60 Skeeter Dayton, OH 45458

Estimated Value: $113,889

--

Bed

--

Bath

--

Sq Ft

1.77

Acres

About This Home

This home is located at 60 Skeeter, Dayton, OH 45458 and is currently estimated at $113,889. 60 Skeeter is a home located in Montgomery County with nearby schools including Primary Village South, Weller Elementary School, and Magsig Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 21, 2023

Sold by

Beyoglides Harry G

Bought by

Cincinnati Bell Telephone Company Llc

Current Estimated Value

Purchase Details

Closed on

Nov 7, 2016

Sold by

Smith Jung H

Bought by

Harry G Beyoglides

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

3.54%

Purchase Details

Closed on

Oct 21, 2013

Sold by

Smith William C and Smith Jung H

Bought by

Smith Jung H

Purchase Details

Closed on

Jun 10, 2013

Sold by

Bill Smith Enterprises Ltd

Bought by

Smith William C

Purchase Details

Closed on

Jul 30, 1998

Sold by

Smith Browning Enterprises Ltd

Bought by

Bill Smith Enterprises Ltd

Purchase Details

Closed on

May 22, 1996

Sold by

S & B Enterprises

Bought by

Smith Browning Enterprises Ltd

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cincinnati Bell Telephone Company Llc | $102,000 | None Listed On Document | |

| Harry G Beyoglides | -- | -- | |

| Smith Jung H | -- | None Available | |

| Smith William C | -- | National Title Compa | |

| Bill Smith Enterprises Ltd | $46,000 | -- | |

| Bill Smith Enterprises Ltd | $46,000 | -- | |

| Smith Browning Enterprises Ltd | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Harry G Beyoglides | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,544 | $41,490 | $37,400 | $4,090 |

| 2023 | $3,544 | $41,490 | $37,400 | $4,090 |

| 2022 | $3,533 | $35,640 | $31,170 | $4,470 |

| 2021 | $3,568 | $35,640 | $31,170 | $4,470 |

| 2020 | $3,531 | $35,640 | $31,170 | $4,470 |

| 2019 | $3,589 | $34,950 | $31,170 | $3,780 |

| 2018 | $3,278 | $34,950 | $31,170 | $3,780 |

| 2017 | $3,237 | $34,950 | $31,170 | $3,780 |

| 2016 | $3,299 | $34,950 | $31,170 | $3,780 |

| 2015 | $3,276 | $34,950 | $31,170 | $3,780 |

| 2014 | $3,276 | $34,950 | $31,170 | $3,780 |

| 2012 | -- | $28,540 | $28,050 | $490 |

Source: Public Records

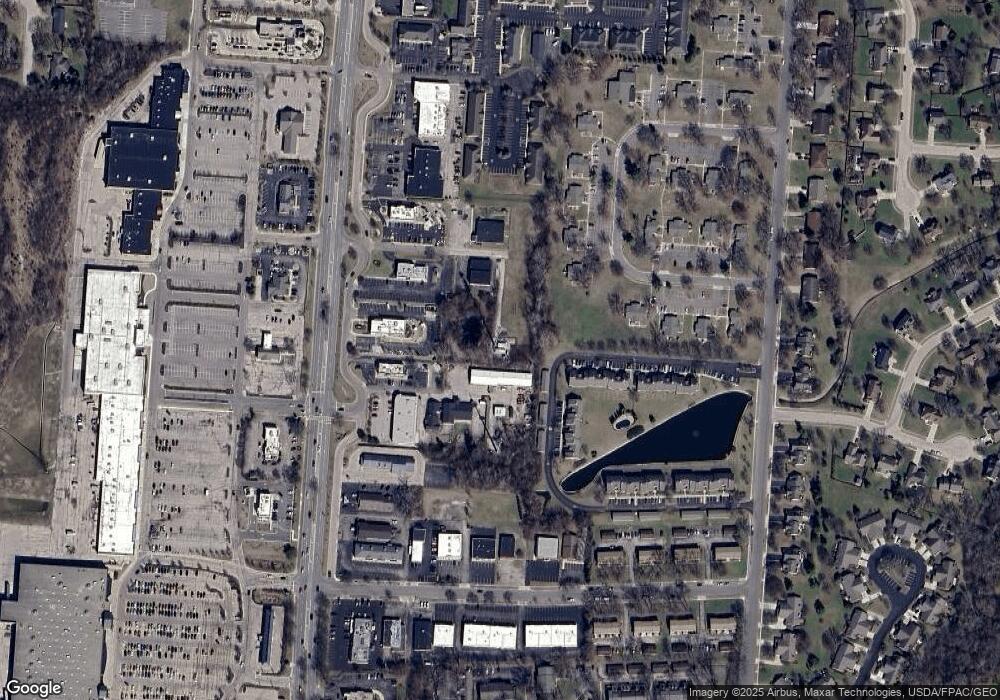

Map

Nearby Homes

- 98 Marco Ln Unit G25

- 460 Jamestown Cir Unit 16

- 843 Clareridge Ln Unit 843

- 694 Spring Ridge Place

- 9095 Heather Dr

- 9737 Centerville Creek Ln

- 1016 Quiet Brook Trail

- 9375 Shawhan Dr

- 9515 Centerbrook Ct Unit 69515

- 9363 Rochelle Ln

- 1071 Star Valley Ct

- 35 Bywood Ct

- 12 Mallard Glen Dr Unit 3

- 154 Queens Crossing Unit 31152

- 184 Edinburgh Village Dr Unit 13184

- 30 Edinburgh Village Dr Unit 530

- 9119 Remy

- 9106 Remy Ct

- 164 Waterford Dr

- 300 Grassy Creek Way

- 402 Waterfront Place Unit 4402

- 404 Waterfront Place Unit 4404

- 400 Waterfront Place Unit 4400

- 408 Waterfront Place Unit 4408

- 406 Waterfront Place Unit 4406

- 410 Waterfront Place Unit 4410

- 412 Waterfront Place Unit 4412

- 414 Waterfront Place Unit 4414

- 320 Waterfront Place Unit 3320

- 322 Waterfront Place Unit 3322

- 416 Waterfront Place Unit Bldg 4

- 418 Waterfront Place Unit 4418

- 416 Waterfront Place Unit 4416

- 65 Fox Creek Ct

- 3086 Fox Creek Ct

- 316 Waterfront Place Unit 3316

- 420 Waterfront Place Unit 4420

- 318 Waterfront Place Unit 3318

- 422 Waterfront Place Unit 4422

- 312 Waterfront Place Unit 3312