600 Wilcrest Dr Unit 27 Houston, TX 77042

Briar Forest NeighborhoodEstimated Value: $220,362 - $239,000

2

Beds

3

Baths

1,588

Sq Ft

$145/Sq Ft

Est. Value

About This Home

This home is located at 600 Wilcrest Dr Unit 27, Houston, TX 77042 and is currently estimated at $230,091, approximately $144 per square foot. 600 Wilcrest Dr Unit 27 is a home located in Harris County with nearby schools including Askew Elementary School, Paul Revere Middle School, and Westside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 14, 2025

Sold by

Talaat Adam Neil and Talaat Miriam Beth

Bought by

Capiello Ana Maria and Tinoco Ana Maria

Current Estimated Value

Purchase Details

Closed on

Mar 16, 2015

Sold by

Ho Anthony K and Cheng Sze Sze Cheryl

Bought by

Lee Kuan Yi and Chen Fen Jen

Purchase Details

Closed on

Sep 30, 2013

Sold by

Esbona Jorge and Esbona Maria

Bought by

Talaat Ismail Mahmond

Purchase Details

Closed on

Apr 12, 2007

Sold by

Monroy Magnolia

Bought by

Esbona Jorge

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,000

Interest Rate

6.1%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 9, 2003

Sold by

Anderson Jean Ellen and Russell Arthur S

Bought by

Esbona Jorge and Monroy Magnolia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,850

Interest Rate

4.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Capiello Ana Maria | -- | None Listed On Document | |

| Talaat Miriam Beth | -- | None Listed On Document | |

| Lee Kuan Yi | -- | Fidelity National Title | |

| Talaat Ismail Mahmond | -- | Chicago Title | |

| Esbona Jorge | -- | Stewart Title Houston Div | |

| Esbona Jorge | -- | Texas American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Esbona Jorge | $115,000 | |

| Previous Owner | Esbona Jorge | $116,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $44 | $231,866 | $54,198 | $177,668 |

| 2024 | $44 | $217,649 | $54,198 | $163,451 |

| 2023 | $44 | $249,674 | $54,198 | $195,476 |

| 2022 | $4,634 | $210,458 | $54,198 | $156,260 |

| 2021 | $4,634 | $198,848 | $54,198 | $144,650 |

| 2020 | $4,398 | $181,611 | $54,198 | $127,413 |

| 2019 | $4,509 | $178,186 | $54,198 | $123,988 |

| 2018 | $591 | $134,570 | $54,198 | $80,372 |

| 2017 | $3,758 | $173,423 | $54,198 | $119,225 |

| 2016 | $3,416 | $170,466 | $32,389 | $138,077 |

| 2015 | $780 | $148,519 | $28,219 | $120,300 |

| 2014 | $780 | $148,519 | $28,219 | $120,300 |

Source: Public Records

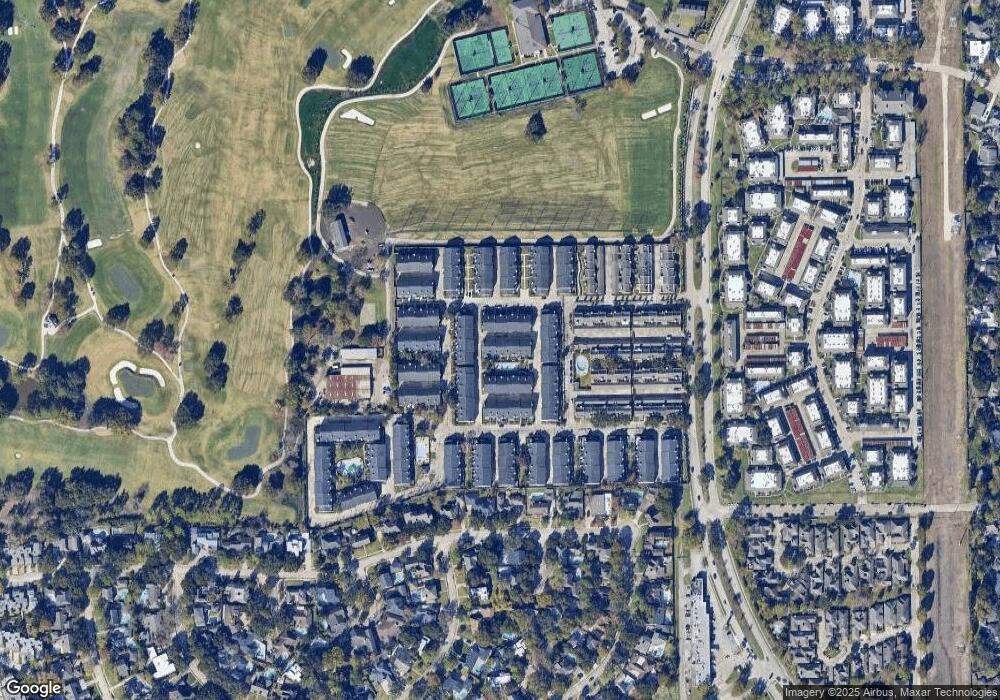

Map

Nearby Homes

- 600 Wilcrest Dr Unit 66

- 580 Wilcrest Dr Unit 580

- 360 Wilcrest Dr Unit 360

- 11418 Lakeside Place Dr

- 1306 Riverview Ct

- 11422 Lakeside Place Dr

- 1506 Haven Lock Dr

- 210 Big Hollow Ln

- 11206 Mattina Dr

- 11418 Long Pine Dr

- 203 Cove Creek Ln

- 11603 Lakeside Place Dr

- 1325 Chardonnay Dr

- 1515 Sandy Springs Rd Unit 1808

- 1515 Sandy Springs Rd Unit 1102

- 1515 Sandy Springs Rd Unit 3003

- 1515 Sandy Springs Rd Unit 2002

- 1515 Sandy Springs Rd Unit 3001

- 1336 Chardonnay Dr

- 1353 Chardonnay Dr

- 600 Wilcrest Dr Unit 5

- 600 Wilcrest Dr Unit 62

- 600 Wilcrest Dr Unit 47

- 600 Wilcrest Dr Unit 59

- 600 Wilcrest Dr Unit 61

- 600 Wilcrest Dr Unit 21

- 600 Wilcrest Dr Unit 37

- 600 Wilcrest Dr Unit 18

- 600 Wilcrest Dr Unit 51

- 600 Wilcrest Dr Unit 50

- 600 Wilcrest Dr Unit 17

- 600 Wilcrest Dr Unit 20

- 600 Wilcrest Dr Unit 39

- 600 Wilcrest Dr Unit 70

- 600 Wilcrest Dr Unit 72

- 600 Wilcrest Dr Unit 71

- 600 Wilcrest Dr Unit 60

- 600 Wilcrest Dr Unit 58

- 600 Wilcrest Dr Unit 38

- 600 Wilcrest Dr Unit 69