602 Lakeside Trail Martin, GA 30557

Estimated Value: $421,888 - $469,000

2

Beds

1

Bath

864

Sq Ft

$514/Sq Ft

Est. Value

About This Home

This home is located at 602 Lakeside Trail, Martin, GA 30557 and is currently estimated at $444,222, approximately $514 per square foot. 602 Lakeside Trail is a home located in Stephens County with nearby schools including Stephens County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 18, 2021

Sold by

Equity Trust Co Custodian Fbo

Bought by

Byers Gregory David and Byers Terri Banks

Current Estimated Value

Purchase Details

Closed on

Jun 26, 2006

Sold by

Mountain Tricia A

Bought by

Equity Trust Co Custodian Fbo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,000

Interest Rate

6.88%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 26, 2006

Sold by

Hatfield Aurelia

Bought by

Mountain Tricia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,000

Interest Rate

6.88%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 1, 1995

Bought by

<Buyer Info Not Present>

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Byers Gregory David | $367,000 | -- | |

| Equity Trust Co Custodian Fbo | -- | -- | |

| Equity Trust Co Custodian Fbo | -- | -- | |

| Equity Trust Compoany Custodia | -- | -- | |

| Mountain Tricia A | $160,000 | -- | |

| <Buyer Info Not Present> | $84,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mountain Tricia A | $112,000 | |

| Previous Owner | Mountain Tricia A | $48,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,411 | $87,826 | $41,450 | $46,376 |

| 2024 | $2,266 | $74,417 | $41,450 | $32,967 |

| 2023 | $2,160 | $72,569 | $41,450 | $31,119 |

| 2022 | $2,122 | $71,294 | $41,450 | $29,844 |

| 2021 | $2,163 | $69,187 | $41,450 | $27,737 |

| 2020 | $2,187 | $69,262 | $41,450 | $27,812 |

| 2019 | $2,196 | $69,262 | $41,450 | $27,812 |

| 2018 | $2,196 | $69,262 | $41,450 | $27,812 |

| 2017 | $2,231 | $69,262 | $41,450 | $27,812 |

| 2016 | $2,196 | $69,262 | $41,450 | $27,812 |

| 2015 | $2,305 | $69,420 | $41,450 | $27,970 |

| 2014 | $2,349 | $69,570 | $41,450 | $28,120 |

| 2013 | -- | $69,570 | $41,450 | $28,120 |

Source: Public Records

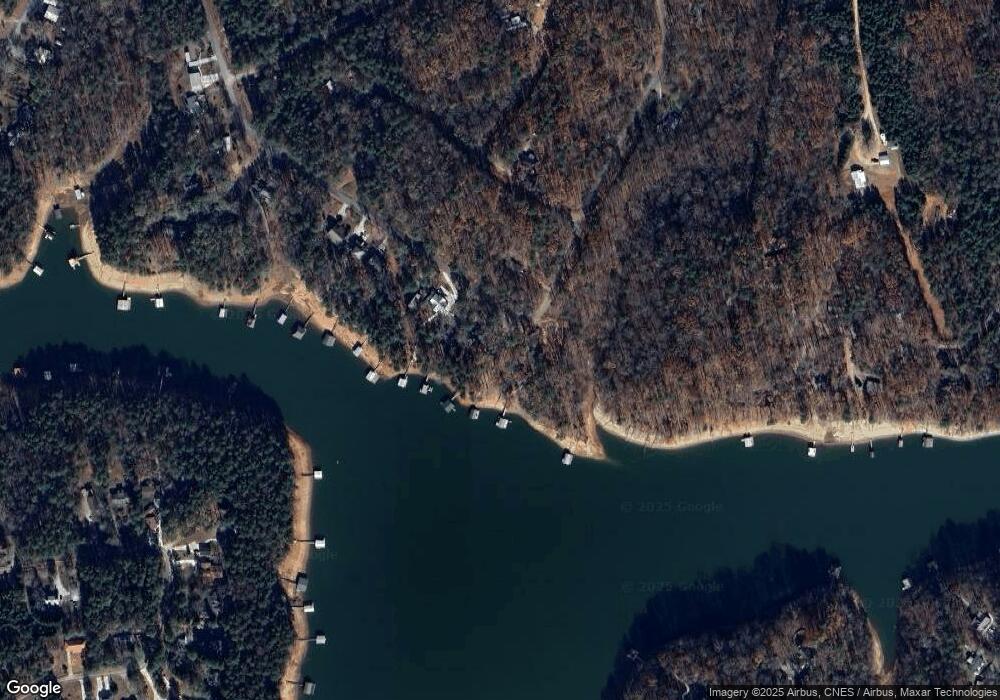

Map

Nearby Homes

- 57 Dogwood Trail

- 30 & 48 Dogwood Trail

- 72 Dogwood Trail

- 114 Lakeview Trail

- 243 Lakeside Trail

- 45 Sequoia Trail

- 647 Lake Harbor Trail

- 17 Lakeside Trail

- 0 N Holcomb Dr Unit 25286978

- 1041 N Holcomb Dr

- 0 N Holcomb Dr Unit 10559631

- 0 N Holcomb Dr Unit 10629494

- 201 Hickory Hill Ln

- 69 Cheyenne Trail

- 137 Cheyenne Trail

- 156 Navajo Trail

- 311 Caprice Dr

- 298 Caprice Dr

- 3595 Gumlog Rd

- 2830 N Holcomb Dr

- 1308 Lakeside Trail

- 1302 Lakeside Trail

- 1318 Lakeside Trail

- 1288 Lakeside Trail

- 756 Lakeside Trail

- 1328 Lakeside Trail

- 580 Lakeside Trail

- 1272 Lakeside Trail

- 1343 Lakeside Trail

- 1254 Lakeside Trail

- 1246 Lakeside Trail

- 156 Dogwood Trail Unit 708

- 1224 Lakeside Trail

- 1224 Lakeside Trail

- 1206 Lakeside Trail

- 344 Dogwood Trail

- 141 Dogwood Trail

- 1190 Lakeside Trail

- 1179 Lakeside Trail

- 48 & 30 Dogwood Trail