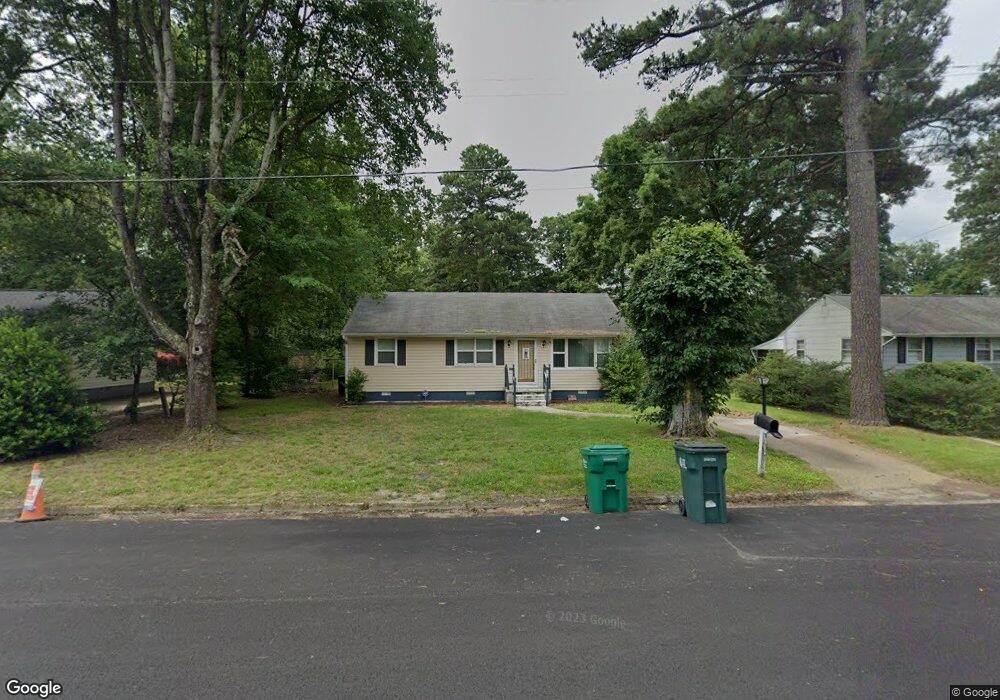

603 South St Henrico, VA 23075

Estimated Value: $221,067 - $266,000

3

Beds

1

Bath

960

Sq Ft

$256/Sq Ft

Est. Value

About This Home

This home is located at 603 South St, Henrico, VA 23075 and is currently estimated at $245,517, approximately $255 per square foot. 603 South St is a home located in Henrico County with nearby schools including Fair Oaks Elementary School, Elko Middle School, and Highland Springs High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 14, 2010

Sold by

Wells Fargo Bank Na

Bought by

Jordan Christopher M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$59,900

Outstanding Balance

$40,112

Interest Rate

5.11%

Mortgage Type

New Conventional

Estimated Equity

$205,405

Purchase Details

Closed on

Mar 4, 2010

Sold by

Samuel I White Pc Sub Tr

Bought by

Wells Fargo Bank Na

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$59,900

Outstanding Balance

$40,112

Interest Rate

5.11%

Mortgage Type

New Conventional

Estimated Equity

$205,405

Purchase Details

Closed on

Oct 26, 2006

Sold by

Manning Kenya

Bought by

Richard Donald L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jordan Christopher M | $79,900 | -- | |

| Wells Fargo Bank Na | $78,200 | -- | |

| Richard Donald L | $92,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jordan Christopher M | $59,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,635 | $172,300 | $42,000 | $130,300 |

| 2024 | $1,635 | $164,100 | $40,000 | $124,100 |

| 2023 | $1,411 | $164,100 | $40,000 | $124,100 |

| 2022 | $1,300 | $151,200 | $38,000 | $113,200 |

| 2021 | $1,093 | $111,400 | $25,000 | $86,400 |

| 2020 | $980 | $111,400 | $25,000 | $86,400 |

| 2019 | $972 | $110,500 | $25,000 | $85,500 |

| 2018 | $902 | $102,500 | $25,000 | $77,500 |

| 2017 | $800 | $90,900 | $25,000 | $65,900 |

| 2016 | $800 | $90,900 | $25,000 | $65,900 |

| 2015 | $839 | $90,900 | $25,000 | $65,900 |

| 2014 | $839 | $95,300 | $25,000 | $70,300 |

Source: Public Records

Map

Nearby Homes

- 501 Sherilyn Dr

- 304 E Jerald St

- 260 Sag Harbor Ct

- 213 Meroyn Dr

- 235 Banks St

- 508 Highland Dr

- 4 W Jerald St

- 1517 Sir William Ct

- 13 N Rose Ave

- 704 S Ivy Ave

- 103 S Ivy Ave

- 204 Cornett St

- 24 S Grove Ave

- 104 W Union St

- 4813 Gilmour Rd

- 405 Roxana Rd

- 1928 Repp Cir

- 3 E Sedgwick St

- 428 Roxana Rd

- 206 N Oak Ave