6006 Balcones Ct Unit 2 El Paso, TX 79912

Chaparral Park North NeighborhoodEstimated Value: $625,398 - $678,000

Studio

3

Baths

2,884

Sq Ft

$228/Sq Ft

Est. Value

About This Home

This home is located at 6006 Balcones Ct Unit 2, El Paso, TX 79912 and is currently estimated at $657,799, approximately $228 per square foot. 6006 Balcones Ct Unit 2 is a home located in El Paso County with nearby schools including Western Hills Elementary School, Coronado High School, and IDEA Mesa Hills Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 15, 2021

Sold by

Vanhaselen William

Bought by

Estrada Paul M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$470,000

Outstanding Balance

$364,712

Interest Rate

2.28%

Mortgage Type

New Conventional

Estimated Equity

$293,087

Purchase Details

Closed on

Mar 23, 2018

Sold by

Comey Robert G and Comey Carol Jacobs

Bought by

Vanvanhaselen William Van

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,500

Interest Rate

4.38%

Mortgage Type

Commercial

Purchase Details

Closed on

Jun 12, 2017

Sold by

Tredennick Steven B

Bought by

Scott Margaret L Jacobs and Comey Carol Jacobs

Purchase Details

Closed on

Oct 2, 2009

Sold by

Tredennick Steven B and Estate Of Homer Avery Jacobs J

Bought by

Jacobs Myrna Marie Winston and Myrna Jacobs Residence Qtip Tr

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Estrada Paul M | -- | None Available | |

| Vanvanhaselen William Van | -- | None Available | |

| Scott Margaret L Jacobs | -- | None Available | |

| Jacobs Myrna Marie Winston | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Estrada Paul M | $470,000 | |

| Previous Owner | Vanvanhaselen William Van | $187,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,891 | $297,947 | -- | -- |

| 2024 | $5,891 | $270,861 | -- | -- |

| 2023 | $5,891 | $286,615 | $50,444 | $236,171 |

| 2022 | $8,484 | $286,615 | $50,444 | $236,171 |

| 2021 | $8,921 | $286,615 | $50,444 | $236,171 |

| 2020 | $8,096 | $263,419 | $50,444 | $212,975 |

| 2018 | $7,796 | $263,419 | $50,444 | $212,975 |

| 2017 | $7,707 | $273,618 | $50,444 | $223,174 |

| 2016 | $7,707 | $273,618 | $50,444 | $223,174 |

| 2015 | $5,921 | $273,618 | $50,444 | $223,174 |

| 2014 | $5,921 | $273,618 | $50,444 | $223,174 |

Source: Public Records

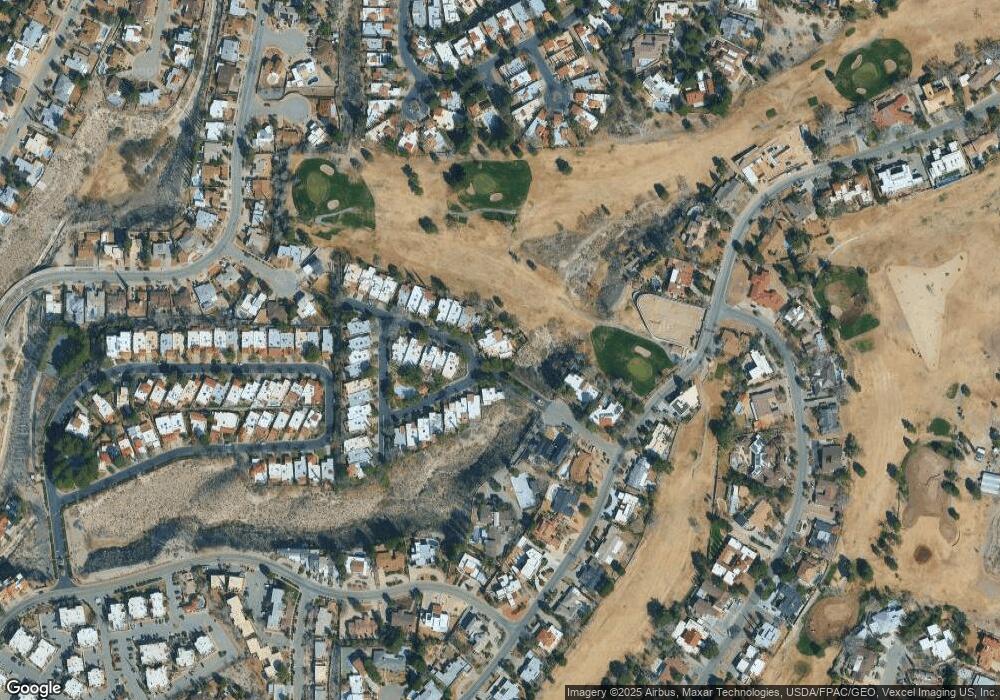

Map

Nearby Homes

- 6006 Balcones Ct Unit 19

- 6135 Los Felinos Cir

- 1039 Los Jardines Cir

- 1114 Los Jardines Cir

- 6130 Sierra Valle Ln

- 1007 Los Jardines Cir

- 6016 Camino Alegre Dr

- 6140 Los Robles Dr

- 6142 Los Robles Dr

- 1003 Los Jardines Cir

- 6248 Bandolero Dr

- 6225 Camino Alegre Dr

- 605 Cresta Alta Dr

- 822 Via Descanso Dr

- 1349 Belvidere St

- 6041 Torrey Pines Dr

- 1005 Singing Hills Dr

- 6350 Escondido Dr Unit A-24

- 920 Thunderbird Dr

- 31 Stratford Hall Cir

- 6006 Balcones Ct Unit 3

- 6006 Balcones Ct Unit 3

- 6006 Balcones Ct Unit 2

- 6006 Balcones Ct Unit 2

- 6006 Balcones Ct Unit 2

- 6006 Balcones Ct Unit 2

- 6006 Balcones Ct Unit 2

- 6006 Balcones Ct Unit 2

- 6006 Balcones Ct Unit 2

- 6006 Balcones Ct Unit 2

- 6006 Balcones Ct Unit 2

- 6006 Balcones Ct Unit 3

- 6006 Balcones Ct Unit 3

- 6006 Balcones Ct Unit 3

- 6006 Balcones Ct Unit 3

- 6006 Balcones Ct Unit 3

- 6006 Balcones Ct Unit 1

- 6006 Balcones Ct Unit 18

- 6006 Balcones Ct Unit 1

- 6006 Balcones Ct Unit 1