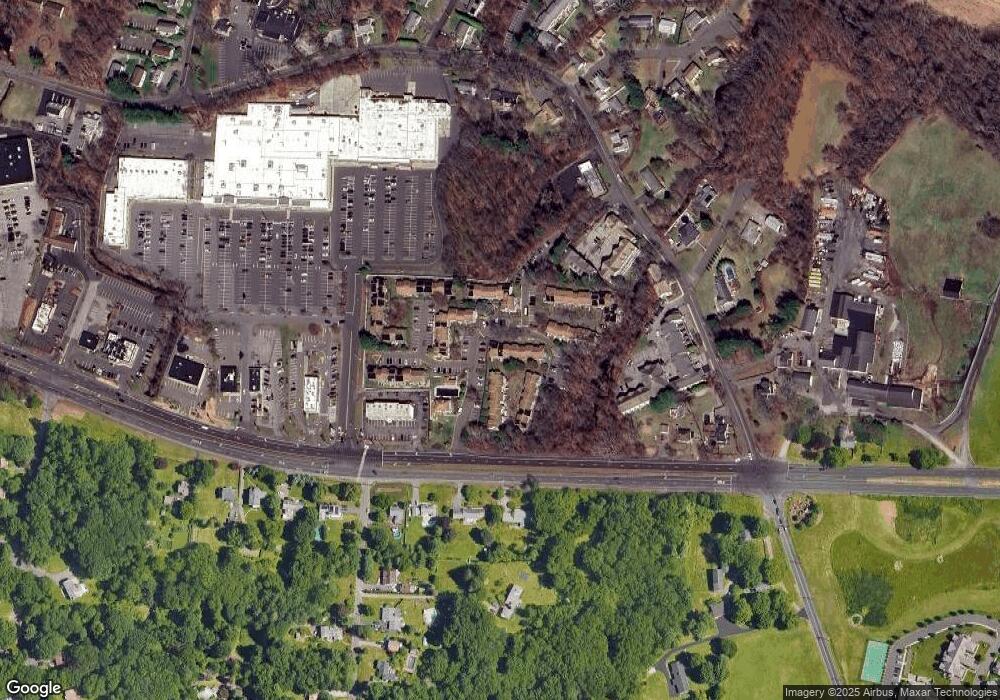

Map

Nearby Homes

- 37 Orangewood W

- 161 Shagbark Dr Unit 161

- 249 Shagbark Dr Unit 249

- 206 Deerfield Ln Unit 206

- 195 Marshall Ln

- 235 Sylvan Valley Rd

- 103 Pleasant View Rd

- 965 Red Fox Rd

- 59 Chestnut Dr

- 204 New Haven Ave Unit 7E

- 374 Wildwood Dr

- 45 Sherwood Ave

- 920 Green Cir

- 196 New Haven Ave Unit 322

- 8 Fox Hill Terrace

- 29 N Coe Ln

- 120 Pulaski Hwy

- 819 Quarter Mile Rd

- 151 Benz St

- 847 Glenbrook Rd

- 79 Orangewood W

- 57 Orangewood W

- 59 Orangewood W

- 74 Orangewood W

- 75 Orangewood W

- 66 Orangewood W

- 61 Orangewood W

- 68 Orangewood W

- 65 Orangewood W

- 77 Orangewood W

- 86 Orangewood W

- 69 Orangewood W

- 89 Orangewood W

- 90 Orangewood W

- 83 Orangewood W

- 62 Orangewood W

- 92 Orangewood W

- 63 Orangewood W

- 70 Orangewood W

- 85 Orangewood W