6026 E Pershing Blvd Cheyenne, WY 82001

Estimated Value: $222,658 - $328,000

3

Beds

1

Bath

1,014

Sq Ft

$272/Sq Ft

Est. Value

About This Home

This home is located at 6026 E Pershing Blvd, Cheyenne, WY 82001 and is currently estimated at $276,165, approximately $272 per square foot. 6026 E Pershing Blvd is a home located in Laramie County with nearby schools including Saddle Ridge Elementary School, Carey Junior High School, and East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 7, 2021

Sold by

Calaway Dylan R

Bought by

Jones Michelle R and Jones William T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$233,000

Outstanding Balance

$209,569

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$66,596

Purchase Details

Closed on

Apr 21, 2015

Sold by

Tyner Corey M

Bought by

Calaway Dylan R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$6,100

Interest Rate

3.73%

Mortgage Type

Unknown

Purchase Details

Closed on

Mar 13, 2015

Sold by

Miller Sheila Kay and Millercatellier Nancy Jean

Bought by

Calaway Dylan R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,373

Interest Rate

3.25%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones Michelle R | -- | First American | |

| Jones Michelle R | -- | First American Title | |

| Calaway Dylan R | -- | None Available | |

| Calaway Dylan R | -- | None Available | |

| Calaway Dylan R | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jones Michelle R | $233,000 | |

| Closed | Jones Michelle R | $233,000 | |

| Previous Owner | Calaway Dylan R | $6,100 | |

| Previous Owner | Calaway Dylan R | $142,373 | |

| Previous Owner | Calaway Dylan R | $142,373 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $471 | $10,370 | $1,930 | $8,440 |

| 2024 | $471 | $13,008 | $2,474 | $10,534 |

| 2023 | $435 | $12,619 | $2,474 | $10,145 |

| 2022 | $330 | $10,905 | $2,474 | $8,431 |

| 2021 | $590 | $8,762 | $1,235 | $7,527 |

| 2020 | $574 | $8,551 | $1,235 | $7,316 |

| 2019 | $549 | $8,163 | $1,235 | $6,928 |

| 2018 | $495 | $7,448 | $1,150 | $6,298 |

| 2017 | $482 | $7,176 | $1,150 | $6,026 |

| 2016 | $469 | $6,974 | $1,097 | $5,877 |

| 2015 | $456 | $6,782 | $1,097 | $5,685 |

| 2014 | $448 | $6,617 | $1,097 | $5,520 |

Source: Public Records

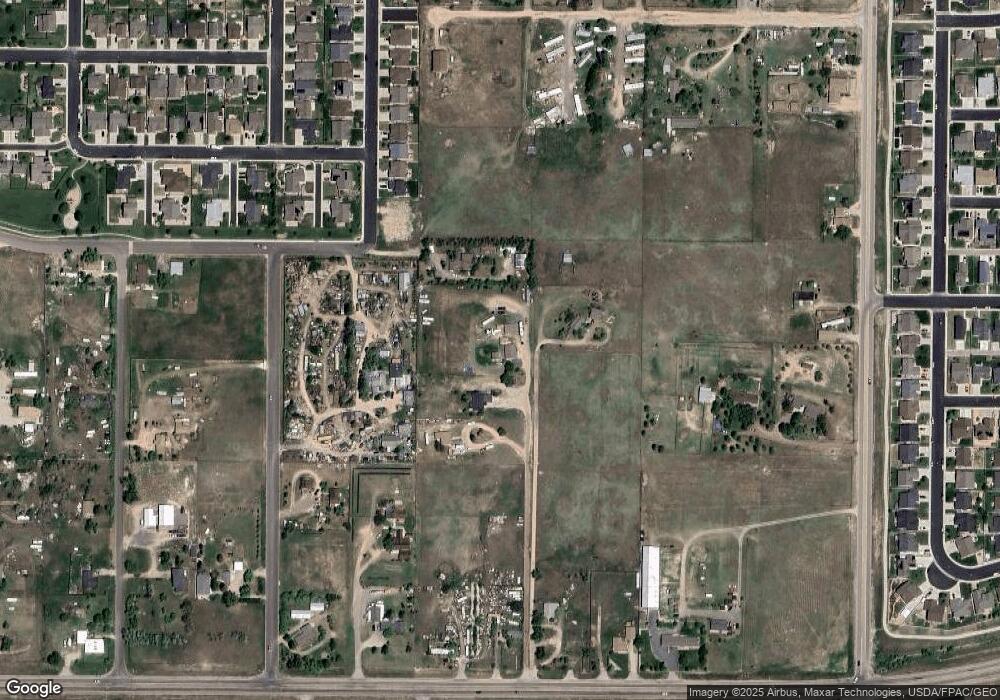

Map

Nearby Homes

- 3540 Saratoga St

- 5831 Indigo Dr

- 6507 Hitching Post Ln

- 6519 High Spring Rd

- 6608 Hitching Post Ln

- 3815 Blue Sage Rd

- Lot 3 Hitching Post Ln

- 3908 Campfire Trail

- 5611 Independence Dr

- 6501 Painted Rock Trail

- 6505 Painted Rock Trail

- 5501 Independence Dr

- 6510 Painted Rock Trail

- 6605 Painted Rock Trail

- 4107 Hayes Ave

- 5816 Parkside Dr

- 4112 Independence Dr

- 5724 Parkside Dr

- 3821 Rain Dancer Trail

- 5502 Aurora Place

- 6024 E Pershing Blvd

- 6028 E Pershing Blvd

- 6007 Charles St

- 6020 E Pershing Blvd

- 3403 Mckinley Ave

- Blk 7 lot Saratoga St

- Blk 7 lot Saratoga St

- 3515 Saratoga St

- Blk 7 lot Saratoga St

- 3521 Saratoga St

- 5920 E Pershing Blvd

- 3527 Saratoga St

- 3320 Whitney Rd

- 5859 Indigo Dr

- 3333 Mckinley Ave

- 3533 Saratoga St

- 6010 E Pershing Blvd

- 5851 Indigo Dr

- 6032 E Pershing Blvd